It Could Reduce Your Monthly Debt

When you have a debt discharged through Chapter 7 bankruptcy, youre no longer legally required to pay that debt back. That means the money you were paying toward that loan or credit card, for example, can now be used for other things, like household necessities.

Note that there are a number of exceptions to the debts that can be discharged in Chapter 7, so we recommend contacting a bankruptcy lawyer before you file.

Discussing Your Finances Goals And Priorities

Our law office offers robust bankruptcy strategies that suit your needs. We can also provide non-bankruptcy strategies and legal services that will allow you to stop foreclosure, address student loan debt, and resolve other complex financial problems.

Talk about your non-exempt assets and discuss your debt reorganization plans, if any. Clarify what can be done to have certain types of debt forgiven, be allowed to repay secured and unsecured debts while retaining your assets, or both.

What Do You Need To Do Before Filing For Bankruptcy

Regardless of whether you file for Chapter 7 or Chapter 13 bankruptcy, there are a series of steps that you are going to need to follow before you officially file with the courts.

The first step is you are going to need to make a complete list of all of the debts that you owe, and verify the amount of each debt with official paperwork.

Next, youre going to need to take a pre-bankruptcy credit counseling course at an approved agency before you can officially file. This has been mandated by the United States Federal government since 2005. The purpose of the counseling is to determine if filing for bankruptcy is even the right course of action for you to take and to determine if there are any other steps you can take to pay back your debts instead. This is the course that CC Advising provides, and the certificate you receive after taking our course is valid for 180 days.

Remember, bankruptcy is never your only choice no matter how much debt you are in. You can try lowering your interest rates, developing a debt management plan with a credit counseling agency, consolidating your debt, or simply cutting back on your daily expenses and using the money leftover to pay back your debts.

You May Like: Help With Debt Consolidation

Why Would Someone Choose Chapter 13 Over Chapter 7

First, under Chapter 13, the list of debts eligible for discharge is more expansive than under Chapter 7. This includes debts arising from willful and malicious injury to property and debts from divorce property settlements.

Retired bankruptcy court attorney adviser Shaun K. Stuart has some other possible explanations. Stuart assisted with the St. Louis Feds Page One Economics essay, Bankruptcy: When All Else Fails, published in April 2018.

Stuart noted that:

- Chapter 13 allows you to reschedule certain debts to be spread out over a longer period of time, which could lead to smaller, more manageable payments.

- If you are behind on your mortgage, you can keep your home and prevent foreclosure, as long as you keep making payments.

- Furthermore, you have more time to pay back debts that cant be discharged under Chapter 7 .

- Chapter 13 can also protect third parties who are liable with the debtor on consumer debts. For example, if a payment plan is completed, co-signers are protected from creditor action.

- You can assign debts with co-debtors to different payment percentages and creditor classes than debts incurred by yourself.

Lastly, Stuart said, you can pay attorney fees through the Chapter 13 plan, and file a Chapter 13 more than once if needed.

Debating Between Chapter 7 Or Chapter 13 Bankruptcy Let Leinart Law Firm Help

If youre trying to decide between Chapter 7 and Chapter 13, the bankruptcy lawyers at Leinart Law Firm can consult with you on your financial situation to help you make an informed decision. Alternatively, we also specialize in other debt relief solutions if bankruptcy isnt your best option.

Visit Dallas law firm or our Fort Worth law firm, and we can help you and your family get the fresh start you deserve.

Call for a free consultation and talk to an experienced bankruptcy attorney. Call today or email .

214-6276

426-3328

Free Bankruptcy Evaluation

Discuss your situation and your options with an experienced bankruptcy lawyer.

Don’t Miss: How Long Can A Bankruptcy Stay On Your Credit Report

Power Over Special Unsecured Creditors

There are certain types of debt that are not discharged in bankruptcy, such as recent income taxes, all child and spousal support, student loans, and a few others. Under Chapter 7, if you have any of these debts, you need to deal with them after your case is finished.

This may be fine if the surviving debt is relatively small and discharging your other debts has made dealing with it manageable. Additionally, many types of unsecured debts are discharged under Chapter 7 bankruptcy. These include medical debt and .

Under Chapter 13, you can arrange to pay those kinds of special debts through a court-approved repayment plan which usually gives you more control, is based on what you can afford, and protects you from all your creditors throughout the process.

This continued protection can be especially important because otherwise, the law tends to give these kinds of creditors extraordinarily aggressive collection powers. Also, in some casessuch as income taxesyou will be able to pay less by avoiding ongoing interest and penalties.

What Are The Eligibility Requirements For Filing A Chapter 13 Bankruptcy

In order to be eligible for a chapter 13 bankruptcy, the debtorâs unsecured debts must be less than $394,725 and his or her secured debts must be less than $1,184,200. A secured debt is a debt, like a mortgage or a car loan, for which the creditor can take back certain property from the debtor if the debt is not paid. An unsecured debt is a debt for which there is no collateral.

If a previous bankruptcy case was dismissed based on the debtorâs willful failure to appear in court or to comply with the courtâs orders, or if the case was voluntarily dismissed after a creditor requested relief from the automatic stay, a Chapter 13 case may not be filed within 180 days of the dismissal.

