Are The National Debt And The Budget Deficit The Same Thing

No, the deficit and the national debt are different things, although related. The national debt is the sum of a nations annual budget deficits, offset by any surpluses. A deficit occurs when the government spends more than it raises in revenue. To finance its budget deficit, the government borrows money by selling debt obligations to investors.

Fannie Mae And Freddie Mac Obligations Excluded

Under normal accounting rules, fully owned companies would be consolidated into the books of their owners, but the large size of Fannie Mae and Freddie Mac has made the U.S. government reluctant to incorporate them into its own books. When the two mortgage companies required bail-outs, White House Budget Director Jim Nussle, on September 12, 2008, initially indicated their budget plans would not incorporate the government-sponsored enterprise debt into the budget because of the temporary nature of the conservator intervention. As the intervention has dragged out, pundits began to question this accounting treatment, noting that changes in August 2012 “makes them even more permanent wards of the state and turns the government’s preferred stock into a permanent, perpetual kind of security”.

Is China In A Debt Crisis

Their outstanding debt amounted to $8 trillion at the end of 2020, Goldman Sachs estimated, equivalent to around half of China’s gross domestic product last year they also replaced property developers as the biggest Chinese debt issuers offshore, with $31 billion of dollar bonds coming due in 2022.

Read Also: Repo Home For Sale

What Would Happen If China Were To Call In Its Debt

China’s position as the largest foreign holder of U.S. debt gives it some political leverage. It is responsible for lower interest rates and cheap consumer goods. If it were to call in its debt, U.S. interest rates and prices could rise, slowing U.S. economic growth.

On the other hand, if China were to call in its debt, the demand for the dollar could plummet. This dollar collapse could disrupt international markets even more than the 2008 financial crisis. China’s economy would suffer along with everyone else’s.

If China ever did call in its debt, it slowly would begin selling off its Treasury holdings. Even at a slow pace, dollar demand would drop. That would hurt China’s competitiveness by raising the yuans value relative to the dollar. At some price point, U.S. consumers would buy American products instead. China could start this process only after it further expanded its exports to other Asian countries and increased domestic demand.

Why Does The Federal Government Borrow

The U.S. has run a deficit in 77 out of the past 90 years, under governments run by both parties. So far, the U.S. has always been able to pay its debts.

The size of a budget deficit in any given year is determined by two factors: the amount of money the government spends that year and the amount of revenues the government collects in taxes. Both of these factors are affected by the state of the economy, as well as by the tax and spending policies enacted by Congress.

During tough times like the COVID-19 pandemic, government spending must increase. At the same time, tax revenues tend to decrease too: people are working less, and therefore paying less in taxes. During the pandemic, Congress voted to increase spending to deal with both the health threat and the economic upheaval. Recessions and wars can also cause spending and the deficit to spike.

Finally, tax policy plays a major role in determining whether we run surpluses or deficits. Many factors likely contributed to the budget surpluses of the 1990s, but one of them was tax increases, which took the form of tax rate increases for the highest-income taxpayers. Likewise, major tax cuts in 2001, 2003, and 2017 were a significant contributor to deficits over the last decade, and to today’s debt.

: OMB, National Priorities Project

Also Check: Can You File Bankruptcy During Divorce

National Debt Vs Budget Deficit

Its important to understand the difference between the federal governments annual budget deficit and the national debt. The federal government generates an annual deficit when its spending over the course of a year exceeds government revenue from sources including taxes on personal income, corporate income, and payroll earnings.

