How Is The Debt

High Debt Doesnt Always Mean A High Dti Ratio

Owing a large amount of money doesnt necessarily mean youll have a high DTI ratio it depends on what you earn and how much of your income goes toward debt repayment.

As an example, if you owe $1,000 in monthly debt payments and have a gross monthly income of $2,000, your DTI ratio will be high at 50%. However, if your gross monthly income is $10,000, your DTI ratio is only 10%.

In other words, your debt payments need to remain in proportion to your monthly income to remain affordable. But if your income is on the low side, its easier for your DTI ratio to creep up quickly.

Add Up All The Minimum Payments You Make Toward Debt In An Average Month Plus Your Mortgage Payment

You dont need to factor in common living expenses or paycheck deductions contributions). But you should include all types of debt, like:

Mortgage payments Personal loans Timeshare payments

Youll also include recurring monthly paymentslike rent, child support or alimonyeven though they arent technically considered debt.

Confusing? We get it . But think about it like thisto get an accurate picture of how much youre spending each month, lenders look at more than just your debt to decide if theyll approve you for new credit.

So, to sum it up, include all your monthly minimum debt payments and recurring or legally binding payments in your debt-to-income ratiobut not basic monthly bills.

You May Like: How Many Times Are You Allowed To File Bankruptcy

Why Does Your Debt

Many lenders use credit scoring formulas that take your debt-to-credit ratio into consideration. In general, lenders like to see a debt-to-credit ratio of 30 percent or lower. If your ratio is higher, it could signal to lenders that you’re a riskier borrower who may have trouble paying back a loan. As a result, your credit score may suffer.

How Quickly Can I Improve My Dti

Since your DTI is based on the total amount of debt you carry at any given time, you can improve your ratio immediately by repaying your debt. The more aggressively you pay it down, the more youll improve your ratio and the better your mortgage application will look to lenders. Alternatively, you can also pick up a job to earn more income.

Recommended Reading: Income To Qualify For Mortgage

Can I Qualify For Credit Or Loans If My Dti Is High

Some lenders are willing to extend smaller personal loans to applicants with a higher DTI. These creditors take on borrowers with more risk. These types of loans can be a lifesaver for people who encounter emergencies.

If you only need to borrow $1,000 to get your car out of the shop or pay the hospital for medical tests, it can be more favorable than using a credit card.

What Determines Your Debt

A persons debt to income ratio is calculated using two things: what you owe to creditors each month and your gross monthly income from all sources. It does not include the total amount you owe to lenders, but rather your monthly minimum payments.

Lets say you have a mortgage with an outstanding balance of $150,000. Your required monthly payment is $800. Its the $800 that gets factored into your DTI, not the $150,000.

Its also your gross monthly income lenders use, not your take-home pay after taxes and deductions. If you earn a yearly salary of $60,000, that translates to a gross monthly income of $5,000. But if you have income from a side hustle or second job, that counts too.

Also Check: Buy Liquidation Pallets Online

What Is Debt To Income Ratio And Why Is It Important

Shopping around for a or a loan? If so, you’ll want to get familiar with your debt-to-income ratio, or DTI.

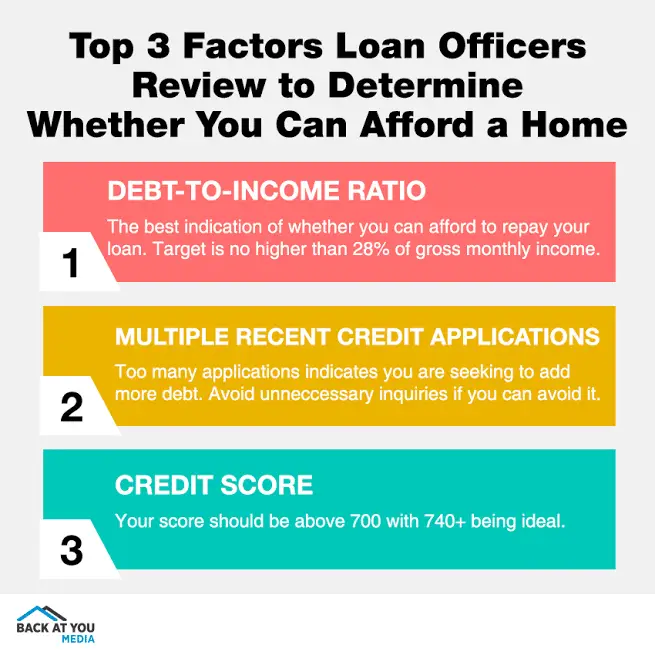

Financial institutions use debt-to-income ratio to find out how balanced your budget is and to assess your credit worthiness. Before extending you credit or issuing you a loan, lenders want to be comfortable that you’re generating enough income to service all of your debts.

