What To Include When Calculating Your Debt

When adding up your debt, take a look at your bills. Consider your new mortgage payments principle, plus interest, taxes, insurance and homeowners association dues. Also include any other mortgages you may have, alimony and child support payments, credit cards, student loans, car loans, personal loans and any other loans you make a payment on each month.

Whats not included? Household expenses, like utilities, internet or groceries.

To calculate your gross monthly income, youll want to consider your income before taxes and other deductions are taken.

If youre earning income from multiple sources and your income is more difficult to calculate, you can speak with a licensed loan originator who can explain how income stream flows together to create your gross monthly income.

Multiply That Number By 100 To Get A Percentageand Thats Your Debt

Lets look at an example:

Bob pays $600 a month in minimum debt payments plus $1,000 per month for his mortgage payment. Before taxes, Bob brings home $5,000 a month. To calculate his DTI, add up his monthly debt and mortgage payments and divide it by his gross monthly income to get 0.32. Multiply that by 100 to get a percentage.

So, Bobs debt-to-income ratio is 32%.

Now, its your turn. Plug your numbers into our debt-to-income ratio calculator above and see where you stand.

Why Is Dti Important

Your debt-to-income ratio shows lenders youre able to make payments on-time and are likely to repay the money you borrow improving your chances of being approved for a loan and getting a more favorable loan term. Sometimes, a lender will allow a higher DTI if you can show a good credit score and additional savings and assets that demonstrate your ability to repay the loan.

However, DTI is just one piece of the puzzle. When applying for a mortgage, its also helpful to figure out how much you can comfortably afford to spend on a home without overextending yourself and to start saving for a down payment as soon as possible.

Don’t Miss: Can You File Bankruptcy On Ssi Overpayment

How Is Your Dti Ratio Calculated

To calculate your DTI ratio, divide your total recurring monthly debt by your gross monthly income the total amount you earn each month before taxes, withholdings and expenses.

For example, if you owe $2,000 in debt each month and your monthly gross income is $6,000, your DTI ratio would be 33 percent. In other words, you spend 33 percent of your monthly income on your debt payments.

How To Use Our Debt

Your DTI ratio is an important part of the how much house can I afford decision. Knowing your DTI provides a good indication of what to expect from the mortgage preapproval process.

For example:

-

If your housing-related monthly debts are below 28%, you may qualify for a larger loan amount than originally expected

-

If your total debts are above 36%, it may explain why you werent approved despite good credit

-

If your DTI is 50% or above, you may have to pay down a substantial portion of your debts before you can purchase a home

You May Like: Has Mark Cuban Ever Filed For Bankruptcy

A Good Dti Ratio Is 43% Or Lower

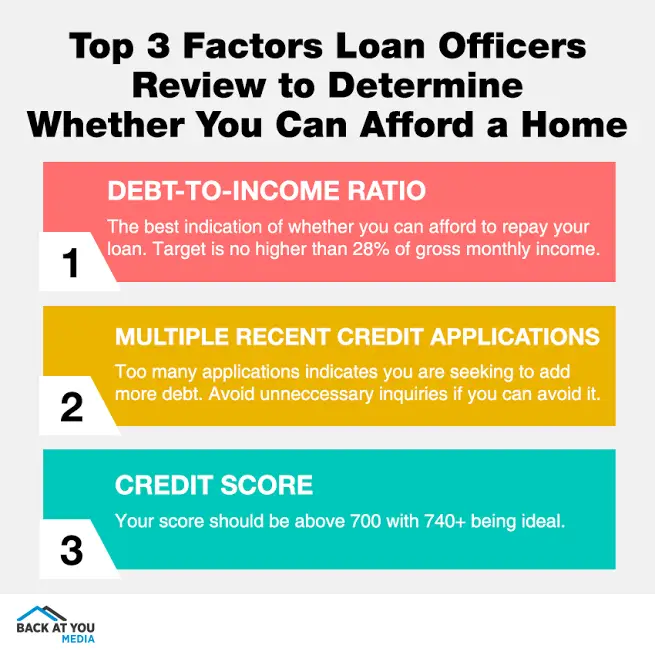

Your debt-to-income ratio is one of the most important factors in qualifying for a home loan. DTI determines what type of mortgage youre eligible for. It also determines how much house you can afford. So naturally, you want your DTI to look good to a lender.

