Debt Service Coverage Ratio Common Questions

While most analysts acknowledge the importance of assessing a borrowers ability to meet future debt obligations, they dont always understand some of the nuances of the DSCR formula.

Common questions include:

Why use EBITDA?

EBITDA is not cash flow. However, it often serves as a proxy for it because its easy to calculate, and both its definition and its purposes are generally agreed-upon across jurisdictions.

Some important points include:

Why remove cash taxes?

In most jurisdictions, income taxes owing to the regional or federal governments count as super-priority liabilities .

Basically, the cash portion of taxes owing must be paid in order for the business to continue operating unimpeded by intervention from tax authorities.

Why not just use cash flow from the cash flow statement?

Cash flow includes increases and decreases of cash like tightening or extending payable days, increasing or decreasing inventory turns, and collecting payments more quickly from customers.

Does Your Dti Affect Your Credit Score

Your debt-to-income ratio does not affect your credit scores credit-reporting agencies may know your income but do not include it in their calculations.

But your credit-utilization ratio, or the amount of credit youre using compared with your credit limits, does affect your credit scores. Credit reporting agencies know your available credit limits, both on individual cards and in total, and most experts advise keeping the balances on your cards no higher than 30% of your credit limit. Lower is better.

To reduce your debt-to-income ratio, you need to either make more money or reduce the monthly payments you owe.

How Do You Improve Your Debt

Unless you suddenly make windfall profits that rapidly increase your assets, you will need to repay debt to improve your debt-to-asset ratio. Ideally, you want to start by paying off the debts with the highest interest rates, says Bessette.

But, you have to approach it strategically. You have to reduce your debt as much as possible, says Bessette. To do this properly, financial forecasting must include debt repayment and sufficient cash flow to avoid harming a company’s operations.

Don’t Miss: Scd Sales And Liquidation Llc

How To Improve Your Dti

Wed like to tell you to just spend less and save more, but youve probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly , you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

You May Like: Can You Get A Reverse Mortgage On A Condo

How To Calculate Affordability

Zillow’s affordability calculator allows you to customize your payment details, while also providing helpful suggestions in each field to get you started. You can calculate affordability based on your annual income, monthly debts and down payment, or based on your estimated monthly payments and down payment amount.

Our calculator also includes advanced filters to help you get a more accurate estimate of your house affordability, including specific amounts of property taxes, homeowner’s insurance and HOA dues . Learn more about the line items in our calculator to determine your ideal housing budget.

Also Check: How Can Bankruptcy Be An Advantage To A Creditor

Lower Your Monthly Payments

DTI doesnt consider the full amount of debt you have it only takes into account the amount of your income going toward your debt each month. By reducing your monthly payments, you can reduce the percentage of your income being used for debt.

There are several ways to lower your monthly payments, including refinancing your loans or negotiating the interest rate on your debt. While negotiating your interest rate may be possible for , installment loans like personal loans, auto loans, or student loans will likely require a refinance to adjust the rate.

- Monthly recurring debts: $2,000

- Monthly housing payment: $2,500

Most mortgage programs require homeowners to have a DebttoIncome of 40% or less, but loan approvals are possible with DTIs of 45 percent or higher. In general, mortgage applicants with elevated DTI must show strength on some other aspect of their application.

This can include making a large down payment showing an exceptionallyhigh credit score or having large amounts of reserves in the bank accounts and investments.

Also, note that once a loan is approved and funded, lenders not longer track DebttoIncome ratio. Its a metric used strictly for loan approval purposes. However, as a homeowner, you should be mindful of your income versus your debts. When debts increase relative to income, longterm saving can be affected.

How Much Does Your Debt

Your DTI never directly affects your or . may know your income but they dont include it in their calculations. Your is still factored into your home loan application. However, borrowers with a high DTI ratio may have a high credit utilization ratio which accounts for 30 percent of your credit score. Lowering your credit utilization ratio will help boost your credit score and lower your DTI ratio because you are paying down more debt.

Read Also: Fair Debt Collection Practices Act Summary

Read Also: Can You Stop Bankruptcy Proceedings Once Started

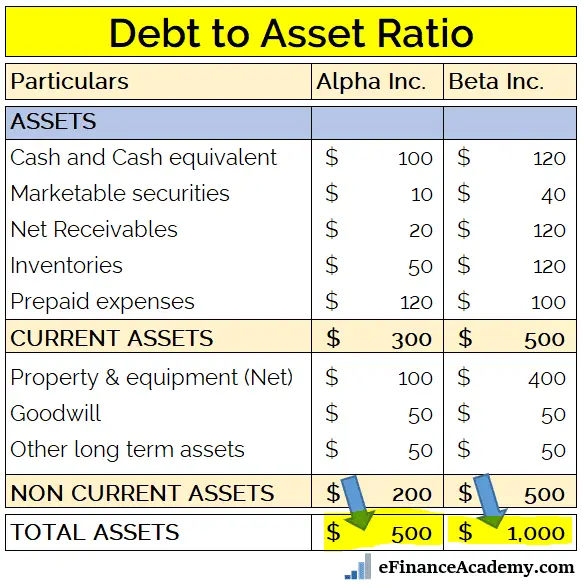

Debt To Asset Ratio Explained

Of all the leverage ratios used by the analyst community to understand the financial position of a company, debt to assets tends to be one of the less common ones.