Keeping your ratio down makes you a better candidate for both revolving credit and non-revolving credit .

Here’s how debt-to-income ratio works, and why monitoring and managing your ratio is a smart strategy for better money management.

How Does The Debt

Sometimes the debt-to-income ratio is lumped in together with the debt-to-limit ratio. However, the two metrics have distinct differences. The debt-to-limit ratio, which is also called the credit utilization ratio, is the percentage of a borrowerâs total available credit that is currently being utilized. In other words, lenders want to determine if you’re maxing out your credit cards. The DTI ratio calculates your monthly debt payments as compared to your income, whereby credit utilization measures your debt balances as compared to the amount of existing credit you’ve been approved for by credit card companies.

Recommended Reading: What Is Needed To File Chapter 7 Bankruptcy

A Good Dti Ratio Is 43% Or Lower

Your debt-to-income ratio is one of the most important factors in qualifying for a home loan. DTI determines what type of mortgage youre eligible for. It also determines how much house you can afford. So naturally, you want your DTI to look good to a lender.

The good news is that todays mortgage programs are flexible. While a 36% debt-to-income ratio is ideal, anything under 43% is considered good. And its often possible to qualify with an even higher DTI.

In other words, you definitely dont need a perfect debt-to-income ratio to buy a house.

In this article

Is All Debt Treated The Same In My Debt

Ultimately, your total recurring debt influences your debt-to-income ratio and can improve or lower your chances of getting qualified for a mortgage. The ratio doesnt weigh the type of debt differently. The more debt you have, the higher your DTI and the harder it may be to qualify for a great loan.

Recommended Reading: How To File Bankruptcy And Keep Your Home

Why Is Monitoring Your Debt

Calculating your debt-to-income ratio can help you avoid creeping indebtedness, or the gradual rising of debt. Impulse buying and routine use of credit cards for small, daily purchases can easily result in unmanageable debt. By monitoring your debt-to-income ratio, you can:

- Make sound decisions about buying on credit and taking out loans.

- See the clear benefits of making more than your minimum credit card payments.

- Avoid major credit problems.

- Jeopardize your ability to make major purchases, such as a car or a home.

- Keep you from getting the lowest available interest rates and best credit terms.

- Cause difficulty getting additional credit in case of emergencies.

Debt-to-income ratios are powerful indicators of creditworthiness and financial condition. Know your ratio and keep it low.

What Exactly Is A Debt

A debt-to-income ratio is a percentage that compares your debt, including student loans, to your annual income. This number is one of the ways lenders measure your ability to manage the monthly payments to repay the money you plan to borrow. Lenders will consider your DTI when evaluating your eligibility for a loan or new line of credit. Lenders find applicants with a low ratio to be less risky of an investment, and therefore will be more willing to lend to you.

Don’t Miss: Consumer Debt Help Association

How To Calculate Your Debt

Here’s an example:

You pay $1,900 a month for your rent or mortgage, $400 for your car loan, $100 in student loans and $200 in credit card paymentsbringing your total monthly debt to $2600.

Your gross monthly income is $5,500.

Your debt-to-income ratio is 2,600/5,500, or 47%.

What Is Your Debt

Your debt-to-income ratio refers to the total amount of debt payments you owe every month divided by the total amount of money you earn each month. A DTI ratio is usually expressed as a percentage.

This ratio includes all of your total recurring monthly debt credit card balances, rent or mortgage payments, vehicle loans and more.

You May Like: How Do You File For Bankruptcy In Ohio

Front End And Back End Ratios

Lenders often divide the information that comprises a debt-to-income ratio into separate categories called front-end ratio and back-end ratio, before making a final decision on whether to extend a mortgage loan.