The good news is that todays mortgage programs are flexible. While a 36% debt-to-income ratio is ideal, anything under 43% is considered good. And its often possible to qualify with an even higher DTI.

In other words, you definitely dont need a perfect debt-to-income ratio to buy a house.

In this article

What Is The Best Debt

Long term, the answer is as low as you can get it.

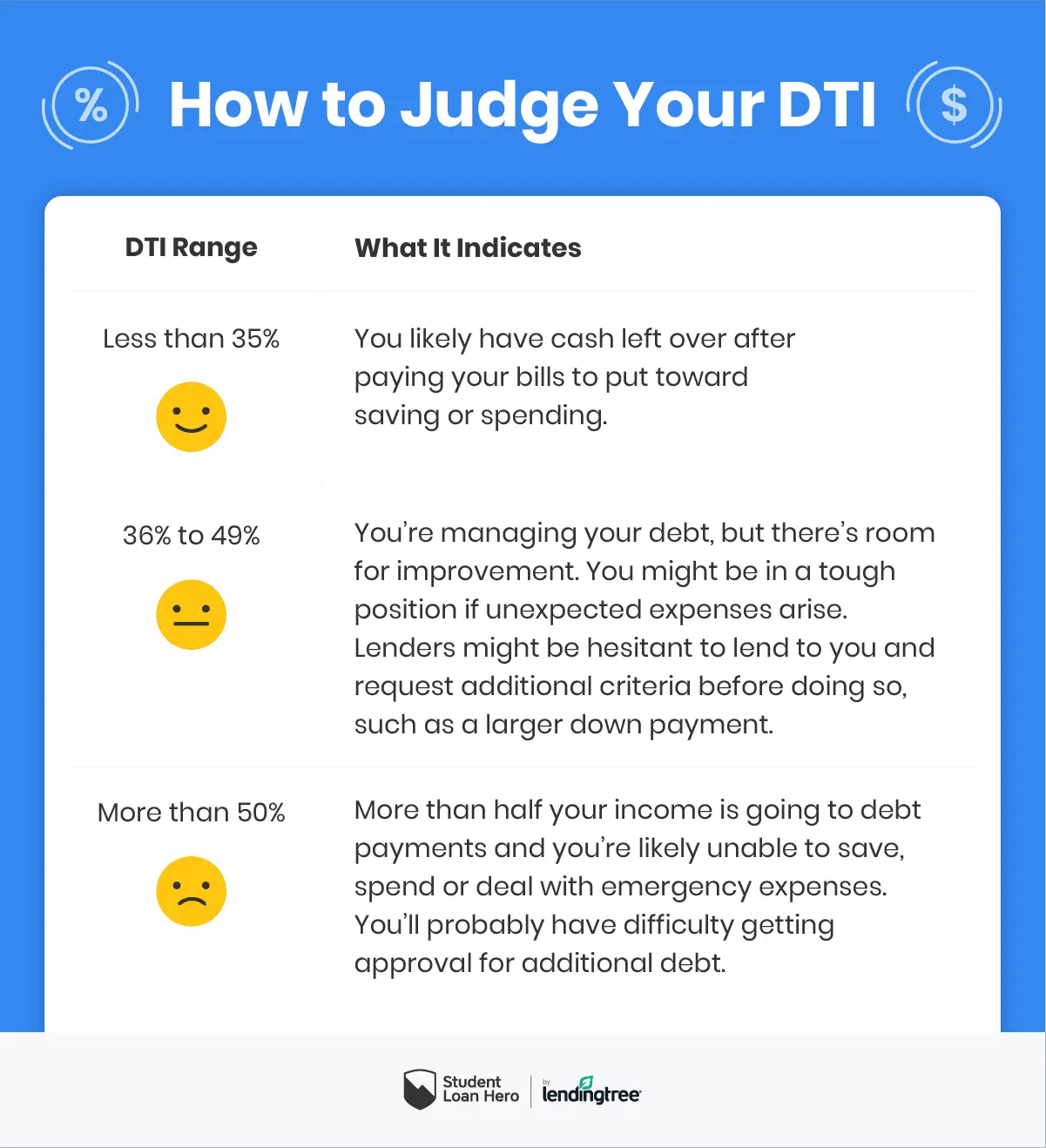

However, hard numbers are better tools for comparison. Take a look at the following DTI ranges:

- 35% or less = Good

- 36-43% = Acceptable but Needs Work

- 44% and up = Bad

If youre trying to get a home loan, 36% is the most recommended debt-to-income ratio. If you dont have a significant down payment saved up, 31% is a better target.

