How Much Do I Need To Earn To Get A Mortgage Of 300000 On A Buy To Let

Some buy to let mortgage lenders will expect you to earn a minimum of £25,000 per year in order to apply for a buy to let mortgage. However, when calculating how much theyd be willing to lend you, most will use the amount of rental income youre likely to achieve as a guide. The majority of lenders will expect you to be able to charge 25-45% more rent than your mortgage repayment on the amount you have borrowed.

You May Like: Mortgage Recast Calculator Chase

What Is A Stable Income

In mortgage terms, a stable income is defined as income that is paid in a set or fixed amount from the same source on a regular basis. For example, payslips from your employer will show that you receive a regular source of income.

Most lenders like to see that youve been in the same job, or at least with the same employer for two years or more, and that there are no big fluctuations in what youve been earning.

So, if youve just landed a well-paid job, youve switched careers or you recently started your own business, it may not be as straightforward to qualify for a conventional mortgage but if you can show that your income is stable or rising, then youre in a much better position.

Dont worry too much if you havent been in the same job for two years or more. If you can show that youve stayed in the same field, or that by changing jobs youve accepted a clear career progression with a pay increase, then a lender will take that into account.

And even if youve changed jobs more than once over the past couple of years, lenders will often look at the bigger picture in terms of income stability.

Why Calculate Mortgage Affordability

When you’re looking to buy a home, it’s handy to know how much you can afford. Being able to calculate an estimate of how much you’re able to borrow is an important part of setting your budget.

You also need to determine if you have enough cash resources to purchase a home. The cash required is derived from the down payment put towards the purchase price, as well as the closing costs that must be incurred to complete the purchase. We can help you estimate these closing costs with the first tab under the mortgage affordability calculator above.

Taken together, understanding how large a mortgage you can afford to borrow and the cash requirements involved will help you determine what kind of home you should be on the look out for. To learn more about mortgage affordability and how our calculator works, have a read of the information below.

You May Like: America First Credit Union Foreclosures

Get The Seller To Carry A Note

A seller can also carry a note on your real estate investment if they cant sell it. You can get approved for this kind of mortgage and be paid back over time with interest like any other loan. This can also help you ease into the credit requirements needed when taking out a traditional mortgage in the future.

Read Also: How To Shave Years Off Your Mortgage

Income Debt & Mortgage Qualification

To mortgage-qualify in Canada, for the most part you have to prove you reliably make money “sufficient to service your debts.” That means steady and predictable income sufficient to cover all your payments, including loans, credit cards, credit lines, support, etc. and of course the new mortgage payment and property taxes.