The front-end ratio only considers debt directly related to a mortgage payment. It is calculated by adding the mortgage payment, homeowners insurance, real estate taxes and homeowners association fees and dividing that by the monthly income.

For example: If monthly mortgage payment, insurance, taxes and fees equals $2,000 and monthly income equals $6,000, the front-end ratio would be 30% .

Lenders would like to see the front-end ratio of 28% or less for conventional loans and 31% or less for Federal Housing Association loans. The higher the percentage, the more risk the lender is taking, and the more likely a higher-interest rate would be applied, if the loan were granted.

Back-end ratios are the same thing as debt-to-income ratio, meaning they include all debt related to mortgage payment, plus ongoing monthly debts such as credit cards, auto loans, student loans, child support payments, etc.

Our Standards For Debt

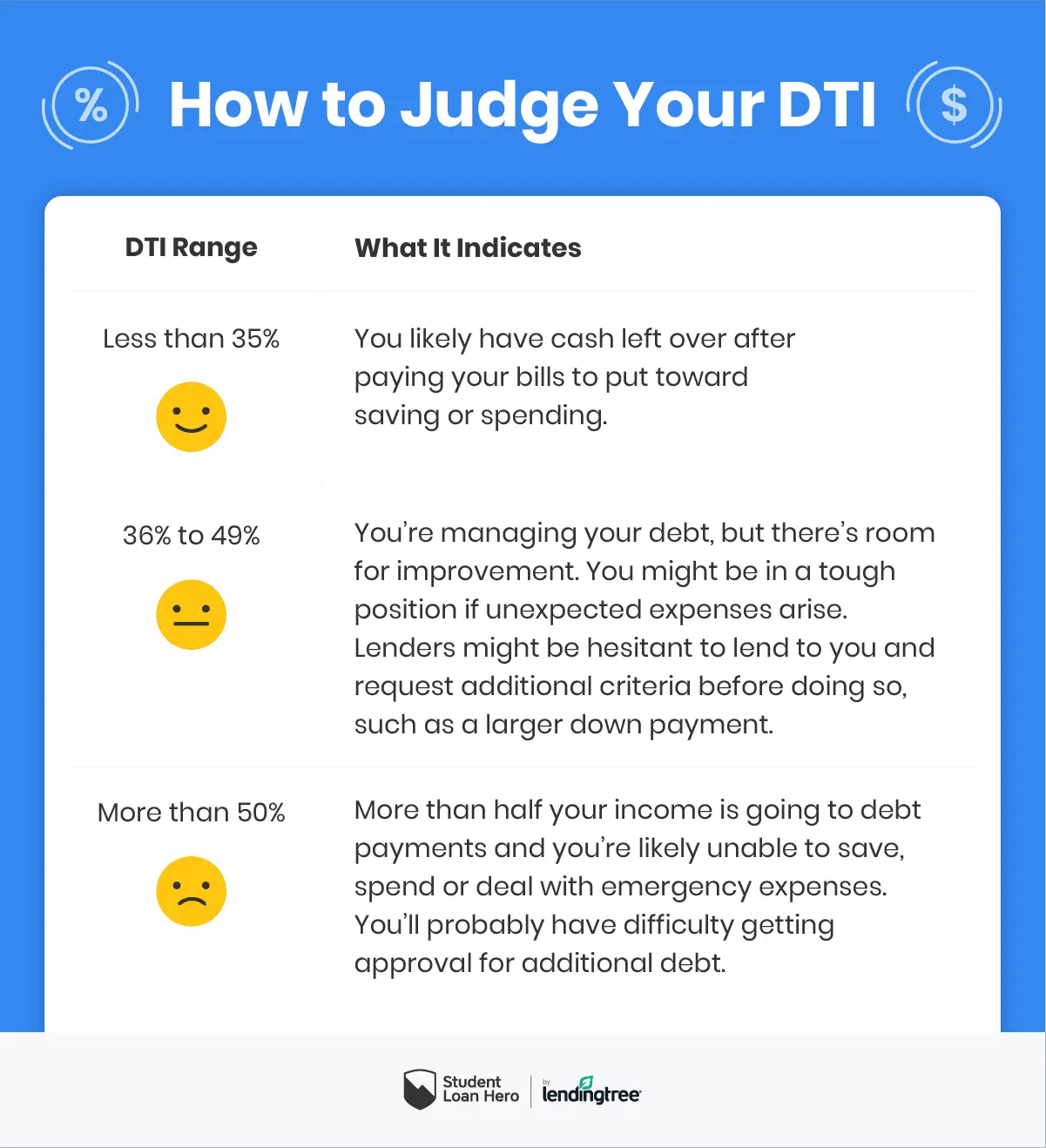

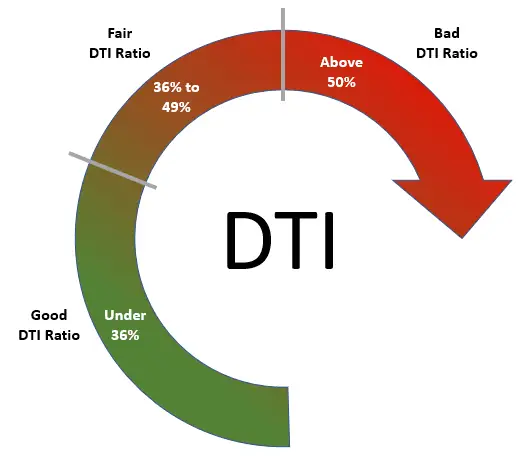

Once youve calculated your DTI ratio, youll want to understand how lenders review it when theyre considering your application. Take a look at the guidelines we use:

35% or less: Looking Good – Relative to your income, your debt is at a manageable level

You most likely have money left over for saving or spending after youve paid your bills. Lenders generally view a lower DTI as favorable.

36% to 49%: Opportunity to improve

Youre managing your debt adequately, but you may want to consider lowering your DTI. This could put you in a better position to handle unforeseen expenses. If youre looking to borrow, keep in mind that lenders may ask for additional eligibility criteria.

50% or more: Take Action – You may have limited funds to save or spend

With more than half your income going toward debt payments, you may not have much money left to save, spend, or handle unforeseen expenses. With this DTI ratio, lenders may limit your borrowing options.

Recommended Reading: What Are The Different Bankruptcy Options

Dti And Getting A Mortgage

When you apply for a mortgage, the lender will consider your finances, including your credit history, monthly gross income and how much money you have for a down payment. To figure out how much you can afford for a house, the lender will look at your debt-to-income ratio.

