Servicing The National Debt

Similarly, households have finite lifespans, and therefore a time-constrained ability to earn money. Prudence may dictate getting out of debt and starting to accumulate retirement savings long before they are needed. Countries, on the other hand, can expect to generate revenue indefinitely, and they are usually able to refinance debt.

Countries must still pay interest on the debt of course, and debt service costs are another useful indicator of debt’s sustainability. U.S. debt service costs amounted to 1.5% of GDP in 2021, down from 3% in 1995. However, the Congressional Budget Office projects the federal government’s debt service costs will rise to 7.2% of GDP by 2052 as a result of “rising interest and mounting debt.”

Solutions To Reduce The National Debt

76% of voters believe that the President and Congress should allocate more time and energy towards addressing the national debt. Americans care about the national debt, and some work has been done in order to address this issue. Solutions include raising revenue , cutting spending, and growing the countrys GDP.

Policy options such as the Simpson-Bowles plan and the Domenici-Rivlin Task Force have made efforts to create plans to reduce the national debt. Centers and institutes such as the American Enterprise Institute, Bipartisan Policy Center, Center for American Progress, and Economic Policy Institute all proposed things ranging from slow growth to reduction in benefits for high-income individuals.

Young people across America are getting educated about fiscal policy and making changes at their colleges and universities with Up to Us. Sign the pledge to let local representatives know that you are concerned about the nations fiscal future, or get involved by learning about how you can make a difference in your own community.

What Is A Cds Spread

Credit default swaps are a type of derivative that provides a lender with insurance in the event of a default. The seller of the CDS represents a third party between the lender and borrower .

In exchange for receiving coverage, the buyer of a CDS pays a fee known as the spread, which is expressed in basis points . If a CDS has a spread of 300 bps , this means that to insure $100 in debt, the investor must pay $3 per year.

Applying this to Ukraines 5-year CDS spread of 10,856 bps , an investor would need to pay $108.56 each year to insure $100 in debt. This suggests that the market has very little faith in Ukraines ability to avoid default.

Recommended Reading: What Happens When A Country Files For Bankruptcy

Can The Us Pay Off Its Debt

As budget deficits are one of the factors that contribute to the national debt, the U.S. can take measures to pay off its debt through budget surpluses. The last time that the U.S. held a budget surplus was in 2001. Much of the world depends on U.S. bonds to fund their own countries, and it has become a way of life for governments around the world. While it is unlikely that the U.S. will stop doing this, measures can be taken in other areas to decrease the national debt.

Unsecured Credit Card Debt And Debt Collection

Unsecured debt does not give creditors a fallback collateral, as we have mentioned. So they may turn to third-party debt collectors or sell the debt to collection agencies to try and recover some of their money.

Debt collectors are aggressive and persistent. Their calls and collection letters are a consumer’s nightmare.

You may want to steer clear of unsecured credit card debt if you suspect that you might default. However, if you are already in debt and debt collectors are coming after you, SoloSuit can help.

Example: Joan was attracted to unsecured credit cards because of the ease of approval. Soon, she applied for one card after the other and ended up with seven cards. Before Joan knew it, she was falling behind on multiple accounts. And then her worst fears materialized collection calls and letters started coming. Fortunately for her, she had heard about SoloSuit from a friend. She could respond quickly, offer to settle, and rebuild her credit.

Don’t Miss: Is It Bad To File Bankruptcy Twice

Americas Ticking Time Bomb: $66 Trillion In Debt That Could Crash The Economy

Wake up, America. That ticking sound youre hearing is the American debt time bomb that with each passing day is getting precariously close to detonating and crashing the US economy.

Businesses, consumers and especially the federal and state governments have become hooked on red ink as if it were crack cocaine.

Two factors have fueled this borrowing binge: an era of low interest rates and falling real wages thanks to the 15% rise in prices of Bidenflation.

Lets review the borrowing up-escalator that accelerated during COVID but hasnt subsided.

The King Kong of borrowing is Uncle Sam. The national debt is $31 trillion when including Social Securitys and Medicares unfunded liabilities.

Thats getting close to 150% of our national gross domestic product of $22 trillion. Some $5 trillion has been added in just the past three years.

Balancing the budget seems like a pipe dream these days.

Next add state and local government debt and unfunded liabilities. The American Legislative Exchange Council estimates that at just under $6 trillion.