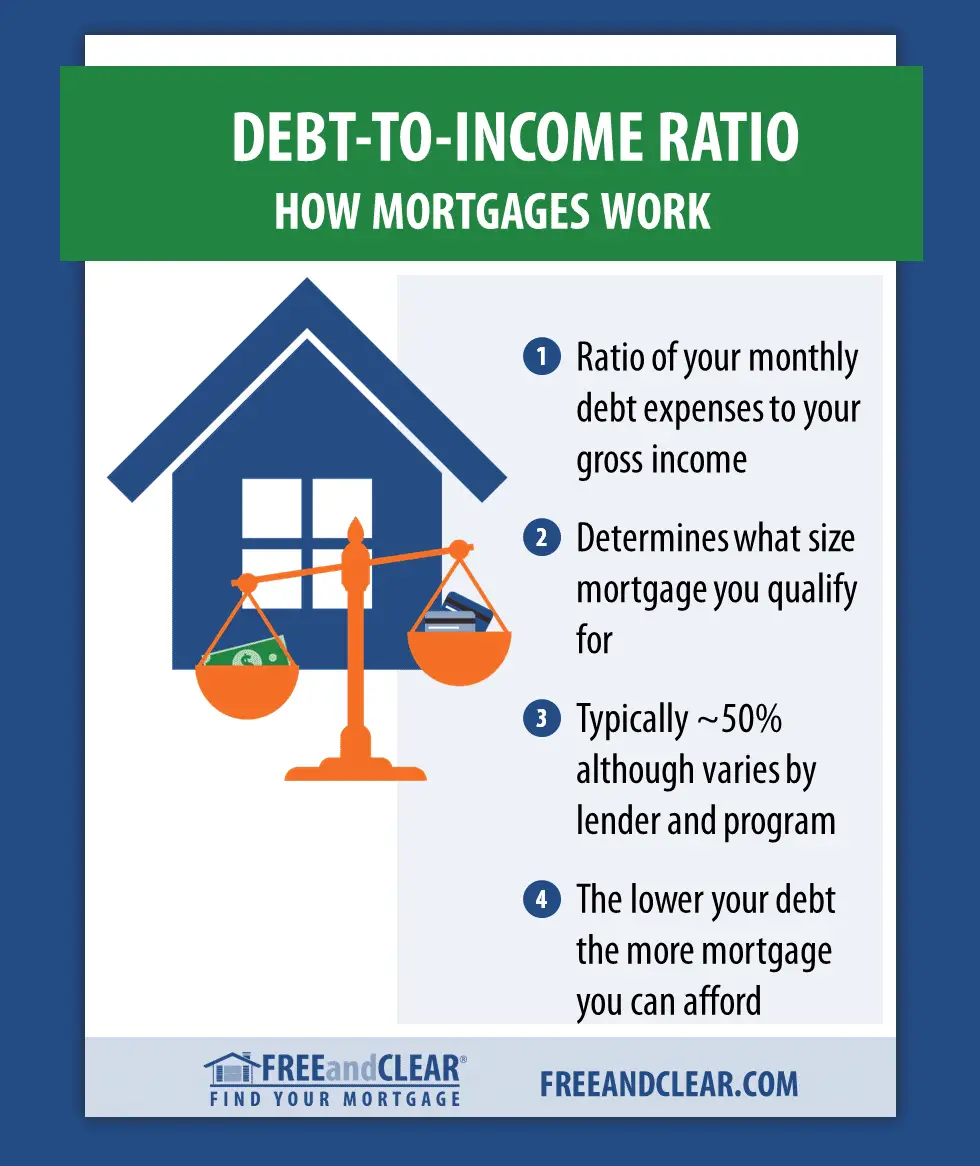

The maximum mortgage that you can be approved for is determined by a maximum ratio of monthly debt payments to monthly income. This means if you have a lot of debt and payments given a fixed amount of income, there might not be enough left over for the home youd like to buy.

Read Also: Where Can I Buy Liquidation Pallets

What Is Needed As Proof Of Income For A Mortgage

For proof of income, typically, lenders will need to collect:

- Employment pay stubs

Stay in the know with our latest home stories, mortgage rates and refinance tips.

In your inbox every Thursday

- A valid email address is required.

- You must check the box to agree to the terms and conditions.

Thanks for signing up!

Have A Question About Our Mortgage Calculators

What is a mortgage calculator?

Its a tool that gives you an estimate of how much you could borrow from us or what your monthly repayments and other costs might be, for a mortgage in the UK.

We have different calculators that can help you in different ways each calculator does something slightly different.

Who is a mortgage calculator for?

Its for you if youre a first time buyer, youre looking to remortgage, move or buy an additional home, or youre a buy-to-let landlord.

What information do I need to use a calculator and how do you decide what I can afford?

When you apply for a mortgage or use our calculator, well ask you for information like

- How many people are applying

- How much you regularly spend on things like your credit or store cards, loans, overdrafts, maintenance and pension

- Why youre applying for example, buying your first home, moving home, or buying a second home

We wont ask about groceries, utility bills or travel.

How much can I afford to borrow?

Our calculators give you a idea of what you might be able to borrow from us to buy a home, and what your monthly and total mortgage payments could be, for different types of mortgages.

Which mortgage calculator is right for me?

The most popular place to start is our borrowing calculator or our affordability calculator.

You May Like: Best Pallets To Buy

Take A Longer Mortgage Term

The longer your mortgage term, the lower your monthly payment. If you take a longer term, you spread your payments over a larger number of months and years, which reduces the amount youll owe each month. While taking a longer term will increase the amount you pay in interest over time, it can free up more cash to keep your DTI low.