Don’t Miss: Houses That Are In Foreclosure

How Much Do Debt Ratios Affect A Credit Score

Your income does not have an impact on your credit score. Therefore, your DTI does not affect your credit score.

However, 30% of your credit score is based on your credit utilization rate or the amount of available on your current line of credit. Generally, your utilization rate should be 30% or lower to avoid having a negative effect on your credit score. That means that in order to have a good credit score, you must have a small amount of debt and actively pay it off.

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

Also Check: Does A Married Couple Have To File Bankruptcy Together

Work On Paying Down Debt

Paying off loans and bringing down debt balances can improve your debt-to-income ratio. To free up cash flow you can use to pay down your debt faster, give your budget a second look.

You may find ways to cut down on monthly expenses such as by:

- Shopping for a lower-cost cell phone plan

- Reducing how often you get food delivery or takeout

- Canceling streaming services you no longer use

When deciding which debt to pay down first, borrowers often use one of two strategies. The debt avalanche method involves targeting your highest-interest debt first, while continuing to make minimum payments on all other debts. This strategy helps you save money on interest over time. The other method, debt snowball, has borrowers focus on the debt with the lowest balance first, while keeping up with the minimum payments on other debts. It helps borrowers stay motivated by giving them small wins on their path to getting out of debt.

If youre unsure how to approach your debt, you could sign up for free or low-cost debt counseling with a certified credit counselor. These professionals can provide personalized financial advice, help you create a budget and provide useful tools that can teach you about money management. You can search for a certified credit counselor through the Financial Counseling Association of America or the National Foundation for Credit Counseling .

Calculating Income For A Mortgage Approval

Mortgage lenders calculate income a little bit differently than you may expect. Theres more than just the take-home pay to consider, for example.

Lenders also perform special math for bonus income give credit for certain itemized tax deductions and apply specific guidelines to part-time work.

The simplest income calculations apply to W-2 employees who receive no bonus and make no itemized deductions.

For W-2 employees, the lender will typically look at your pay stubs and use the year-to-date average to determine your gross income and your monthly household income.

Recommended Reading: Is B Stock Legit

How To Reduce Your Debt

Here are few things to consider if you want to reduce your debt-to-income ratio or learn how to use credit wisely:

Avoid Taking On New Debt

Avoiding debt can help build your financial well-being, according to the CFPB. And because your DTI ratio depends on your amount of debt versus your income, taking on more debt without growing your income will increase your DTI ratio. So itâs a good idea to apply only for the credit you need and avoid taking on new debt.

Pay Down Existing Debt

There are a few different strategies for paying off debt. The CFPB talks about the snowball and highest-interest-rate methods. But there are many more strategies for handling loan paymentsâsuch as consolidating debtâthat you might explore, too.

Before you make any decisions, consider talking to a qualified financial professional to figure out a debt management plan for your specific situation. You might even have access to some financial planning services through your employer or retirement plan administrator.

Pay More Than the Minimum

The CFPB recommends paying more than the minimum payment on your credit cards whenever possible. This may help you reduce your credit card debt faster and minimize charges. It can also help your , which can be an important factor in calculating your credit scores.

Use a Budget

How To Calculate Your Income

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don’t Forget Your Spouse!

Your spouse’s income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Also Check: How Do I Find Foreclosed Homes

