What Does That Mean For You

If youâre current with your mortgage payments â¡ï¸ everything will stay basically the same.

Youâll continue to make your mortgage payments until the house is paid off. Of course, there are some legal nuances, like the discharge of your personal liability on the home loan, and how it protects you in the event you lose your home down the road, but the important takeaway here is this:

If you have enough income to pay your mortgage lender, you can keep your home even after filing Chapter 7 bankruptcy.

Itâs a little more complicated if your home is worth more than what you owe on your mortgage. In that case, you may have to deal with the bankruptcy trustee. More on that below.

Can I Get A Home Equity Loan To Pay Off A Chapter 13 Bankruptcy

One way that you could get a home equity loan during Chapter 13 bankruptcy is if the proceeds are used to pay off your creditors. This would have to be approved by your creditors, the trustee, and the bankruptcy court.

You would have to have made all the agreed plan payments on time and have enough equity in your home to justify the loan.

Bear in mind that the payoff amount will not necessarily be the amount of your current payment multiplied by the remaining months in the plan. When your creditors originally approved the plan, it included expected future increases in your income.

They will expect the payoff amount to reflect this. In some cases, they or the court can decide that the bankruptcy will not be discharged without full payment of the original amount that you owe.

How Much Equity In Your Home Is Exempt In Chapter 7 Bankruptcy

One of the most frightening things about filing for bankruptcy is the potential for your assets to end up liquidated by the courts to pay your debts. If you need help deciding your best options, you should contact an experienced bankruptcy attorney today.

For those with lower incomes, who pass the state means test Chapter 7 bankruptcy can offer relief from unsecured debts, including credit card debt and medical debts. However, the courts will look at your assets to see if you have the ability to repay some of those debts before granting a discharge.

Its only natural to worry about how filing for bankruptcy could impact your home equity or status as a homeowner in the state of Texas. Certain assets are exempt from the liquidation process in bankruptcy. Thankfully, Texas has some of the most generous homestead exemption laws in the country.

If you qualify for Chapter 7 bankruptcy, your interest in your home or ranch is protected to a certain degree.

Don’t Miss: How Long After Creditors Meeting Is Bankruptcy Discharged

Home Equity Loan After Bankruptcy Discharge Is It Possible

Yes, its possible to get a home equity loan after bankruptcy. If you were able to keep your home during the bankruptcy process, you will be allowed to apply for either a home equity loan, a HELOC, or you might be able to remortgage and borrow more.

Whether the application will be accepted will depend on the lender, affordability and your credit history.

Chapter 7 bankruptcies usually remain on your credit history for ten years, while a Chapter 13 bankruptcy will stay on record for up to seven years.

How Filing Bankruptcy Can Make Paying Your Mortgage Easier

Your bankruptcy discharge wipes out most of your unsecured debts. Medical bills, credit card payments, loan payments, etc. all of the bills that are making it hard for you to make ends meet now are eliminated by a bankruptcy filing.

With debt repayment obligations gone, you can focus on the expenses that really matter: mortgage payments, utilities and regular living expenses.

Thatâs actually true if youâre renting, too. Rent will always need to be paid, just like a mortgage, electricity, water and other utilities. But as soon as the automatic stay kicks in, you’ll be protected from debt collectors.

You May Like: Where Can You Buy Pallets

Home Equity In Chapter 13 Bankruptcy: You Wont Lose Your House In A Chapter 13but You May Pay More

Increasing home equity with rising real estate prices in many areas of Metro Detroit is one thing that many are thankful for this Thanksgiving holiday.

However, when considering Chapter 7 or Chapter 13 bankruptcy, it is important to remember that all assets, including your home, are at issue in the bankruptcy process.

In a Chapter 7 bankruptcy, the consequence of having too much home equity can, in some circumstances, be that your home is seized and sold off by the Chapter 7 Trustee assigned administer your case by the Bankruptcy Court in order to repay some of the debt you owe your creditors.

In a Chapter 13 bankruptcy, there is never any liquidation or sale and seizure of assets, regardless of the amount of your home equity, but there is still a consequence that may affect the affordability of your particular Chapter 13 bankruptcy process.

Why Do People Take Out Home Equity Loans

Homeowners take out these secured loans for different reasons. They might use the money to:

There are generally no restrictions on what the money can be used for.

Don’t Miss: Will Filing For Bankruptcy Stop A Judgement

The Heloc In A Chapter 13 Bankruptcy

In Chapter 13 bankruptcy you keep your property and repay your debt over three or five years.

Chapter 13 provides two advantages in dealing with a HELOC in certain situations.

Stripping Off HELOCs in Chapter 13

If the market value of your home is less than the balance on your first mortgage, you can “strip off” the HELOC. The HELOC loan amount is treated like other unsecured debts in your Chapter 13 Plan. Most Chapter 13 filers pay pennies on the dollar when it comes to unsecured debt. At the end of the plan, you receive a discharge of liability for any unpaid balance due the unsecured creditors, including the HELOC. In addition, the lien securing the HELOC is removed, which means your home is only subject to the first mortgage going forward.