Budget For Homeowner Costs

Beyond the costs of purchasing a home, youll likely have expenses related to owning and maintaining your home:

Homeowners insurance

Lenders will require that you carry homeowners insurance, which protects your property in case of damage. The amount will vary depending on your homes value and location. Certain areas that are prone to floods or earthquakes may have higher premiums.

Property taxes

You will also pay property taxes to your local government. This amount is based on the value of the property and land and is used to cover costs such as infrastructure, school, law enforcement, and fire service.

Maintenance and repairs

Maintenance includes the ordinary expenses that come with owning a home, such as painting, taking care of a lawn, fixing appliances, and cleaning living spaces. The average homeowner spent $2,289 a year on maintenance and repairs in 2016, according to Bureau of Labor StatisticsConsumer Expenditure Survey. If youre preparing your home for sale or just curious about general upkeep, review our home maintenance and repair checklist.

The average Homeowners Association fee is $200 to $300 per month for a typical single-family home, according to Realtor.com. This money usually covers shared amenities and services for a community such as a pool or gym, trash removal, snow removal, or maintenance to common areas.

Also Check: Does Rocket Mortgage Sell Their Loans

You May Like: Can You File Bankruptcy On Titlemax

Choosing The Right Down Payment Amount For You

Phew! That was a lot of information. But youre now much better equipped to decide which sort of mortgage will work best for you.

Of course, many maybe most home buyers have limited options. Because you cant get a zerodownpayment loan unless youre eligible for one. And you cant get a Fannie or Freddie loan unless your credit scores 620 or better.

As importantly, you cant duck mortgage insurance unless your savings add up to a 20% down payment or you qualify for a VA loan.

So many will find their choices whittled down to one by their circumstances. And those who still have two choices will have to pick with one eye on mortgage insurance and the other on monthly payments.

You can easily learn what your options are by getting a preapproval from a mortgage lender.

Recommended Reading: Rocket Mortgage Requirements

Why Mortgage Companies Care About Income Sources

Many first-time home buyers wont have to worry much about multiple income sources. Chances are, you have pretty straightforward finances. Indeed, for many, a single income stream from one employer is all they have and all they need.

But others have multiple streams from different sources. Or one stream made up of different elements. In this case, approval can be a little more complicated. Thats because the lender has to verify each income stream individually to ensure youll continue at the same total income level for years to come. Remember that a mortgage lenders ultimate goal is to make sure you can afford your home loan payments for many years into the future.

Don’t Miss: Can You Get A Mortgage After Declaring Bankruptcy

Tips To Determine How Much Mortgage You Can Afford

Whats a rule of thumb to determine how much mortgage you can afford? Theres no one rule, but these four tips will tell you.

Home ownership should make you feel safe and secure, and that includes financially. Be sure you can afford your home by calculating how much of a mortgage you can safely fit into your budget.

Why not just take out the biggest mortgage a lender says you can have? Because your lender bases that number on a formula that doesnt consider your current and future financial and personal goals.

Think ahead to major life events and consider how those might influence your budget. Do you want to return to school for an advanced degree? Will a new child add day care to your monthly expenses? Does a relative plan to eventually live with you and contribute to the mortgage? Do you like to travel?

Consider those lifestyle issues as you check out these four methods for estimating the amount of mortgage you can afford.

You May Like: Reverse Mortgage For Mobile Homes

What You Qualify For Vs What You Can Afford

Though the above steps can give you a good idea of what you can afford, the number you come up with may not match what a mortgage lender deems you’re eligible for when you apply.

Mortgage lenders base your loan amount and monthly payment on several factors, including:

When you apply for a mortgage loan, your lender will give you a loan estimate that details your loan amount, interest rate, monthly payment and total loan costs. Loan offers can vary greatly from one lender to the next, so you’ll want quotes from a few different companies to ensure you get the best deal.

You May Like: California Debt Relief Org

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Increase Your Credit Score

The higher your credit score, the greater your chances are of getting a lower interest rate. To increase your credit score, pay your bills on time, pay off your debt and keep your overall balance low on each of your credit accounts. Don’t close unused accounts as this can negatively impact your credit score.