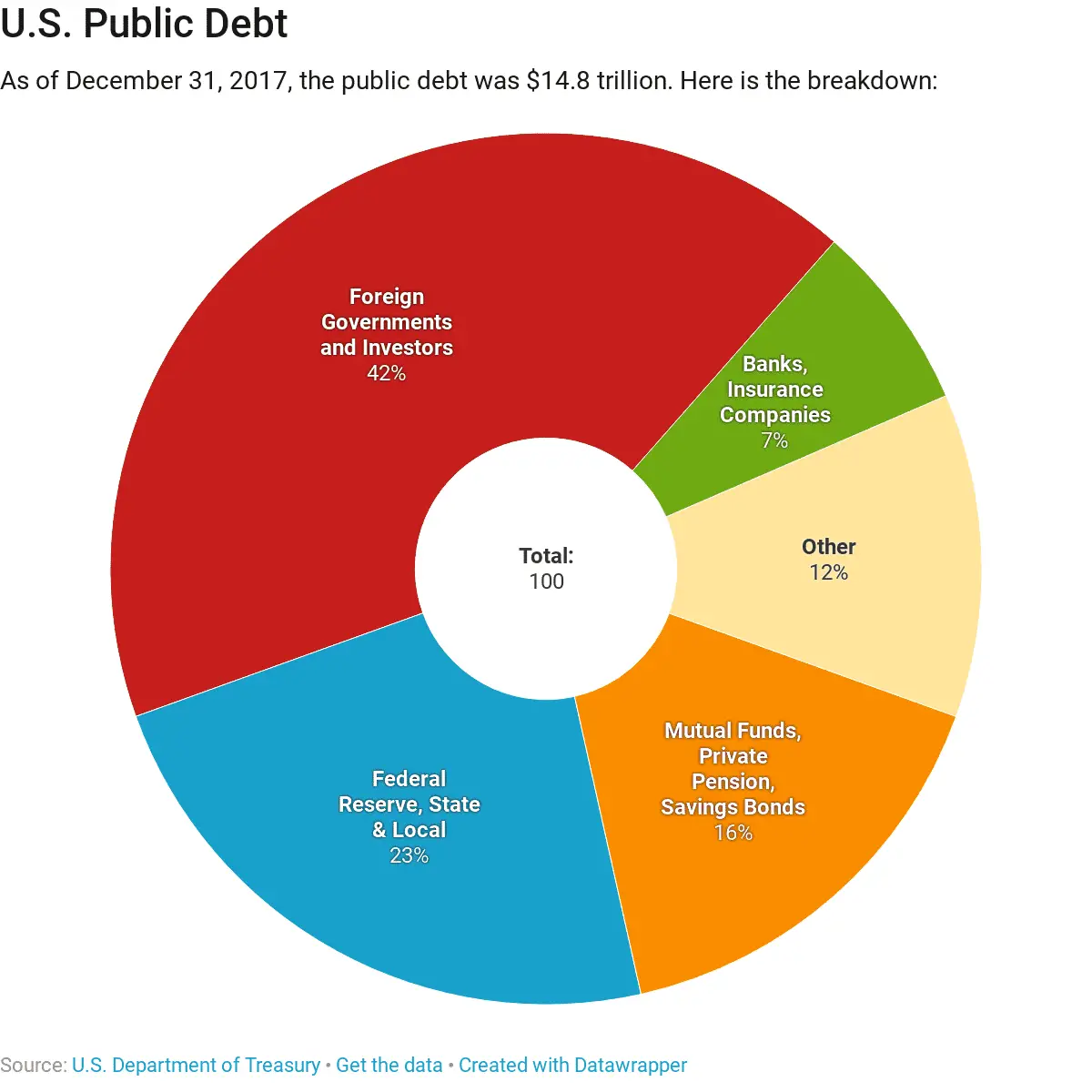

When annual congressional appropriations exceed federal revenue, the U.S. Treasury finances the deficit by issuing Treasury bills, notes, and bonds. These Treasury products may be purchased by investors including individuals and pension funds banks, insurers, and other financial institutions and the Federal Reserve as well as foreign central banks.

A countrys national debt is the sum of such annual budget deficits and any offsetting surpluses. It is the total amount of money that a country owes .

How Our National Debt Got So High

So how did the nations $16.4 trillion debt get to where it is today? Rather than going all the way back to the late 1700s, when we had to borrow money to wage the War of Independence, and which began our ongoing relationship with a national debt, lets just begin with the current century.

Because of a number of factors, we added two-thirds of our debt over the past 12 years. In fact, throughout the 1990s, debt growth was almost zero, because there were no annual deficits created.

This stemmed from a booming economy, no expensive wars, and the fact that income tax rates had been raised substantially by President Bill Clinton and Congress, from where they were during the two previous administrations. During the final year Clinton was in office, there was a budget surplus of $86 billion.

