The Impact On Your Credit May Not Be As Severe

Like Chapter 7, Chapter 13 bankruptcy may have a very negative impact on your credit. A completed Chapter 13 bankruptcy can stay on your for up to seven years from the date you file. But some creditors could view a Chapter 13 bankruptcy more favorably than a Chapter 7 bankruptcy. It could be an indication that you repaid more of your debt.

How Our Bankruptcy Attorney Will Help You File

When you hire a bankruptcy lawyer from our firm to manage your case, we will:

- Explain state and federal laws for the type of bankruptcy you want to file

- Ensure you understand the differences between Chapter 7 and Chapter 13, including the pros and cons of each

- Review your income and debts to determine which filing option works for your situation

- Explain how your assets, income, and property are affected

- Prepare your bankruptcy petition and compile essential financial documents showing your income, assets, and creditors owed

- File your petition and all paperwork with the court on time

- Attend creditor meetings with you

- Walk you through each step of the process and keep you informed with prompt updates

We help many people file for financial relief and aim to make it as manageable for them as possible. Our team will handle your entire case so you can have peace of mind as you start to rebuild your finances.

Complete a Case Evaluation form now

How Can A Bankruptcy Attorney Help Me

There are several reasons its in your interest to hire a bankruptcy lawyer to handle your case. First, a lawyer can analyze your situation, explain whether Chapter 7 or Chapter 13 bankruptcy is in your interest, and help you find a path forward. Your attorney can file all the necessary forms with the court and represent you in the 341 meeting and any other legal proceedings. Finally, if there are disputes regarding your bankruptcy for example, whether a particular debt is dischargeable or whether you can keep a particular asset your lawyer can represent your interests and fight for the best possible outcome.

Remember, while the bankruptcy code is the same everywhere, each bankruptcy court is different. Thats why its in your interest to hire an attorney who has experience handling bankruptcy cases in your jurisdiction and knows the judges and legal procedures. If youre facing overwhelming debt and are considering a financial reset, contact a bankruptcy lawyer in your area today.

Don’t Miss: When Can You Refinance After Bankruptcy

What Is Chapter 13 Bankruptcy

Chapter 13 bankruptcy, also known as reorganization bankruptcy, rolls your debts into a repayment plan, usually for 3 to 5 years. When the repayment plan is complete, any remaining debt is generally discharged. Chapter 13 helps debtors get caught up on their secured debt, such as auto loans or mortgages, and it makes it easier to retain your assets if they arent protected by an exemption. However, its also a much longer process than Chapter 7.

Chapter 13 Is Better If

-

you want to keep property thatâs not protected by an exemption,

-

youâre behind on your mortgage and want to catch up,

-

you have debts that canât be discharged,

-

you have a car loan with a high interest rate or negative equity from a trade-in

-

you have multiple mortgages

-

you owe money to your ex-spouse from a property settlement

Of course, life isnât always that clear cut, so itâs also important to consider the downsides when weighing your bankruptcy options.

Read Also: Chicago Bankruptcy Law Firm

Which Is Better: Chapter 7 Or Chapter 13

Which form of bankruptcy is best for you depends on your financial situation and goals.

To determine whether Chapter 7 or Chapter 13 bankruptcy is best for you, consult with a bankruptcy attorney. Youll want to ensure that your problem debts can be handled by bankruptcy and that you’re in a position to make the most of the fresh start that bankruptcy offers.

Most consumers opt for Chapter 7 bankruptcy, which is faster and cheaper than Chapter 13. The vast majority of filers qualify for Chapter 7 after taking the means test, which analyzes income, expenses and family size to determine eligibility. Chapter 7 bankruptcy discharges, or erases, eligible debts such as credit card bills, medical debt and personal loans. But other debts, like student loans and taxes, typically arent eligible. And Chapter 7 doesnt offer a route to get caught up on secured loan payments, like a mortgage or auto loan, and it doesnt protect those assets from foreclosure or repossession.

In some instances, a bankruptcy trustee an administrator who works with the bankruptcy courts to represent the debtor’s estate may sell nonexempt items, meaning belongings that are not protected during bankruptcy. Nonexempt items vary according to state law.

Contact Indiana Bankruptcy Attorneys

Dont go it alone when filing Chapter 7 or Chapter 13 bankruptcy contact bankruptcy lawyers who can assist you with the process of addressing personal loans from before and after bankruptcy and protect you from creditor harassment. Looking for bankruptcy attorneys in Indiana? Call the legal associates at Sawin & Shea, LLC at 317-759-1483, or you can schedule a FREE consultation online.

Read Also: Can Restitution Be Included In Bankruptcy

Why Would You Convert From Chapter 7 To Chapter 13

In bankruptcy, conversion means switching from one chapter of bankruptcy to another before the first one is completed. This blog is about going from Chapter 7 to 13. These two options are quite different, so why would a person make that switch?