It represents the proportion assets that are financed by interest bearing liabilities, as opposed to being funded by suppliers or shareholders. As a result its slightly more popular with lenders, who are less likely to extend additional credit to a borrower with a very high debt to asset ratio.

In the above-noted example, 57.9% of the companys assets are financed by funded debt. As with any ratio, however, it cant be taken in isolation. Analysts will want to compare figures period over period , or against industry peers and/or a benchmark .

A valid critique of this ratio is that the proportion of assets financed by non-financial liabilities are not considered. In other words, the ratio does not capture the companys entire set of cash obligations that are owed to external stakeholders it only captures funded debt.

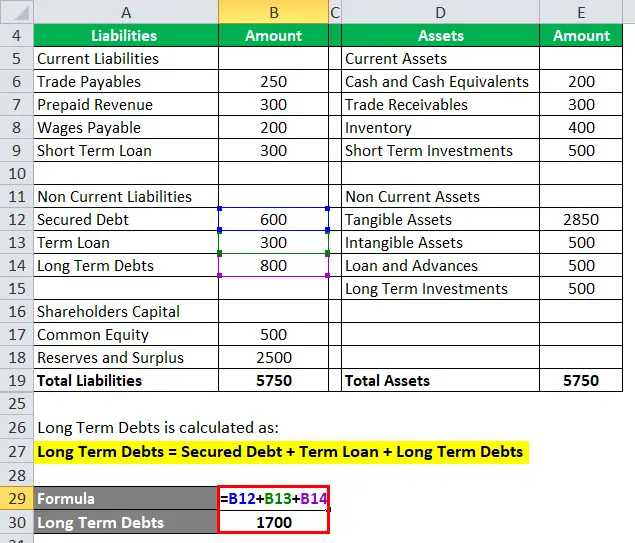

How To Calculate Debt To Equity Ratio

There are two main components in the ratio: total debt and shareholders equity. Shareholders equity is already mentioned in the balance sheet as a separate sub-head so that does not need to be calculated per say. What needs to be calculated is total debt.

As the term itself suggests, total debt is a summation of short term debt and long term debt.

Lets look at a sample balance sheet of a company.

We have taken the balance sheet of Reliance Industries Ltd. as of March 2020 as a sample for this example.

| Standalone Balance Sheet |

Recommended Reading: Can You Get A Mortgage While In Bankruptcy

Limitations Of The Debt Ratio

What Is The Debt Ratio

Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology. He is a CFA charterholder as well as holding FINRA Series 7, 55 & 63 licenses. He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

Investopedia / Zoe Hansen

Read Also: How Long Does Bankruptcy Stay On Your Credit Score

How To Interpret A Debt

The goal for a business is not necessarily to have the lowest possible ratio. A very low debt-to-equity ratio can be a sign that the company is very mature and has accumulated a lot of money over the years, says Lemieux.

But it can also be a sign of resource allocation that is not optimal. There is no doubt that the level of risk that shareholders can support must be respected, but it is possible that a very low ratio is a sign of overly prudent management that does not seize growth opportunities, says Lemieux.

He also notes that it is not uncommon for minority shareholders of publicly traded companies to criticize the board of directors because their overly prudent management gives them too low a return.

For example, minority shareholders may be dissatisfied with a 5% capital gain because they are aiming for 15%, says Lemieux. To get to 15%, you cant sit on a lot of money and run the business super-prudently. The company has to invest in productive resources using debt to leverage.

What Is Your Debt

Your debt-to-income ratio, which is typically expressed as a percentage, shows how much of your total monthly income goes toward your monthly debt payments. This debt may include your mortgage, , car loans, student loans, and personal loans.

When a lender is reviewing your loan or credit application, itll consider your DTI ratio as an indicator of how likely you are to repay a loan. A high DTI ratio could indicate a greater risk because youre already using a lot of your income to pay other debt.

A lender may assume this means you might not be able to comfortably afford to take on a new debt payment. The lower your DTI ratio, the more attractive you are to a lender and the more likely you are to get approved.