Expressed as a percentage, a debt-to-income ratio is calculated by dividing total recurring monthly debt by monthly gross income.

Lenders prefer to see a debt-to-income ratio smaller than 36%, with no more than 28% of that debt going towards servicing your mortgage. For example, assume your gross income is $4,000 per month. The maximum amount for monthly mortgage-related payments at 28% would be $1,120 .

Your lender will also look at your total debts, which should not exceed 36%, or in this case, $1,440 . In most cases, 43% is the highest ratio a borrower can have and still get a qualified mortgage. Above that, the lender will likely deny the loan application because your monthly expenses for housing and various debts are too high as compared to your income.

How To Figure Out Your Debt

To determine your debt-to-income ratio , start by adding up all your monthly debt payments.

Monthly debts for DTI include:

- Future mortgage payments on the home you want *

- Auto loan payments

- Health insurance

- Other non-debt expenses that dont appear on your credit report

Next, divide the sum of your debts by your unadjusted gross monthly income. This is the amount you earn every month before taxes and other deductions are taken out otherwise known as your pre-tax income.

Then, multiply that figure by 100.

* 100 = Your DTI

For example, say your monthly debt expenses equal $3,000. Assume your gross monthly income is $7,000.

$3,000 ÷ $7,000 = 0.428 x 100 = 42.8

In this case, your debt-to-income ratio is 42.8% just within the 43% limit most lenders will allow.

Don’t Miss: What Does Filing For Bankruptcy Do To Your Credit Score

Want To Learn More About Our Debt Solutions

Fill out this form and we’ll be in touch.

*JGW Debt Settlement, LLC d/b/a JG Wentworth has partnered with Even Financial, Inc to provide this loan referral service. JG Wentworth is not a lender and cannot ultimately decide whether or not you are approved for a loan. JG Wentworth does not determine or influence the amount of money you may receive from using this referral services.