For two sets of reasons: because 1) changed circumstances make Chapter 13 the better option, and 2) you are induced to convert to Chapter 13 even if you would have rather just finished the Chapter 7 case.

Chapter 7 Vs Personal Bankruptcy

When a person finds themselves in deep financial trouble in the United States they may file personal bankruptcy under Chapter 7, Title 11 of the United States Code. Overtime this has simply come to be known as Chapter 7 bankruptcy.

In Canada it is simply called filing for bankruptcy. The law is known as the Bankruptcy and Insolvency Act of Canada, or BIA for short, but the only people that refer to the law are professionals working in this area.

Recommended Reading: Can You File Bankruptcy On A Car Loan

Exemptions Available In Florida

Just because chapter 7 is known as liquidation bankruptcy does not mean that all of your assets must be sold off. Many exemptions are available for those filing for chapter 7 in Florida, which means that many of your assets will be protected from sale during bankruptcy proceedings. Some of your exemptions may include:

- Floridas homestead exemption, which may allow you to protect your home equity Florida Statutes § 222.01-02

- Other personal property, including one car , health aids, and other property, per Florida Statutes § 222.25

Depending on your situation, you may even fall into a category known as a no-asset case, in which you are deemed to own no assets after available exemptions are applied.

To consult with an experienced bankruptcy lawyer today, call

How Does Bankruptcy In The Us Compare To Canada

American personal bankruptcy differs from Canadian bankruptcy and consumer proposals in these ways:

- There are personal income regulations which determine whether a person is legally permitted to file for Chapter 7 bankruptcy. For example, there is a chapter 7 median income by each state in America that is updated approximately every 6 months. There are instances where people make above the Chapter 7 median income and can still qualify for a Chapter 7 bankruptcy as the calculation also takes into account expenses. If you do not qualify for a Chapter 7 bankruptcy, many people qualify for a Chapter 13 bankruptcy as long as their debt is under the Chapter 13 debt limits.

- Any American bankruptcy requires a petition to a bankruptcy court, where the judge examines such issues as whether the individual qualifies for Chapter 7, or has a viable repayment plan for Chapter 13. In Canada, not all bankruptcies or consumer proposals require court hearings.

- Any American bankruptcy requires a meeting of creditors, whereas this is often not necessary in a Canadian bankruptcy or consumer proposal.

- In an American bankruptcy, the professional that an individual uses is a bankruptcy attorney, a personal advocate, whereas in Canada, an individual uses a Licensed Insolvency Trustee, who is usually a professional accountant and whose role is to ensure fairness between the debtor and creditors.

American solutions are similar to those in Canada in these ways:

Recommended Reading: How To Declare Bankruptcy With No Money

Getting A Loan After Filing For Bankruptcy

Although bankruptcy is sometimes the best solution for getting your finances back on track, it can impact your ability to qualify for a new personal loan. Banks that work with bankruptcies for personal loans are available, but your ability to find a reasonable personal loan will depend on when you filed for bankruptcy, how the bankruptcy impacted your credit score and history, your income, and whether the new loan is secured or unsecured.

When a person files for Chapter 7 bankruptcy, it will remain on their credit report for ten years. Chapter 13 bankruptcies remain on credit reports for seven years. That does not mean that loans are not available for that period of time. Most people that file bankruptcy can rehabilitate their credit in a year or two. Even though it can be more challenging to get a personal loan after bankruptcy is listed on your credit history, you need to apply for loans from lenders who check credit. No-credit-check loans, such as payday and title loans, often come with unreasonable fees and astronomical annual percentage rates .

When seeking a new personal loan, ensure that you use legitimate lenders and that your estimated APR and any additional fees wont hinder your ability to eventually become financially secure and debt free.

What To Expect In Your Bankruptcy Filing

Bankruptcy filing is a complex process, and any errors made during the initial phase of your bankruptcy case can significantly increase the time required for the bankruptcy case to unfold. An experienced attorney will be invaluable as you begin the bankruptcy filing process. They will help you gather the documentation you will need to provide to the bankruptcy court and prepare you for each stage of your case.

The first phase of filing for bankruptcy is the initial petition. Once you file for bankruptcy, an automatic stay is placed on your assets and property that will prevent creditors from continuing with their collection efforts. This alone can be a major relief, especially if you have dealt with repeated calls and other collection efforts for months. However, the initial filing is only the first step in securing bankruptcy status.

Don’t Miss: Total Debt Ratio Formula

What Is The Difference Between Chapter 7 And Chapter 13 Bankruptcy In Texas

Bankruptcy is a serious financial and legal matter. It is not a silver bullet to fix financial troubles, and both the financial and legal implications of beginning bankruptcy proceedings deserve a thorough examination. Part of the process of making the decision is to assess the different forms of personal bankruptcy, Chapter 7 and Chapter 13.

