Why The Debt Clock Is Important

The U.S. national debt is the sum of all outstanding debt owed by the federal government. Itâs an accumulation of each yearâs budget deficits. About three-fourths of the national debt is public debt, which is held by individuals, businesses, and foreign governments that bought Treasury bills, notes, and bonds. The government owes the rest to itself, mainly to Social Security and other trust funds, and thatâs known as intragovernmental holdings.

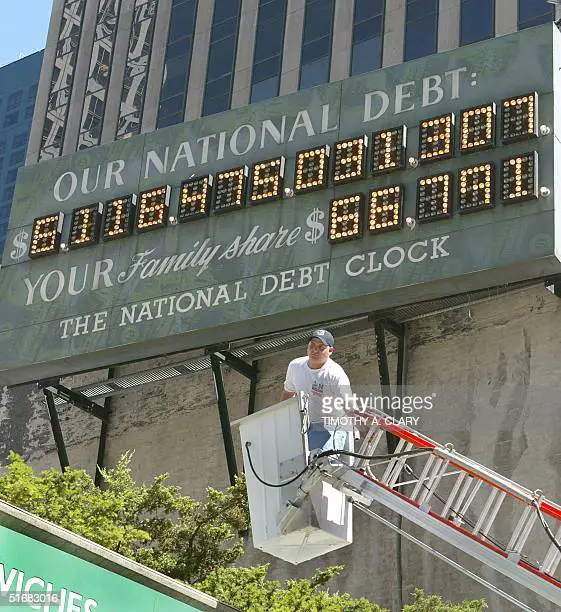

The debt clock shows how much the U.S. government owes its citizens, other countries, and itself. Most federal revenue comes from individual taxes. The government counts on you to pay the debt back one day. Corporations pass their tax costs through to you by raising prices. In other words, you, your children, and your grandchildren must pay 100% of the debt through higher taxes. The higher tax burden that the level of U.S. debt causes dampens expectations. Itâs a big threat to the quality of life for future generations.

On Dec. 14, 2021, the debt ceiling was raised again. The increase of $2.5 trillion set the new limit around $31.4 trillion. This increase constituted the largest dollar amount increase of the national debt.

Also Check: How To File Bankruptcy Yourself In South Dakota

A Tax Haven For Major Corporations

Apple adjusted its accounting procedures to run all of its European sales through its Irish office, thus taking advantage of the tax advantages that it gets in that country.

So, one company accounted for a leap of GDP of more than 25% that generated no income for the government.

Thus, the debt to GDP ratio does not assist buyers of Irish government bonds in assessing the borrowers ability to repay the debt.

Recommended Reading: What Does The Bankruptcy Trustee Investigate

What Can You Do

The national debt continues to grow, and it is important to be informed and proactive. Up to Us is an organization that empowers young adults to be educated about fiscal policy through on-campus activities. Get involved by hosting an event, attending a program, and connecting with other like-minded individuals.

Examples of infrastructure spending that improve an economy are:

- The development of transport infrastructure, such as motorways and railways

- Investment in universities to create more educational institutions or crate centers of excellence from existing establishments.

- Improvements in communication infrastructure, such as a fibre optic backbone to expand the nations internet bandwidth availability and speed.

If you are thinking of investing in a countrys economy, or if you are considering moving there, researching the national debt of that place and how the government spends money may be insightful.

A countrys national debt is one of many economic indicators that interplay to create a judgment on a countrys prospects for success.

Read Also: How Long Is Chapter 7 Bankruptcy

A Stark Warning From Treasury Secretary Janet Yellen Has Outlined The Risk Of A First

Earlier this week Treasury Secretary Janet Yellen informed Congress that the United States is on track to reach its statutory debt limit next Thursday, bringing the prospect of a disastrous default into sharp focus.

Failure to meet the governments obligations would cause irreparable harm to the US economy, the livelihoods of all Americans, and global financial stability, she warned.

I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.

For now, the Treasury will enact a number of extraordinary measures in order to satisfy the countrys ongoing financial obligations. The US can raise enough money from cash reserves and accountancy tricks to last beyond Thursday, but those powers are not infinite.

Yellens estimates that the measures could delay a default until early June, but the US risks breaching the debt ceiling and suffering a hugely harmful default unless the ceiling is raised by Congress. Even without a historic default, reaching the debt ceiling can have damaging economic consequences.

The US has never previously defaulted on its debt but tense situations where it approaches the statutory limit have become increasingly common.

What Other Factors Impact National Debt Rating

A countrys rating is also influenced by the:

- Rate of population growth

- Distribution of income in the country

- Levels of private debt

- Value of the housing stock

- Rate of homeownership

- Annual inward investment in a country

The above factors show whether the economy is likely to grow. A growing economy can bear the burden of tax that is needed to comfortably repay national debt.

Also Check: When Does Bankruptcy Come Off Your Credit

Why Is National Debt A Problem

If a government increases its national debt to a level that the market thinks is too high, it will have to increase the interest it pay in order to find lenders.

With the backstop of a high return from a safe source, banks do not need to lend to businesses to make a profit. When banks are less interested in offering loans, they raise interest rates for all borrowers.