What Is An Automated Underwriting System

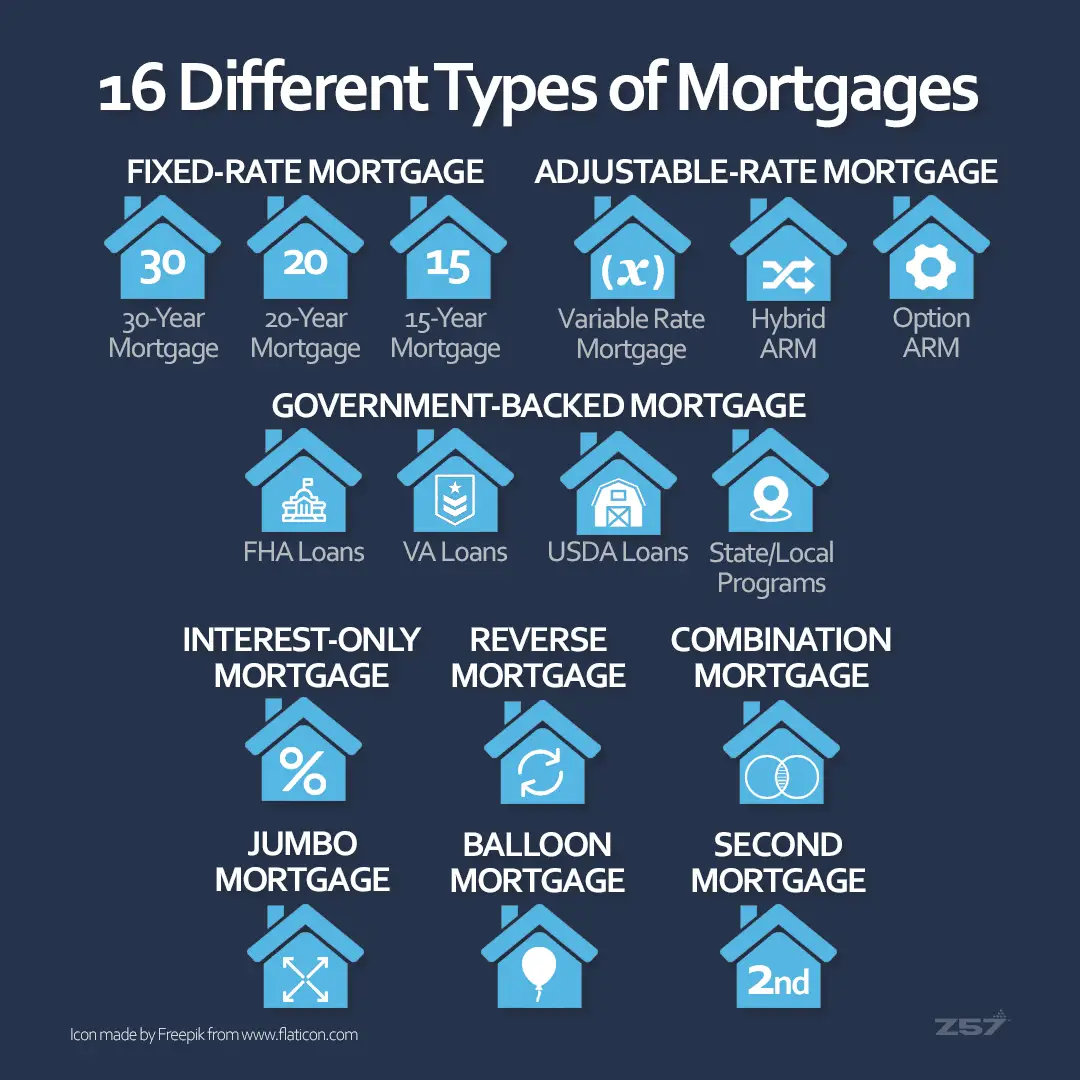

Themortgage underwriting processis almost always automated using an Automated Underwriting System . The AUS uses a computer algorithm to compare your credit score, debt and other factors to the lender requirements andguidelines of the loanyou’re applying for. While lenders use to manually underwrite loans, only a few do so today and usually only under a few special circumstances like:

- If you do not have aFICO scoreor credit history

- If you’re new to building credit

- If you’ve had financial problems in the past like a bankruptcy or foreclosure

- If you’re taking out ajumbo loan

Loans Which Dont Use Dti For Approval

Mortgage lenders use DTI to see whether homes are affordable for a U.S. home buyer. They verify income and debts as part of the process.

However, there are several high-profile mortgage programs which are more flexible about the DTI calculation. These include loan options from the FHA, the VA, and Fannie Mae and Freddie Mac.

Also Check: What Bankruptcy Cannot Do For You

How Much Does Your Debt

or credit reports are never affected directly by your DTI. While credit-reporting agencies can know your income, they do not consider it when calculating your credit score. When you apply for a home loan, your creditworthiness is still considered.

Nevertheless, borrowers with high DTI ratios may also have high credit utilization ratios, which account for 30% of your credit rating. Due to the fact that you are paying down more debt as you lower your credit utilization ratio, your credit score will increase and your DTI ratio will decrease.