Don’t Miss: Can You Discharge Medical Bills In Bankruptcy

I Own An Investment Property That I Purchased In The Middle Of Last Year My Tax Returns Don’t Show An Accurate Reflection Of The Income I Would’ve Made If I’d Owned The Full Year Is That Going To Impact How Much Rental Income Can Be Used Toward Qualifying For A Home Loan

it is possible to use more income than what is reported on your tax returns.You should prepare to provide documentation, such as a settlement statement to prove when the home was acquired, a current lease agreement to show what it’s being rented for, and/or documentation to explain why the rental property was out of service for a specific amount of time.ready to answer any additional questions

Fill out the form below to learn more!

Keywords:

How To Qualify For A Mortgage

8-minute read

*As of July 6, 2020, Rocket Mortgage® is no longer accepting USDA loan applications.

Are you ready to make the jump from renting a home or apartment to owning a home? The first step is applying for a mortgage, but how can you tell ahead of time if youll qualify?

Well introduce you to some of the factors that lenders look at when they consider mortgage applications. Well also share a few tips to make your application stronger.

Don’t Miss: Has Michael Bloomberg Ever Declared Bankruptcy

What Does It Mean To Be House Poor

House poor is a situation where most of your wealth is tied up in your house and much of your income goes toward servicing the mortgage debt and related expenses. An example would be if you had $100,000 in savings and used all of it to finance a $500,000 property with a $2,500 monthly mortgage payment when your net income is $3,000 per month.

Such a situation can give the illusion of economic prosperity but quickly unravel to foreclosure if things turn sour.

How Do Lenders Determine Mortgage Loan Amounts

While each mortgage lender maintains its own criteria for affordability, your ability to purchase a home will always depend mainly on the following factors.

Many different factors go into the mortgage lenders decision on homebuyer affordability, but they boil down to income, debt, assets, and liabilities. A lender wants to know how much income an applicant makes, how many demands there are on that income, and the potential for both in the futurein short, anything that could jeopardize its ability to get paid back.

Income, down payment, and monthly expenses are generally base qualifiers for financing, while and score determine the rate of interest on the financing itself.

You May Like: How To Lookup A Bankruptcy Case Number

Your Income Is Probably Ok For A Mortgage If

- You have been at a permanent job with a guaranteed minimum hours/salary for more than 3 months and have some experience or training in your field.

- You have had the same income source for at least 2 years, even if the income/hours are not guaranteed.

- You have been self-employed for 2 years or more and can prove it.

- You make enough money to pay the new mortgage and your current payments.

- Your personal taxes are filed and paid.

- You have permanent disability or pension income.

- Any income coming from child tax benefits or from the ex- as alimony or child support payments represents 1/3rd or less of your total income.

# Probably OKs?______

Income Rules And Rule Makers

Mortgage lenders all have the same legal obligation to ensure your ability to repay. But some interpret that duty differently. So if youre turned down by one lender, it may be worth trying others.