High interest on loans increases business costs and the return on investment that is funded on debt reduces. In this instance, businesses cease to expand and unemployment rises.

Recommended Reading: How Long Bankruptcy Stay On Credit Report

Why Is This Important

Interests costs continue to rise, meaning that much of government spending may go towards paying it off. This means that areas of development such as education and infrastructure could receive less funding as more and more is allocated towards interest payments. In addition to this, higher interest rates create obstacles for private investments which affect economic growth. When the interest rate is high, it can be harder for businesses and individuals to receive funding and investments.

The national debt does not only affect the economy and its growth â it can also have a large effect on individuals and their livelihoods. As investments become harder to gain, businesses increase the costs of goods and services to balance out debt service obligations. In the long term, this can lead to lower investment returns. In addition to the possibility of paying more for goods and services, the average income for a family of four is projected to if debt continues to grow. This means that the money spent on necessities and luxuries will decrease. In addition to this, rising debt can equate to higher interest rates, meaning that houses, cars, and loans for college or businesses will become more expensive. In addition to this, the government may need to cut budgets around various programs which can affect those who rely on Medicare or Social Security to live.

Want to know more about how the debt is affecting our fiscal future? Check out our graphs and see it for yourself!

Recommended Reading: Who Does The Us Owe Debt To

What Are Short Term Instruments In Ireland

The NTMA issues three types of short-term loans:

Recommended Reading: Foreclosed Homes Jacksonville Fl

When Was The Last Time The Us Hit The Debt Ceiling

The 2011 debt ceiling crisis outlined what can happen if the US is allowed to reach the debt ceiling, even if a full default is avoided. Worryingly, 2011 shared a number of key factors with the situation in Washington DC today.

In the midterms of the first term of the Obama administration the GOP took control the House of Representatives, disrupting the Democrats unified control in Washington. President Obama had enacted some expensive social programs that had drawn the ire from Republicans, who argued that he had pushed the national debt too far.

As the country approached the debt ceiling, the Republican-led House initially refused to approve legislation that would allow Obama to raise the debt limit. The debt ceiling was breached and on 31 July the Treasury estimated that the US was just two days from a full default.

With financial catastrophe on the horizon, House Republicans eventually agreed to approve a raising of the debt ceiling in exchange for a raft of future spending cuts. Crisis was averted but the Bipartisan Policy Centre went on to estimate that the stalemate had served to increase borrowing costs by $18.9 billion.

The 2011 debt ceiling crisis came at a point when the Republicans controlled the House and the Democrats the Senate and White House, as is the case today. However there is one key difference between then and today, one that could make the prospect of a long stand-off even more likely.

You May Like: Can You Be Fired For Filing Bankruptcy

Us National Debt Clock

The US National Debt Clock covers the outstanding debt owed by the federal government. Two-thirds of the clock shows the public debt by way of treasury bills, notes, and bonds â this covers individuals, businesses, and foreign governments. The other third of the debt is what the government owes to itself â this covers federal programs like Social Security.

The largest budget items include: Medicare and Medicaid, Social Security, defense, and interest paid on the national debt. The former two items are a part of the mandatory programs that the government is required to fund with federal expenses. To give you an idea of how much more the U.S. spends compared to other countries, for the defense budget alone the U.S. spends more than China, India, Russia, Saudi Arabia, France, Germany, the United Kingdom, Japan, South Korea, and Brazil combined.

The Debt Clock also gives statistics on the demographics of the country, which is helpful in understanding where program funding may go. With a population of over 329 million, 60 million people are enrolled in Medicare and 79 million people receive Medicaid. In addition to this, there are currently 54 million retirees who seek Social Security benefits.

How Government Debts Affect You

The approximate interest rate on the cost of market debt in Canada is about 2.01 percent. Interestingly enough, the country accrues $75 million of debt per day in interest charges alone. That trickles down to the taxpayers, many of whom are seeking debt relief options for themselves.

According to the Financial Post, a study shows that Canada is a world leader in debt. One hypothesis for the debt getting so high is the fact that Canada came out largely unscathed from the last financial crisis. Low interest rates encouraged more borrowing, which led to bankruptcies and other economic downturns.

Recommended Reading: Liquidation Pallets San Francisco

Why Is The National Debt So High

When the federal government spends more than it takes in, we have to borrow money to cover that annual deficit. And each years deficit adds to our growing national debt.

Historically, our largest deficits were caused by increased spending around national emergencies like major wars or the Great Depression.

National Debt Comparisons: Real

- $loadingâ¦since you arrived loading⦠seconds ago

Disclosure:

This guide explains what national debt is and what a countrys national debt figures represent. We explain what a debt-to-GDP ratio means and explore which countries have the highest and lowest national debt-to-GDP ratios in the world.

If you want to learn about the reasons why national debt occurs, head over to the section on the reasons for national debt. More, you can learn about why foreign investors buy the national debt of other nations.