Curing Mortgage Arrearages in Chapter 13

Chapter 13 also allows you to cure a HELOC arrearage in your plan and prevent foreclosure. For example, if you are $3,600 behind on your HELOC payments when you file your Chapter 13, you can cure the arrearage in a 36-month plan by paying $100 per month into your plan. You don’t have to get bank approval of this if the court approves your plan the bank must accept the terms. At the end of the plan, you will be current on the HELOC.

Calculating Home Equity Protection In Chapter 13 Bankruptcy

These steps will help you determine whether you can protect your home equity in Chapter 13 bankruptcy.

If you can exempt all of your home equity, you won’t pay an additional amount in your Chapter 13 plan. However, if you have nonexempt equity, you’ll have to pay an equivalent amount toward your general unsecured debts through your repayment plan.

You might also need to know what happens if you’re on the deed to someone else’s home when you file for bankruptcy.

Recommended Reading: How Long Does It Take To Get Discharged From Bankruptcy

Whats The Difference Between Chapter 7 And Chapter 13

If youre thinking about filing bankruptcy, its important to understand your options. Chapter 7 bankruptcy and Chapter 13 bankruptcy are the bankruptcies that people most frequently seek out.

Chapter 7 bankruptcy is also known as total bankruptcy. Its a wipeout of much of your outstanding debt. Also, it might force you to sell or liquidate some of your property in order to pay back some of the debt. Chapter 7 is also called straight or liquidation bankruptcy. Basically, this is the one that straight-up forgives your debts .

Chapter 13 bankruptcy is more like a repayment plan and less like a total wipeout. With Chapter 13, a borrower files a plan with the bankruptcy court detailing how they will repay their creditors. The borrower will pay some debts in full while paying otherspartially or not at all, depending on what they can afford. Chapter 7 = wipeout. Chapter 13 = plan.

How Bankruptcy Exemptions Work

When you file a petition for bankruptcy, you typically have to submit information about your assets and financial resources to the courts. Certain assets are exempt, which means that the courts will not require that you sell or liquidate them in order to repay creditors before you receive a discharge. ERISA benefits, a certain amount of life insurance, some clothing and even home furnishings are among the exemptions available.

There are both federal and state exemptions available, although Maryland does not allow those who file bankruptcy to claim the federal exemptions. You will need to use the state exemptions if you move forward with Chapter 7 bankruptcy in Maryland.

Also Check: How Many Times Has Sears Filed Bankruptcy

Is There A Simpler Option Than A Home Equity Loan In A Bankruptcy Situation

To rebuild your finances you need access to every financial tool possible, including the equity in your home. Having a bankruptcy on your record will make this more difficult. While bankruptcy is a legitimate method of dealing with a bad financial situation, it will damage your credit.

There is another financial tool that you may not be aware of called a leaseback. With the help of an experienced real estate investor, a leaseback can be a quick and simple solution for any homeowner in this situation.

How Does A Home Equity Line Of Credit Or Refinance Work

The basic trade off when borrowing against your house is that with these loans, the borrower pledges their house to cover the debt, but gets a lower interest rate.

Remember:

- Taking out a second mortgage or refinance your house, you are risking your house to pay debts that would be discharged in bankruptcy

- Increasing the loan balance against your house means you are also increasing your mortgage payment for many years or even decades

- Borrowing against your house or refinancing to take out cash to consolidate the debt, your bank will increase your interest rate on the entire mortgage, not just the new loan

This is a pretty big risk just to save a few percentage points in interest.

Recommended Reading: Can You Buy A Home While In Bankruptcy

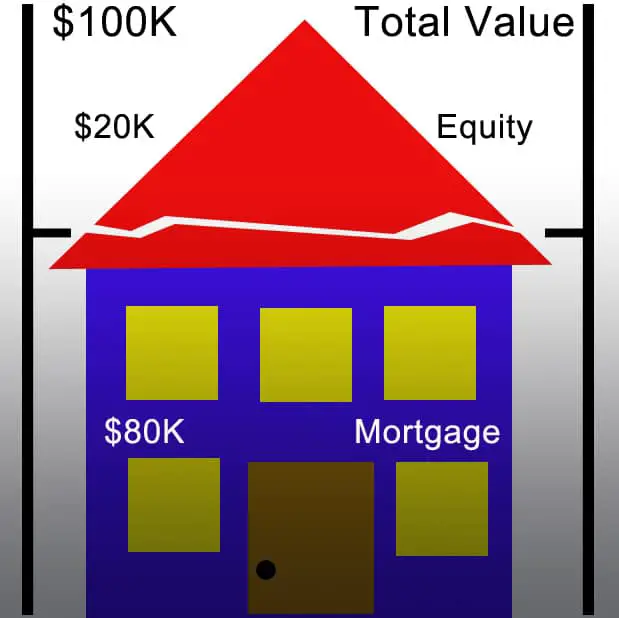

How Much Home Equity Do You Have

Start by calculating your home’s value and your home’s equity, or how much you’d get if you were to sell it. Suppose you own your home free and clear. In that case, your equity and your home’s value would be the same. By contrast, if your home is “underwater” because your mortgage balance exceeds your home’s value, you wouldn’t have any equity in your home.