How To Determine How Much House You Can Afford

Most people use a mortgage to buy a home, but everyoneâs income and expenses are different. Because of this, youâll want to calculate your potential monthly payment based on your current financial situation. Youâll need to calculate some figures like:

- Income: This is how much you earn on a monthly basis from your regular day job and any side hustles you have. Make sure you have gross and net numbers at the ready. You can find these on your most recent pay stub. If you have a fluctuating income, use your most recent tax returns for guidance.

- Debt: Debt consists of what you currently owe money on. This would include things like credit cards, student loans, car loans, personal loans and other types of debt. Debt isnât the same as expenses, which might fluctuate month-to-month .

- Down payment: This is how much cash youâll pay up-front for the cost of a home. A 20% down payment might remove private mortgage insurance charges from your monthly costs, but itâs not always required to buy a home. The higher your down payment, however, the lower your monthly mortgage payment will be.

- : Having good or excellent credit means you can get the lowest interest rate available offered by lenders. A high interest rate typically means a higher monthly payment.

Recommended Reading: Car Dealerships That Accept Bankruptcy

When Can Dti Be Higher Than 36%

Some mortgages such as those offered by the FHA, have certain, more stable features that make it more likely youll be able to afford your loan, according to the CFPB. Current FHA loan requirements allow for a total DTI ratio of up to 50% or less.

Both small lenders and large banks may offer loan options at higher DTI percentages. Be sure to compare mortgage loans from several lenders to find the best option for your financial needs.

How To Qualify For A Mortgage With A High Dti

It is possible to buy a home with a high debt-to-income ratio. If you are approved with a DTI above 43%, your loan may be subject to additional underwriting that can result in a longer closing time.

Overall, higher DTI ratios are considered a greater risk when an underwriter reviews a mortgage loan for approval. In some cases, if the DTI is deemed too high, the lender will require other compensating factors to approve the loan, explains DiBugnara. He says compensating factors can include:

- Additional savings or reserves

- Proof of on-time payment history on utility bills or rent

- A letter of explanation to show how an applicant will be able to make payments

A higher credit score or a bigger down payment could also help you qualify. Cook notes that, for conventional, FHA, and VA loans, your DTI ratio is basically a pass/fail test that shouldnt affect the interest rate you qualify for.

But if you are making a down payment of less than 20% with a conventional loan, which will require you to pay mortgage insurance, your DTI ratio can affect the cost of that mortgage insurance, adds Cook. In other words, the higher your DTI, the higher your private mortgage insurance rates.

Also Check: Can You Keep Some Credit Cards When Filing Bankruptcy

What Dti Should I Aim For

As a rule of thumb, your DTI should range between 36% and 43% when youre applying for a mortgage.

That said, a lower debt-to-income ratio is always better. The lower your debt-to-income ratio, the better mortgage rate youll get.

DTI is a key ingredient in home affordability for many borrowers: When a low DTI helps you avoid high-interest mortgage loans, you can afford a more expensive home.

Tips To Improve Your Debt

Reducing your debt-to-income ratio may seem self-explanatory, but paying down debt is often easier said than done. Follow these tips to make a meaningful, timely impact on your debt-to-income ratio before you apply for a mortgage or another major loan:

Read Also: How Many Times Can A Person File Bankruptcy

Does My Dti Influence My Credit Score

Your debt-to-income ratio does not influence your . It simply gives you a way to see how much of your income each month has to go toward repaying your recurring debt. Having a high DTI doesnt necessarily mean that your credit score will be low, provided youre making the minimum payments on time each month.

How Does Your Dti Ratio Affect You

You might not be able to get a mortgage if you have a high debt-to-income ratio. Whatâs more, youve got a better chance of qualifying for a home loan if you have a lower DTI.

You can also get lower mortgage rates by improving your debt-to-income ratio, which determines whether youre eligible for the type of loan you want.

In the case of mortgage loans, refinancing mortgages, and home equity loans, lenders factor DTI into the equation.

But, thatâs not all. Having a debt-to-income ratio higher than 43% can have adverse effects on your financial life in multiple ways, none of which are good:

- Your budget is less flexible. When you spend most of your income on debt repayment, there is less left over for saving, investing, or spending.

- With a high debt-to-income ratio, youre seen as a riskier borrower. It is possible that lenders will assign higher interest rates to loans or credit to risky borrowers, impose steeper penalties for missed or late payments, and impose stricter conditions for them.

Also Check: Can Filing Bankruptcy Stop Wage Garnishment Student Loans