Read Also: Us Debt Clock Org

Don’t Miss: Where Do You File For Bankruptcy

How We Gather National Debt Data

Most of our data is directly obtained from official government agencies and central banks. When this is not possible, we use data from:

This raw data is then processed through our algorithms. Among other variables, these algorithms consider the average 10-year interest rate paid on the debt to calculate the current debt amount at the time you are viewing the debt clock.

We update our exchange rates using data from the European Central Bank.

Also Check: How Do People Get Into Debt

Other Impacts Of Rising Interest Rates

When interest rates rise, the cost of mortgages on properties rise and so the cost of rents also rise. The increase in the cost of premises forces businesses to increase their prices in order to remain in profit.

This in turn increases the cost of living and causes inflation without economic growth. A workforce faced with an increased cost of living will demand higher wages.

This increases business costs and the price of goods, stoking inflation further. It doesnt help that companies tend to cut costs through employee salaries.

Eventually, businesses will be squeezed to the point of bankruptcy or move their production abroad to save their profitability.

Donât Miss: Can You Get Rid Of Student Loans By Filing Bankruptcy

Read Also: How To Buy Foreclosure Houses

Interested In Trading Commodities

Start your research with reviews of these regulated brokers available in .

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. Between 74%-89% of retail investor accounts lose money when trading CFDs. You should consider whether you can afford to take the high risk of losing your money.

Read Also: Can You File Bankruptcy After Wage Garnishment

When Was The Debt Clock Installed

Real estate investor Seymour Durst created the debt clock in 1989. At that time, the national debt was almost $3 trillion and 50% of the gross domestic product . It was initially installed on 42nd Street and Sixth Avenue in New York City. Durst is famously quoted as saying, If it bothers people, then itâs working.

Durst also bought front-page newspaper ads to further express his concern about the growing national debt. He conveyed a prophetic message in his 1991 message: âFederal debt soaring, national economy shrinking, soon the twain shall meet.â

The debt clock faithfully recorded the increasing U.S. debt until 2000. Thatâs when the prosperity of the 1990s created enough revenue to reduce the federal budget deficit and debt. It seemed as if the debt clock had accomplished its goal.

Unfortunately, that prosperity didnt last. The 2001 recession and the 9/11 terrorist attacks meant lower revenues and higher government spending, which added to the debt. The national debt exceeded $6 trillion by July 2002more than double what the national debt was when the clock was initially installed. The Durst Corporation reactivated the clock at that time. When the debt exceeded $10 trillion in September 2008, one more digit had to be added.

The national debt has grown by more than $18 trillion since the financial crisis in 2008. In 2020 alone, the national debt hit four new milestones. The table below highlights several national debt milestones from 2017 through 2021.

Also Check: High End Liquidation Pallets

Student Loan Debt Clock

Student Loan Debt Clock

This Student Loan Debt clock reports an estimate of current student loan debt outstanding, including both federal and private student loans. This student loan debt clock is intended for entertainment purposes only. The actual total debt outstanding demonstrates more volatility at the beginning of each semester, when most student loans are disbursed.

In June 2010, total student loan debt outstanding exceeded total credit card debt outstanding for the first time. The seasonally adjusted figure for revolving credit in the Federal Reserves G.19 current report was $826.5 billion in June 2010. Revolving credit started declining in September 2008 when it reached a peak of $975.7 billion. The decrease is probably due a combination of higher minimum payments on credit cards, which were increased to 4% from 2%, lower credit card limits and tighter credit underwriting. Student loan debt, on the other hand, as been growing steadily because need-based grants have not been keeping pace with increases in college costs. Federal student loan debt outstanding reached approximately $665 billion and private student loan debt reached approximately $168 billion in June 2010, for a total student loan debt outstanding of $833 billion. Total student loan debt is increasing at a rate of about $2,853.88 per second.

Practical tips for minimizing debt and reducing the cost of education financing include:

Why Does Larger National Debt Attract Bond Buyer

Having a large national debt doesnt always discourage buyers of bonds. For example, the United States has a debt to GDP ratio of 108% and a lot of people want to buy US Treasury bonds.

You can see this data summary of US Local & State Government Debt for more information.

Some countries, such as the USA are always considered a good place to invest, and the government bonds of those countries are always in high demand.

Recommended Reading: How Many Medical Bankruptcies A Year

The Best Us Military Debt Clock 2022

The Best Us Military Debt Clock 2022. What is 1300 military time? The national debt of the united states is the total unpaid borrowed funds carried by the federal.

The national debt clock tracks the u.s. Personalized air force military clock. Intragovernment debt comprises treasury securities held in accounts administered by the.

Source: stats.areppim.com

The branches of the us military United states national debt clock.

Source: tradingeconomics.com

Us national debt clock : Social security unfunded liability :

Source: www.nytimes.com

Failure to raise the debt ceiling in time could halt payments that millions of americans rely on, including paychecks to federal workers, medicare benefits, military salaries, tax refunds, social. The branches of the us military

Source: zfacts.com

9:00 pm 2100 hrs. 5:00 pm 1700 hrs.

Source: www.marketoracle.co.uk

Us national debt clock : 9:00 pm 2100 hrs.

Source: www.nationalpriorities.org

On top of all this, bush also dealt with two. What is 1300 military time?