It’s likely that your equity falls between the two extremes. Your home’s equity is the difference between the value of your home, and anything you’d have to pay if you sold your property, such as your mortgage, and any other liens.

What Happens To Your Mortgage When You File For Bankruptcy

A mortgage is a secured debt that means that if you pay, you keep the security on it, which is your house. If you dont pay, you lose it. Bankruptcy, of course, complicates that.

Under Chapter 7, if its determined you cant pay your mortgage, then the bank will foreclose. The house will no longer be yours, and youll have to move out. You dont make any more payments in most cases.

With Chapter 13, you continue to make monthly mortgage payments, and also make past due payments, keeping the mortgage alive. But its not easy more Chapter 13 cases were dismissed in 2020, which means finished without being completed, than were discharged. When a case is dismissed, its as though the person never filed. The majority of dismissed cases was because homeowners didnt or couldnt make their payments. Whatever the reason, the debts are still owed, which puts you right back where you were before filing.

Whether you can or cant stick with the payment plan, you are still responsible for paying your mortgage or you will lose your house.

Don’t Miss: How To See If Bankruptcy Is Discharged

Is It Possible To Get A Home Equity Loan While In Chapter 7 Bankruptcy

Unfortunately, you would not be able to get a home equity loan while in Chapter 7 bankruptcy for a number of reasons. Your assets are largely controlled by the bankruptcy court.

When you borrowed money to buy your home, you signed a note and a mortgage . Chapter 7 bankruptcy wipes out the loan, but it does not wipe out the lien.

The lender can foreclose on your house if you are already behind on your payments, or if you fall behind on your payments later during bankruptcy. If you are current on your payments and can show that you are likely to be able to continue to make your payments, the lender will let you keep your home.

In Chapter 7 bankruptcy, you give up your non-exempt assets to repay as much of your debt as possible. The bankruptcy trustee assigned to your case will have complete authority over these assets. Any asset that is not exempt from their use will be sold to pay your creditors.

If you have a lot of equity in your home, unless your state exempts all your equity, the trustee will sell your home to use the equity. They will pay the lender so that the lien is removed, pay you the exempted portion of your equity, and use the rest to pay your creditors.

Even in states that completely exempt your equity in your home, any equity that is turned into cash while in bankruptcy is no longer exempt. A trustee would not allow you to access the equity by turning it into cash.

Do Bankruptcies Affect Second Mortgages

Second mortgages and home equity lines of credit are also impacted by bankruptcies. If you have a second mortgage or HELOC, youre not responsible for it under a Chapter 7 bankruptcy, but youre required to keep paying on it if you want to keep the house without a problem.

Matters become a little more complex with a Chapter 13 bankruptcy. If you can prove that your existing equity isnt enough to cover what you owe on a second mortgage or HELOC, you can present that evidence in bankruptcy court. If a judge agrees, the junior lien taken out after your first mortgage may be stripped off.

Its worth noting that a lender may fight this, so to give yourself the best chance of success, you may want to get an appraisal before filing for bankruptcy.

You May Like: Can Bankruptcy Get Rid Of Judgements

How Long Do I Have To Wait After Chapter 13 To Get A New Mortgage

Rocket Mortgage and other lenders may give you the option of getting an FHA or VA loan as long as the Chapter 13 bankruptcy is discharged or dismissed before you apply.

If youre looking to apply for a conventional loan, it matters whether your bankruptcy was discharged or dismissed. In the event of a Chapter 13 discharge, the discharge date must be at least 2 years prior to the date credit is pulled and a minimum of 4 years since the filing.

If the bankruptcy was dismissed, theres a 4-year waiting period until you can have your credit pulled for a new conventional mortgage.

Finally, jumbo loans still have a 7-year waiting period before you can apply.

If Youre Behind On Your Mortgage Payments

With Chapter 7, if you are behind on your mortgage payments and cant catch up, you can surrender your house. If you want to catch up on payments, there is no provision under Chapter 7 to do that, so, as mentioned before, it should be done before filing for bankruptcy.

One of the biggest benefits of Chapter 13 is that it makes it easier to keep your house, including catching up on payments. Payment plans allow a mortgage modification with a bank that can spread missed payments over the life of the plan, three to five years, and also require current payments be made.

In either case, if the bank is going to foreclose on your house and you know you wont be able to stop it, and you plan to file for bankruptcy, file for bankruptcy before the foreclosure. If the bank sells your house after a foreclosure but doesnt make back what you owe them on it, there is a deficiency judgment, which means you owe the bank the difference. If the foreclosure happens as a result of the bankruptcy, there is no deficiency judgment.

Recommended Reading: How To File Bankruptcy Yourself In Tx

How Much Equity Do I Have In My Home

To calculate your home equity, you must establish your propertys current market value through a home appraisal.

Once you have this value, use a home equity calculator or calculate it yourself by subtracting the amount you owe on your mortgage and any owed property taxes from your homes appraised value.

Example: you owe $150,000 on a mortgage and £5000 in property taxes. Your house was recently appraised at $350,000, so your home equity is $195,000.