-

Structured Settlements

All hours are Eastern Time

Mon – Thurs: 8 am – 11 pm

Fri: 8 am – 9 pm

Sat: 9 am – 6 pm

-

All hours are Eastern Time

Mon – Thurs: 8 am – 11 pm

Fri: 8 am – 9 pm

Sat: 9 am – 6 pm

Breaking Down The Dti Ratio

Lenders often evaluate two different DTI ratios: the front-end ratio and the back-end ratio.

The front-end ratio, sometimes called the housing ratio, shows what percentage of a borrowerâs monthly income is used for housing expenses. This ratio could include monthly mortgage payments, homeowners insurance, property taxes and homeowners association dues.

The back-end ratio is the amount of a borrowerâs income that goes toward housing expenses plus other monthly debts. And it can include revolving debts such as credit card or car payments, student loans and child support.

Lenders typically say the ideal front-end ratio should be no more than 28%, and the back-end ratio, including all expenses, should be 36% or lower. In reality, depending on your credit score, savings, assets and down payment, lenders may accept higher ratios, depending on the type of loan youâre applying for.

Recommended Reading: Filing Bankruptcy On Car Loans

A High Dti May Make It Difficult To Juggle Bills

Spending a high percentage of your monthly income on debt payments can make it difficult to make ends meet. A debt-to-income ratio of 35% or less usually means you have manageable monthly debt payments. Debt can be harder to manage if your DTI ratio falls between 36% and 49%.

Juggling bills can become a major challenge if debt repayments eat up more than 50% of your gross monthly income. For example, if 65% of your paycheck is going toward student debt, credit card bills and a personal loan, there might not be much left in your budget to put into savings or weather an emergency, like an unexpected medical bill or major car repair.

One financial hiccup could put you behind on your minimum payments, causing you to rack up late fees and potentially put you deeper in debt. Those issues may ultimately impact your credit score and worsen your financial situation.

Convert The Result To A Percentage

The resulting quotient will be a decimal. To see your DTI percentage, multiply that by 100. In this example, lets say that your monthly gross household income is $3,000. Divide $900 by $3,000 to get .30, then multiply that by 100 to get 30. This means your DTI is 30%.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

Read Also: Will Filing Bankruptcy Fix My Credit

The Bottom Line On Debt

Your DTI is just one measure of your overall financial health. You could have a not-so-good DTI and still be in a comfortable financial position, and vice versa. Its about taking the time to really evaluate your financial situation compared to your goals.

Best Egg loans are unsecured or secured personal loans made by Cross River Bank, a New Jersey State Chartered Commercial Bank, Member FDIC, Equal Housing Lender or Blue Ridge Bank, a Nationally Chartered Bank, Member FDIC, Equal Housing Lender. Best Egg Credit Card is issued by First Bank & Trust, Brookings, SD pursuant to a license by Visa International. “Best Egg” is a trademark of Marlette Holdings, Inc., a Delaware corporation. All uses of “Best Egg” refer to “the Best Egg personal loan” and/or “Best Egg on behalf of Cross River Bank or Blue Ridge Bank, as originator of the Best Egg personal loan,” as applicable.

How To Lower Debt

The only way to bring your rate down is to pay down your debts or to increase your income. Having an accurately calculated ratio will help you monitor your debts and give you a better understanding of how much debt you can afford to have.

Avoid employing short-term tricks to lower your ratio, such as getting a forbearance on your student loans or applying for too many store credit cards. These solutions are temporary and only delay repaying your current debts.

Don’t Miss: Can A Probate Estate File Bankruptcy

Whats An Acceptable Debt To Income Ratio

Individual creditors set separate debt-to-income guidelines and acceptable ratios. Acceptable DTI ratios can even vary between different financial products issued by the same lender. For instance, the cutoff might be lower for a mortgage than it is for a secured credit card.

Generally speaking, youll want your debt-to-income ratio to be 43% or less if you want to qualify for most mortgages. However, its better if you can lower your DTI to 36% or less.

Most mortgage lenders want to see no more than 28% to 30% of your monthly gross income go toward your payment. So, youll want to aim for 6% to 8% of your income to go toward other debt like credit cards and vehicle loans.

If youre interested in applying for a mortgage or another line of credit with a specific lender, its best to check their guidelines.

However, you may need to abide by additional requirements such as submitting proof of savings or obtaining a co-signer. If your debt-to-income ratio is higher than 49%, you may not get approved for a mortgage or unsecured credit cards.