A specialized bankruptcy firm can be your best legal asset for protecting your financial assets during the bankruptcy process. A highly-regarded attorney from Steele Law Firm in Fort Worth can be a great aid for navigating the bankruptcy process.

The Benefits Of Filing Chapter 13

- Chapter 13 is similar to a debt consolidation plan, where the debtor makes payments to a trustee, who in turn distributes the payments to the debtors creditors. The debtor will not have direct contact with most creditors during this time. However, in Chapter 13 bankruptcy, unlike debt consolidation, the debtor is under the protection of the Bankruptcy Court and creditors cannot take any action against the debtor without first obtaining permission from the court.

- Debtors who file for Chapter 13 can, in some instances, modify the terms of repayment of certain types of secured debts. This can drastically lower the monthly payments that are due, and make repayment more manageable for debtors.

- Filing Chapter 13 can also provide protection for co-signors. It protects third parties who are liable with the debtor on consumer debts, such as car loans. These types of debts are those incurred for personal, family or household purposes.

- A debtor is required to wait less time to file for Chapter 13 bankruptcy after a prior Chapter 7 bankruptcy or prior Chapter 13 bankruptcy, as opposed to the longer wait required for a subsequent Chapter 7 bankruptcy filing.

- Attorneys fees for filing under Chapter 13 can be paid overtime through the repayment plan, as opposed to the upfront payment required when filing for Chapter 7 bankruptcy.

Also Check: How Do You File For Bankruptcy In Sc

Contact An Experienced Bankruptcy Attorney Today

Contact The Law Office of Andrew M. Doktofsky, P.C., today for a free consultation about whether you should file for Chapter 7 or Chapter 13 bankruptcy in Suffolk County, Nassau County or Long Island. I will determine which chapter of bankruptcy is right for you. Call or email the firm if you are considering filing for bankruptcy in New York and would like to learn more about the process from an experienced bankruptcy attorney.

This is a debt relief agency. I help people file for bankruptcy relief under the Bankruptcy Code.