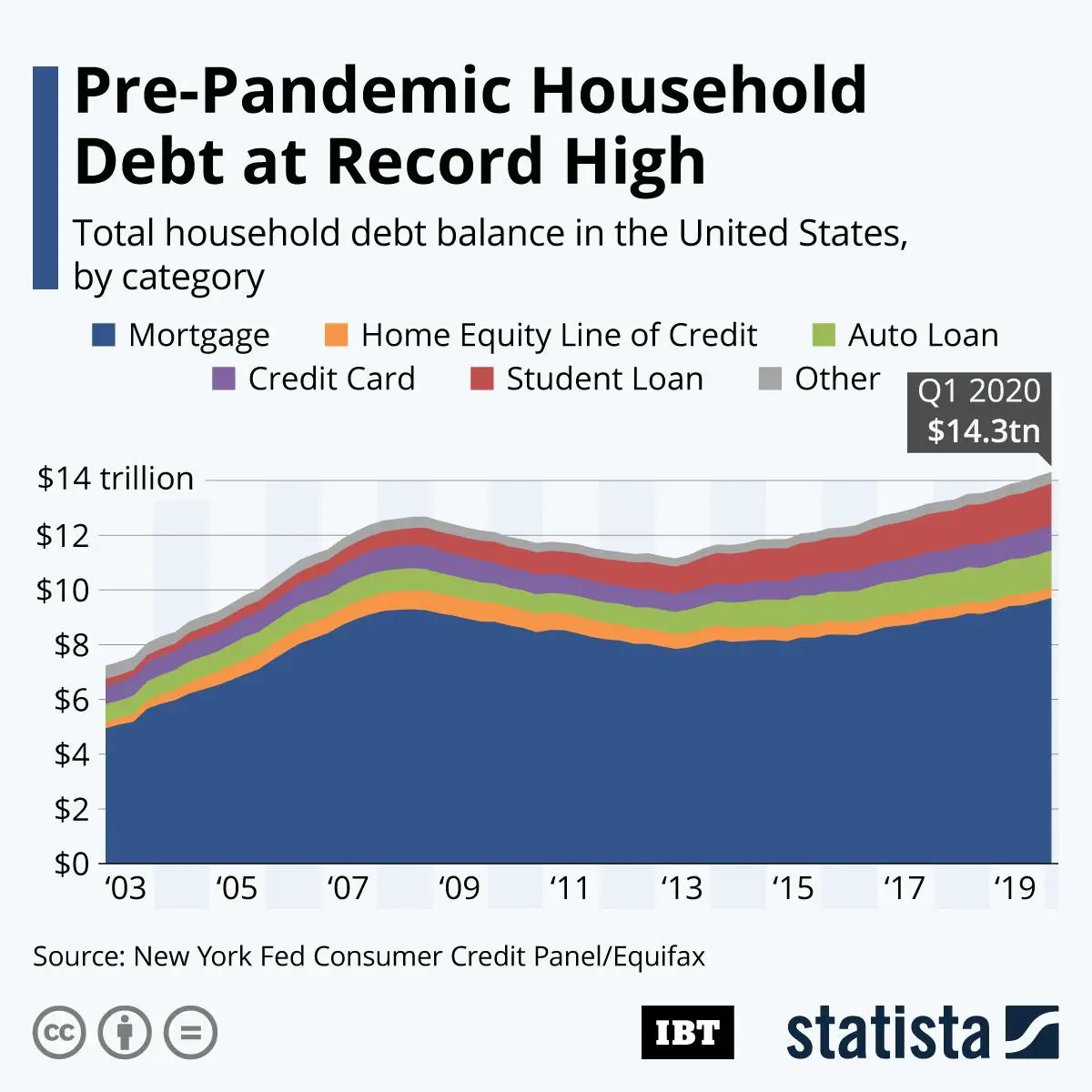

Now what about American households? The latest estimate for consumer debt is $16.5 trillion, per the New York Federal Reserve.

Most of that debt is mortgages, but increasingly Americans are taking on debt for routine expenses to pay monthly bills like groceries and gas at the pump.

Thanks, President Joe Biden.

So add it all up, and American society now owes $66,000,000,000,000 of debt! Thats roughly three times our annual GDP.

Us Starts Fiscal Year With Record $31 Trillion In Debt

WASHINGTON The nations gross national debt has surpassed $31 trillion, according to a U.S. Treasury report released Tuesday that logs Americas daily finances.

Edging closer to the statutory ceiling of roughly $31.4 trillion an artificial cap Congress placed on the U.S. governments ability to borrow the debt numbers hit an already tenuous economy facing high inflation, rising interest rates and a strong U.S. dollar.

And while President Joe Biden has touted his administrations deficit reduction efforts this year and recently signed the so-called Inflation Reduction Act, which attempts to tame 40-year high price increases caused by a variety of economic factors, economists say the latest debt numbers are a cause for concern.