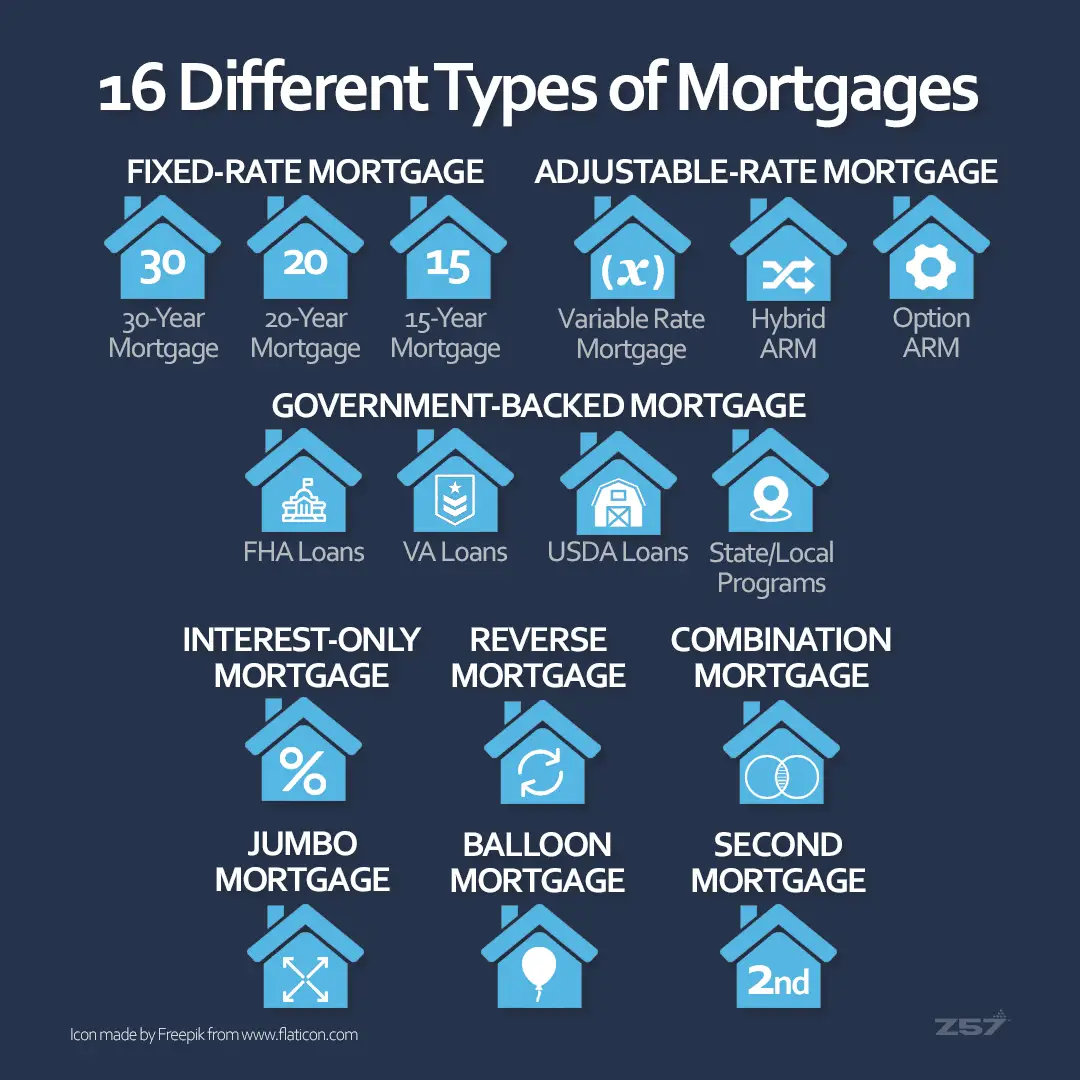

If you want a government-backed home loan, the rules on income for mortgage qualification are written pretty tightly. Those government-backed mortgages include Federal Housing Administration loans, Department of Veterans Affairs loans, and U.S. Department of Agriculture loans.

Fannie Mae and Freddie Mac also closely specify the income streams theyre prepared to accept for conventional loans. However, those arent chiseled in stone. Conventional mortgages may be more flexible when it comes to income qualifying than government-backed mortgages.

Recommended Reading: How Long Does Bankruptcy Stay On Your Credit Report

Is Your Dti Ratio Within A Good Range

Debt-to-income ratio or DTI is a risk indicator that measures how much of your monthly salary goes to your debts. In particular, DTI ratio is a percentage that compares your total monthly debts to your gross monthly salary. Generally, a high DTI ratio means you are not in a good position to acquire more debt. Likewise, a low DTI ratio is a sign that you have enough salary coming in to pay for your mortgage and other debt obligations.

If you have a high DTI ratio, make sure to reduce it before applying for a mortgage. This increases your chances of securing approval. You can lower your DTI by paying off or reducing large debts, such as high-interest credit card balances.

The 2 Main Types of DTI Ratio

Front-end DTI: The percentage of your salary that pays for housing expenses. It includes monthly mortgage payments, property taxes, home insurance, homeowners association dues, etc.Back-end DTI: The percentage of your salary that goes to housing expenses as well as other debt obligations. This includes credit card debt, student debt, car loans, any personal loans, etc.

Lenders assign different DTI limits depending on the type of loan. Most homebuyers obtain conventional loans in the market. These are common mortgages that come with thorough credit and background requirements.

The Two Main Types of Conventional Loans

Meanwhile, borrowers have the option to choose from the following government-backed loans:

Government-Backed Mortgage Programs