In 2001, Clinton handed new President George W. Bush a national debt of $5.6 trillion. That year and again in 2003, Congress passed what is now known as the Bush era tax cuts, causing a steep decline in the amount the treasury would take in each succeeding tax season.

As tax revenues continued to fall short of expenditures, a deficit was created each year of the Bush presidency, thus adding to the national debt. Then the country borrowed even more money nearly $4 trillion to pay for the wars in Iraq and Afghanistan, further pushing the debt upward. By Bushs last year in office, there was a $642 billion deficit, and the debt had almost doubled to $9.98 trillion.

You May Like: Chapter 14 Bankruptcy Definition

Why Does China Hold So Much Of The Debt

China is the second-largest holder of the debt, even after it reduced its holdings, which it has been doing since 2011. It has held up to $1.3 trillion of U.S. debt.

Every year since 2010, China has held more than $1 trillion in U.S. debt. That’s when the U.S. Department of the Treasury changed how it measures the debt. Before June 2010, Treasury reports showed that China held about $843 billion in debt. This Treasury-led change makes it difficult to make long-term comparisons.

China is taking steps to make its currency, the yuan, transition to a global currency. To do that, China had to loosen its peg to the dollar. That made the yuan more attractive to forex traders in global markets. China’s economic growth has slowed over the years. As its exports decline, China is less able to invest in U.S. Treasurys.

China also is liberalizing its control of the yuan, also called the “renminbi.” It has opened yuan trading centers in London and Frankfurt. Its allowed the yuan to trade in a wider trading range around a basket of currencies that include the dollar.

China is also responding to accusations of manipulation. Most countries want their currency values to fall so they can win global currency wars. Countries with lower currency values export more, since their products cost less when sold in foreign countries.

The National Debt Is Now More Than $31 Trillion What Does That Mean

The gross federal debt of the United States has surpassed $31,000,000,000,000. Although the debt affects each of us, it may be difficult to put such a large number into perspective and fully understand its implications. The infographic below offers different ways of looking at the debt and its relationship to the economy, the budget, and American families.

The $31 trillion gross federal debt includes debt held by the public as well as debt held by federal trust funds and other government accounts. In very basic terms, this can be thought of as debt that the government owes to others plus debt that it owes to itself.

Americas high and rising debt matters because it threatens our economic future. The coronavirus pandemic rapidly accelerated our fiscal challenges, but we were already on an unsustainable path, with structural drivers that existed long before the pandemic. Putting our nation on a better fiscal path will help ensure a stronger and more resilient economy for the future.