Owen Zidar, a Princeton economist, said rising interest rates will exacerbate the nations growing debt issues and make the debt itself more costly. The Federal Reserve has raised rates several times this year in an effort to combat inflation.

Zidar said the debt should encourage us to consider some tax policies that almost passed through the legislative process but didnt get enough support, like imposing higher taxes on the wealthy and closing the carried interest loophole, which allows money managers to treat their income as capital gains.

Dont Miss: Banks That Do Debt Consolidation Loans

You May Like: How Often Can Someone File Chapter 7 Bankruptcy

A Major Problem: The Us Is Now A Record $31 Trillion In Debt Made Worse By Rising Interest Rates And This Is Who Holds The Ious

The gross national debt in America has hit new heights, surpassing $31 trillion, according to a U.S. treasury report released this week.

If you find that hard to wrap your head around, it basically boils down to more than $93,000 of debt for every person in the country, according to the Peter G. Peterson Foundation.

And with the dramatic rise in interest rates over the past few months the Fed funds rate is currently between 3% and 3.35% the national debt will be growing at a rate that makes it even harder to ignore.

Interest rates are a major problem, says Phillip Braun, clinical professor of finance at North Western Universitys Kellogg School of Management.

The Treasury finances the debt with a lot of short-term borrowing Itll push other budgetary items out.

Stock Market Crash & The Great Depression

On October 29, 1929, wild speculation and rapid expansion finally caught up with Wall Street. The Black Tuesday stock market crash resulted in billions of dollars lost. In its aftermath, America and the rest of the industrialized world spiraled into the Great Depression, which lasted until 1939. It was the deepest and longest-lasting economic downturn in the U.S. up to that time.

National Debt: $17 billion

Read Also: How To Find Out What Debt You Owe

What To Read Next

-

Here are the top car brands that rich Americans earning more than $200K drive most and why you should too

-

Youre probably overpaying when you shop online get this free tool before Black Friday

-

Inflation eating away at your budget? Here are 21 things you should never buy at the grocery store if you are trying to save money

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Facts And Figures About American Debt

The modern-day credit card which entered the scene in the late 1950s has meant far greater buying power for U.S. consumers, but also financial disaster for many individuals and families.

Consider these statistics about personal debt in America:

- More than 191 million Americans have credit cards.

- The average credit card holder has at least 2.7 cards.

- The average household credit card debt is $5,315.

- Total U.S. consumer debt is at $14.9 trillion. That includes mortgages, auto loans, credit cards and student loans.

The first step to getting help with credit cards is learning about this type of debt. Your goal should be to pay off your credit card debt as soon as possible. Debt consolidation or debt settlement could help you achieve that goal of getting out of debt.

Recommended Reading: How To Calculate My Debt To Income Ratio

Coronavirus And The National Debt

The U.S. government has taken efforts to offset the effects of worldwide health pandemic by borrowing money to invest in individuals, businesses, and state and local governments. Of these responses, the CARES Act has been the largest stimulus package in U.S. history. This stimulus package included $2.3 trillion towards relief for large corporations, small businesses, individuals, state and local governments, public health, and education. In order to pay for the relief fund, the government needed to expand its debt to do so, the government borrowed money from investors through the sales of U.S. government bonds.

Who Is The Us In Debt To

There are generally two categories of debt: intragovernmental holdings and debt from the public. The debt that the government owes itself is known as intragovernmental debt. In general, this debt is owed to other government agencies such as the Social Security Trust Fund.

The public debt consists of debt owned by individuals, businesses, governments, and foreign countries.

Because the Social Security Trust Fund doesnt use all its generated capital, it invests the excess funds into U.S. Treasuries. If the Social Security Trust Fund needs money, it can redeem the Treasurys. As of June 2021, intergovernmental debt hovers around $6 trillion, making the US government the largest single owner of US debt.

The public debt consists of debt owned by individuals, businesses, governments, and foreign countries. Foreign countries own roughly one-third of U.S. public debt, with Japan owning the largest chunk of American debt hovering around $1.26 trillion. US debt to China ranks second, with that country owning roughly $1.07 trillion of American debt.

Recommended Reading: Will Bankruptcy Clear Credit Card Debt

Instruments And Mechanics Of National Debt

Instruments

National debt is issued mainly through two instruments:

1. Bonds

Government bonds are issued in the local currency by the central bank of the country. The government borrows money from the central bank, and then the central bank auctions these bonds to the public via selected financial institutions. These bonds are tradeable and have a liquid market. Common examples of government bonds are the U.S. Treasury Bills, British Gilts, German Bunds, Japanese Government Bonds , etc.