To calculate your DTI ratio, follow these steps:

For example, lets say your monthly income before taxes is $6,000 and these are your debt payments every month:

- Mortgage: $1,100

- Car payment: $400

Recommended Reading: Does Bankruptcy Stop You From Buying A House

All About Mortgages: How Is Debt Ratio Calculated For A Mortgage

Financial stability is an important aspect and responsibility that most struggle with. The financial guru Dave Ramsey is known to say that we buy things we dont need with money we dont have to impress people we dont like. One of the methods banks or lenders analyzes a potential borrower is through the debt-to-income ratio. In other words, the potential borrowers responsibility with money.

In this article, you will learn how is debt ratio calculated for a mortgage? This article is part of a series All About Mortgages that answers questions for those who seek out a general knowledge on the subject matter.

What Types Of Payments Are Included In Dti

A front-end DTI ratio only includes housing-related costs such as rent, mortgage payments , home insurance payments, property taxes, or HOA fees. This ratio is typically only used by mortgage lenders when you buy a home. A back-end ratio includes all financial obligations like car payments or student loans and is used by most lenders. The DTI calculation does not include expenses such as food, utilities, insurance, or cellphone bills even if they are recurring.

An easy way to determine which types of debt payments are included in DTI is to consider the types of payments that affect your credit score. A missed credit card payment would definitely be noted on your credit score. Forgetting to pay your cell phone service provider, however, wouldnt carry the same credit penalties. That phone payment wouldnt be immediately reported to a credit bureau and therefore doesnt need to be included in your debt-to-income calculation.

Other types of payments to include in a DTI calculation are:

- Any other monthly installment loans

Read Also: How Do You File For Bankruptcy In Pa

Using The Debt To Income Ratio Calculator

Start by entering your monthly income. This is the total amount of net income you make in a month. We use net instead of gross because you make debt payments with money after taxes.

Do you have a part-time job or earn money from a side hustle? Click the Add Monthly Income button to add other income types. Income types you can add include the following:

- your and your spouses monthly income

- alimony/child support

- government assistance

Below that in the next section, enter your total monthly debt payments. The various types of debt include the following:

- appliance/furniture and other payments

Once youve completed all the required fields, click the calculate button to compare your monthly income to your monthly debt payments.

How Can Deskera Help You

An online accounting and invoicing application, Deskera Books is designed to make your life easier. This all-in-one solution allows you to track invoices, expenses, and view all your financial documents from one central location.

The platform works exceptionally well for small businesses that are just getting started and have to figure out many things. As a result of this software, they are able to remain on top of their client’s requirements by monitoring a timely delivery.

Thanks to our well-designed and well-thought-out templates, you can now anticipate that your work will become simpler. A template can be used for multiple actions, including invoices, quotes, purchase orders, back orders, bills, and payment receipts.

Take a small tour of the demo here to get more clarity:

Lastly, you would be able to assess all the reports- be it income statement, profit and loss statement, cash flow statement, balance sheet, trial balance, or any other relevant report from your laptop and your mobile phone.

Deskera Books hence is the perfect solution for all your accounting needs, and therefore a perfect assistant to you and your bookkeeping and accounting duties and responsibilities.

Read Also: How To Clear Bankruptcy From Credit Report

What Does My Debt To Credit Ratio Mean

Knowing how to calculate your debt to credit ratio is excellent, but its useless if you dont know what to do with this information.

Using the formula, youll get your debt to credit ratio in the form of a percentage. But what does this percentage mean?

Well, simply enough, this percentage is the portion of your available credit that you use. So, for example, if your debt to credit ratio is 40%, that means you utilize 40% of your credit limit.

Like I mentioned earlier, a good rule of thumb is to aim for a credit utilization rate of 30% or lower. When your ratio is higher than this, it not only lowers your credit score, but it can give lenders the impression that you are an irresponsible or high-risk borrower.

For business owners, this can hurt your chances of being approved for the financing you need to help grow your business.

If your debt to credit ratio is too high, you may need to work on lowering it before you apply for a business loan or choose a lender with more lenient requirements, like Camino Financial.

How To Calculate Debt To Asset Ratio

The debt ratio, also known as the âdebt to asset ratioâ, compares a companyâs total financial obligations to its total assets in an effort to gauge the companyâs chance of defaulting and becoming insolvent.

The two inputs for the formula are defined below.

Once computed, the companyâs total debt is divided by its total assets.

Conceptually, the total assets line item depicts the value of all of a companyâs resources with positive economic value, but it also represents the sum of a companyâs liabilities and equity.

The fundamental accounting equation states that at all times, a companyâs assets must equal the sum of its liabilities and equity.

Therefore, comparing a companyâs debt to its total assets is akin to comparing the companyâs debt balance to its funding sources, i.e. liabilities and equity.

Don’t Miss: How To Find If Someone Filed Bankruptcy

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money