Also Check: What Is Foreclosed Homes

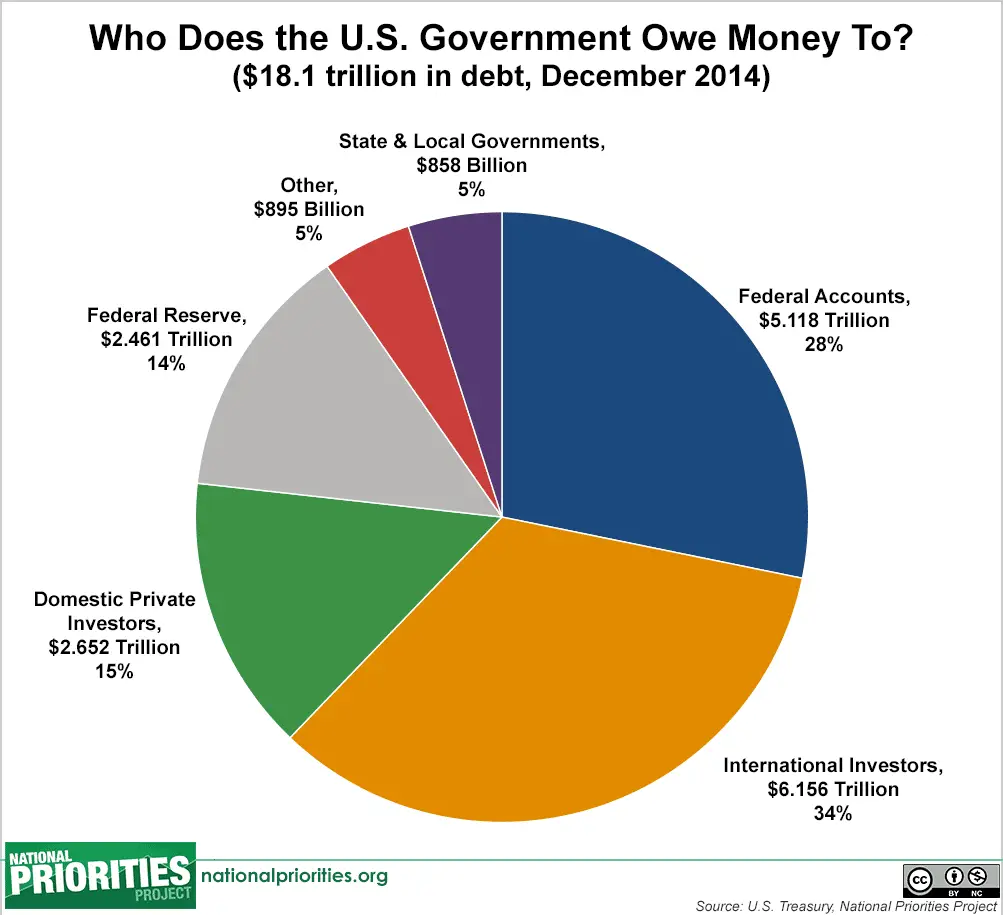

Who Owns The Us National Debt

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

When consumers spend more than they make, they often find themselves in debt. The same is true for countries, and the United States is no exception. When the United States spends more than it earned through taxes and other revenue sources, it creates a deficit.

The United States borrows money, typically by issuing Treasury securities, such as treasury bills , notes and bonds , to cover that difference. Every year the United States cannot pay the deficit between revenue and expenses, the national debt grows.

Heres everything you need to know about the national debt, how it impacts the American economy, and who owns US debt.

Us Debt By Presidential Term

The national debt between the Ronald Reagan era and Bill Clintons administration slowly increased, but it nearly doubled during the presidential term of George W. Bush to more than $9 trillion.

Here, then, is a brief timeline of how American debt has grown since John Hancock signed the Declaration of Independence on July 4, 1776.

Don’t Miss: Ultra Foreclosures Cancel Subscription

Search For Money From Banking And Investments

- Bank Failures Search for unclaimed funds from failed financial institutions. The Federal Deposit Insurance Corporation lists them.

- Find unclaimed deposits from credit unions.

- SEC Claims Funds The Securities and Exchange Commission lists enforcement cases in which a company or person owes investors money.

- Savings Bonds Use TreasuryHunt.gov to find matured savings bonds that have stopped earning interest. You can also learn how to replace a lost or destroyed savings bond.

How Much Us Debt Does China Own

Nations borrowing from each other may be as old as the concept of money. Foreign debt provides the opportunity for countries to secure the financing they ordinarily wouldn’t have access to and to stimulate their economy.

However, the concept of foreign debt carries a negative connotation, especially when it concerns large amounts owed to nations embroiled in controversy. For example, the huge amount of debt that the U.S. government owes Chinese lenders has been the subject of countless debates, headline news stories, and political platforms for decades.

Also Check: I Can’t Pay My Debts What Options Do I Have

Whos Responsible For The Current National Debt

In short? Pretty much every administration.

Regardless of political affiliation, parties in power have run up the deficit through higher spending and lower revenue collection, says Brian Rehling, head of Global Fixed Income Strategy at Wells Fargo Investment Institute.

While its easy to say a particular president or presidents administration caused the federal deficit and national debt to move a certain direction, its important to note that only Congress can authorize the type of legislation with the most impact on both figures.

Heres a look at how Congress acted during four notable presidential administrations and how their actions impacted both the deficit and national debt.

Lower Returns On Your Investments

Bonds issued by the Treasury are typically seen as low-risk investments. When interest rates rise, the yield on these low-risk investments also rises, making them more attractive investments for income-minded investors over other riskier income-generating investments like corporate bonds.

This could leave companies that typically rely on bonds short on the loans they need to finance expansions and operations and translate into lower returns for equity investors when companies fail to meet revenue targets.