2. Loans

Governments can also raise funds via loans from commercial banks. These are syndicated loans extended to national governments. Unlike bonds, they are not tradeable, but there might be derivative instruments like credit default swaps linked to the performance of these loans.

Mechanics

There are clear procedures laid down for the settlement of government debt. The Bank for International Statements is the international body that makes the rules and administers the settlement of national debt. In the case of a default, the rules are not clearly defined. They are dealt with using laws of default pertaining to specific countries.

Typically, national debt is restructured, and some restrictions are placed on government expenditures. The main reason behind restructuring is that the government must continue to function even if it cannot service its debt.

Dont Miss: Debt Consolidation Or Bankruptcy Which Is Better

Why Is The National Debt So High

When the federal government spends more than it takes in, we have to borrow money to cover that annual deficit. And each years deficit adds to our growing national debt.

Historically, our largest deficits were caused by increased spending around national emergencies like major wars or the Great Depression.

Also Check: Bankruptcy And Medical Bills

Who Holds The Debt

The bulk of U.S. debt is held by investors, who buy Treasury securities at varying maturities and interest rates. This includes domestic and foreign investors, as well as both governmental and private funds.

Foreign investors, mostly governments, hold more than 40 percent of the total. By far the two largest holders of Treasurys are China and Japan, which each have more than $1 trillion. For most of the last decade, China has been the largest creditor of the United States. Apart from China, Japan, and the UK, no other country holds more than $500 billion.

In response to the pandemic, the Federal Reserve dramatically increased its purchases of U.S. debt, buying in days what it used to buy in a month, and the central bank committed to essentially unlimited bond buying. Since March 2020, the Feds balance sheet has almost doubled to $8 trillion, renewing concerns among economists about the Feds independence.

Forms Of Government Borrowing

In addition to selling Treasury bills, notes, and bonds, the U.S. government borrows by issuing Treasury Inflation-Protected Securities and Floating Rate Notes . Its borrowing instruments also include savings bonds as well as the government account securities representing intergovernmental debt.

Other nations have borrowed from international organizations like the International Monetary Fund and the World Bank as well as private financial institutions.

You May Like: Foreclosure Homes For Rent

Average Debt To Income Ratios

Debt to income ratio is a key indicator of financial health. Its determined by taking you monthly expenditures and dividing that number by your monthly income.

For instance, if your bills amount to $5,000 a month and you make $7,500 a month, your DTI is 66%. It also means you are dire need of financial overhaul.

The maximum DTI you can have to qualify for a mortgage is usually 43%. Most financial advisors recommend keeping your DTI at 30% or lower.

Overall, DTIs have risen over the years. A 2018 Federal Reserve report showed a slow but steady rise from 1980s, then a sharp increase during the housing boom of the early 2000s.

It dropped with financial crisis of 2008, which indicated many households cut consumption or defaulted on loans.

The median household income hit $79,900 in the first quarter of 2021, according to the U.S. Department of Housing and Urban Development. Thats almost $35,000 more than it was in 2000.

But the typical American household now carries an average debt of $145,000. The median debt was only $50,971 in 2000.

Year-to-year DTI statistics are hard to come by, but given the rise of debt versus the rise in income, its apparent that Americans in all demographic groups have higher debt-to-income ratios.

Wars And Armed Conflict

Overseas wars and military operations and military aid to foreign allies, in combination with increased domestic security spending, interest costs, and long-term veterans funding obligations, have added more than $8 trillion to the national debt since 2001, by one estimate.

Meanwhile, annual U.S. military spending exceeds that of the next nine highest spenders combined.

Also Check: Can You File Bankruptcy And Still Keep Your Home

How The Large Us Debt Affects The Economy

In the short run, the economy and voters benefit from deficit spending because it drives economic growth and stability. The federal government pays for defense equipment, health care, building construction, and contracts with private businesses. New employees are then hired and they spend their salaries on necessities and wants, like gas, groceries, new clothes, and more. This consumer spending boosts the economy. As part of the components of GDP, federal government spending contributes around 7%.

Over the long term, debt holders could demand larger interest payments, because the debt-to-GDP ratio increases, and this high ratio of debt to gross domestic product tells investors that the country might have problems repaying them. That’s a newerand worryingoccurrence for the U.S. Back in 1988, the national debt was only half of what the U.S. produced that year.

Why Is The Us In Debt

Countries around the world currently hold a national debt in order to grow the economy and the country, debt is oftentimes needed to fund expansions and programming. The United States debt levels are extremely high, and can be attributed, in part, to income inequalities and trade deficit. These two factors indicate that some level of debt must be taken on in order to keep the economy moving. The U.S.s national debt increased 840% during the period from 1989 to 2020.

You May Like: B& p Liquidation Pallets