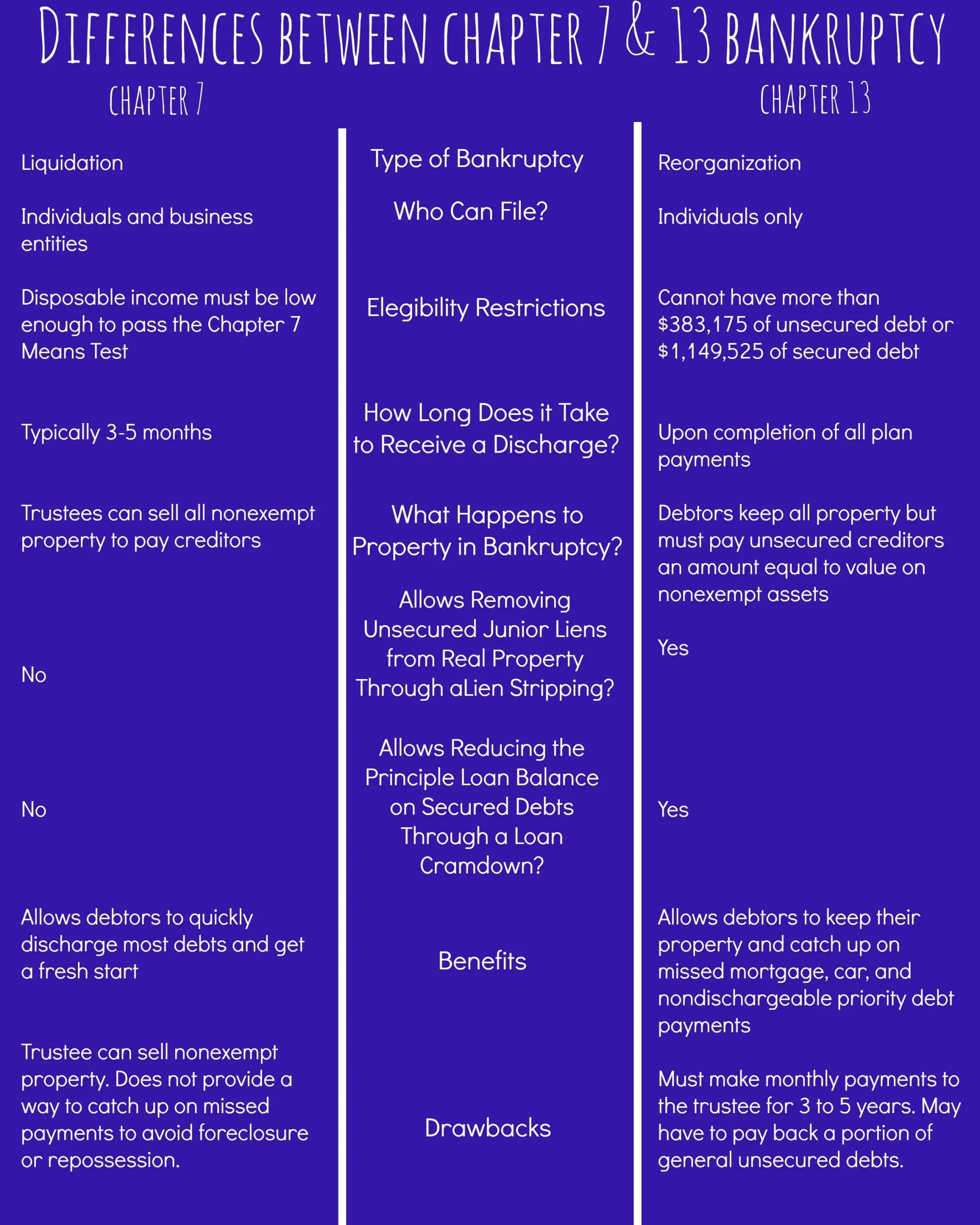

Eligibility Requirements Between Chapter 7 And Chapter 13 Differ

The eligibility restrictions for Chapter 7 and Chapter 13 bankruptcy are also different. Chapter 7 requires your current monthly income to be less than or equal to your states median income level. If not, you must pass a means test to determine whether you will have enough remaining income to pay your debts after covering essential expenses. If you do not pass the means test, you might be able to file for Chapter 13.

To qualify for Chapter 13 bankruptcy, you must have a regular income, unsecured debts under $419,275, and no more than $1,257,850 of secured debt . You will get to keep your property, but you must pay your unsecured creditors an amount that is equal to the value of your assets not covered by a bankruptcy exemption.

Also Check: Current Us Debt 2022

How Does Bankruptcy Work

Bankruptcy is a method to eliminate or at least reduce your debt when bills pile up beyond your ability to repay them. It should be viewed as a last resort to be considered only when all other potential courses of action to get back on track have been exhausted.

Individuals filing for bankruptcy mostly use either Chapter 7 or Chapter 13. The biggest difference between the two is what happens to your property:

- Chapter 7, which is known as liquidation bankruptcy, involves selling some or all of your property to pay off your debts. This is often the choice if you don’t own a home and have a limited income.

- Chapter 13, also known as a reorganization bankruptcy, gives you the chance to keep your property if you successfully complete a court-mandated repayment plan that lasts between three and five years.

Depending on where you live and your marital status, some of your property may be exempt from being sold when you file Chapter 7 because of state-specific and federal exemptions. With exemptions, whether they be your home equity, retirement accounts or even personal possessions such as jewelry, you receive the allowed exemption amounts, and the rest of the proceeds will be used to pay off debts. You can read more about potential exemptions, and check out this chart for a quick rundown on the two types:

| Chapter 7 |

|---|

- Child support or alimony

Debating Between Chapter 7 Or Chapter 13 Bankruptcy Let Leinart Law Firm Help

If youre trying to decide between Chapter 7 and Chapter 13, the bankruptcy lawyers at Leinart Law Firm can consult with you on your financial situation to help you make an informed decision. Alternatively, we also specialize in other debt relief solutions if bankruptcy isnt your best option.

Visit Dallas law firm or our Fort Worth law firm, and we can help you and your family get the fresh start you deserve.

Call for a free consultation and talk to an experienced bankruptcy attorney. Call today or email .

214-6276

426-3328

Free Bankruptcy Evaluation

Discuss your situation and your options with an experienced bankruptcy lawyer.

You May Like: How To File Bankruptcy In Nh

Qualifications For Chapter 13 Bankruptcy

Not everyone will qualify for a Chapter 13 bankruptcy. Although, someone who does not qualify for Chapter 7 bankruptcy will often be able to file for a Chapter 13.

If you want to file this form of bankruptcy, some of the requirements you need to meet include:

- You must not be a registered corporation or LLC.

- You must disclose your income and submit proof to the court within 14 days of filing.

- Your tax filings must be up to date.

- You have not had a previous bankruptcy case dismissed in the last 180 days.

- You must fulfill credit counseling requirements.

As with Chapter 7, its important you work with an experienced lawyer to ensure you meet all of the requirements and submit the correct paperwork to the court.

It Could Reduce Your Monthly Debt

When you have a debt discharged through Chapter 7 bankruptcy, youre no longer legally required to pay that debt back. That means the money you were paying toward that loan or credit card, for example, can now be used for other things, like household necessities.

Note that there are a number of exceptions to the debts that can be discharged in Chapter 7, so we recommend contacting a bankruptcy lawyer before you file.

Read Also: Homes For Sale Foreclosures