Don’t Miss: What Dti For Mortgage

Can America Keep Piling Up Debt

Economists debate whether the spending is sustainable. The U.S. finances the debt by selling bonds at auction. Demand has traditionally been high due to the size of our economy and a historically stable government, but the Treasurys auction of bonds in March 2021 was met with a tepid response.

Historically low interest rates meant the U.S. borrowed money cheaply, and it would theoretically invest it in an economy that would produce higher rates of return.

But interest rates are not expected to stay low forever. The 10-year rate on Treasury notes was expected to rise from 1.7% in March 2021 to at least 2.0% by the end of 2021, according to Kiplingers forecast.

The cost to just finance our debt is expected to be $378 billion in 2021 and increase to $665 billion by the end of the decade, according to CBO estimates. That money will be spent only on interest, not on the principal.

The U.S. is by far the most indebted organization in world history. While debt has been an issue since the inception of the U.S., its rapid growth will continue to challenge lawmakers into creating better programs to reign in expenditures, as well as American consumers who must develop improved way of managing their personal debt.

6 Minute Read

Is China’s Strategy Working

China’s low-cost competitive strategy seems to be working. Its economy grew more than 10% for the three decades before the 2008 recession. In 2019, it grew at 6.1%, an even more sustainable rate.

China has become one of the largest economies in the world. And if you measure it by gross domestic product and consider purchasing power parity , China is seen as the worlds largest economy.

China also became the world’s biggest exporter in 2009. China needs this growth to raise its low standard of living. For these reasons, we’ll likely see China remain one of the world’s largest holders of U.S. national debt.

Also Check: Buying Houses In Foreclosure

President Andrew Jackson Cuts Debt To Zero

The War of 1812 more than doubled the nations debt. It increased from $45.2 million to $119.2 million by September 1815. The Treasury Department issued bonds to pay a portion of the debt, but it was not until Andrew Jackson became president and determined to master the debt that this national curse, as he deemed it, was addressed.

The time of prosperity was short-lived, as state banks began printing money and offering easy credit, and land value dropped.

Risks To Economic Growth

Debt levels may affect economic growth rates. In 2010, economists Kenneth Rogoff and Carmen Reinhart reported that among the 20 developed countries studied, average annual GDP growth was 34% when debt was relatively moderate or low , but it dips to just 1.6% when debt was high . In April 2013, the conclusions of Rogoff and Reinhart’s study came into question when a coding error in their original paper was discovered by Herndon, Ash and Pollin of the University of Massachusetts Amherst. Herndon, Ash and Pollin found that after correcting for errors and unorthodox methods used, there was no evidence that debt above a specific threshold reduces growth. Reinhart and Rogoff maintain that after correcting for errors, a negative relationship between high debt and growth remains. However, other economists, including Paul Krugman, have argued that it is low growth which causes national debt to increase, rather than the other way around.

Commenting on fiscal sustainability, former Federal Reserve Chairman Ben Bernanke stated in April 2010 that “Neither experience nor economic theory clearly indicates the threshold at which government debt begins to endanger prosperity and economic stability. But given the significant costs and risks associated with a rapidly rising federal debt, our nation should soon put in place a credible plan for reducing deficits to sustainable levels over time.”

You May Like: Has Mark Cuban Ever Filed For Bankruptcy

Debts Of The Us Government

Debts Owed by the US Government VS Debts Owed to it

Americans are bombarded by the news and their government representatives with the fact that foreign countries owe us a lot of money. Were also told the reverse, too, which is that we owe foreign countries a lot of money. But do you know the real facts about who owes who, and how much? It might surprise you to know that America is owed a lot more money than it owes. Despite substantial debts that America owes to countries like China and Japan, they owe us money as well.

Its not just the amount of money that America owes that has her citizens so concerned, either. A big part of this discussion is who American owes money to. For a long time, the biggest holder of U.S. debt was China. But did you know that in late 2016, Japan overtook China as the biggest foreign holder of U.S. debt? Japan and China are, by far, the two biggest holders of U.S. debt but the top five is filled with countries that you might not expect. How about Ireland, the Cayman Islands, and Brazil? Did you expect them to be substantial holders of U.S. debt?