About the author

Kevin OâFlaherty is a graduate of the University of Iowa and Chicago-Kent College of Law. He has experience in litigation, estate planning, bankruptcy, real estate, and comprehensive business representation.

What to Expect From a Consultation

The purpose of a consultation is to determine whether our firm is a good fit for your legal needs. Although we often discuss expected results and costs, our attorneys do not give legal advice unless and until you choose to retain us. Consultations may carry a charge, depending on the facts of the matter and the area of law. The cost of your consultation, if any, is communicated to you by our intake team or the attorney.

Also Check: How To File For Personal Bankruptcy In California

Choosing Chapter 7 Bankruptcy

Chapter 7 bankruptcy has strict income guidelines and means testing for who can qualify that looks at expenses, family size, and income. If you qualify, consider these circumstances below to see if Chapter 7 is right for you.

- Your debt is primarily credit cards, medical bills, and personal loans, rather than student loans or tax debt.

- You own little property, including investments, savings, and valuables.

How Do I Find Out Whether I’d Qualify For Chapter 7 Bankruptcy

You’ll take the two-part Chapter 7 means test. If your household income is lower than the median household income in your state, you’ll pass. However, if you don’t qualify after the first part, you’ll have another chance. The second portion of the means test lets you subtract some monthly expenses from your income. If you don’t have enough remaining to pay a meaningful amount to creditors through a Chapter 13 repayment plan, you’ll qualify for Chapter 7.

Don’t Miss: How Much Debt You Need To File Bankruptcy

Cost Of Debt Calculator

It makes sense to think that the cost of debt is simply the amount of debt that you owe, right? But this is most often not the case. Unless you paid extra close attention and were extremely diligent, its likely that your debt or loan involves interest collected over time. Until you calculate what that interest will amount to by the time you finish paying off your debt, you wont know what your debt is really costing you. Use this Cost of Debt Calculator to determine exactly how much youll be paying over time.

Explaining The Entire Bankruptcy Process

A reliable local attorney can give comprehensive legal advice and help you fill out bankruptcy forms. He or she can assist as you prepare the necessary paperwork and supporting documents as well.

Additionally, your lawyer can help you go through the scheduled Meeting of Creditors and subsequent confirmation hearing. These must be taken very seriously, since they can influence the outcome of the bankruptcy case.

Don’t Miss: How To File Bankruptcy In Milwaukee Wi

You Must Repay Creditors

A Chapter 13 bankruptcy requires repayment to creditors using a three- or five-year repayment plan.

This means you must have enough income to pay creditors every month. You must:

- Repay priority debts and secured creditors in full

- Repay unsecured creditors an amount equal to what those creditors would have received if your trustee sold your nonexempt property in a Chapter 7 bankruptcy

When Is Filing For Chapter 13 After Chapter 7 A Good Idea

Here are some common reasons you might file for chapter 13 after filing for chapter 7:

- Back taxes: If you discharge all your debts but still have back taxes that werent dischargeable, chapter 13 will give you five years to pay those taxes.

- Student debt: You may also use the five years provided under chapter 13 to pay back items such as student debt or alimony arrears that werent discharged in your chapter 7 case. If you have large amounts of student loans, filing for chapter 13 allows you to avoid wage garnishments, says Rosenblum. Rather than making your regular student loan payment, you make your chapter 13 plan payment, which will be lower.

- Late payments: A chapter 7 bankruptcy allows the holder of your mortgage to foreclose, so you may want to consider filing for chapter 13 to give yourself more time to catch up on your mortgage payments. Typically, under a chapter 13 bankruptcy, youre allowed to hold onto the property that youre making payments on.

- Lien stripping: This is the process of eliminating junior liens like second mortgages. Not all courts allow this, so consult a bankruptcy professional to see if this makes sense for your situation.

Also Check: How Do I Find Foreclosed Homes

The Debts You Owe And Any Previous Filings

There are certain cases where declaring bankruptcy is not the best choice, or if it is not entirely feasible. Be sure to mention if a petition in bankruptcy had been filed in recent years, or if a bankruptcy petition was dismissed because of failure to appear or comply with a court order. Be transparent with your lawyer when it comes to these things, since other debt-relief options may also be considered.

Explain to your attorney your regular income, total unsecured debt, total secured debt, and details on your tax filings. The amount and types of debt you owe will influence the chapter that must be filed. Additionally, when you are informed of the different implications, you are capable of making smart decisions that can reshape your financial future.

What Is Chapter 7

Chapter 7 bankruptcy is generally a fast bankruptcy the cases usually last about three to four months, and you can discharge credit card debt, medical bills, personal loans, utilities and some income tax debts without having to repay them. You can keep your house and your car in Chapter 7 if you can afford the payments and if you are current on your payments, but you must repay these loans if you want to keep the property. If you have debt that is nondischargeable, such as child support, alimony and most student loans and some taxes, you will still be responsible for them after a Chapter 7.

Don’t Miss: Foreclosure Homes Free Listings

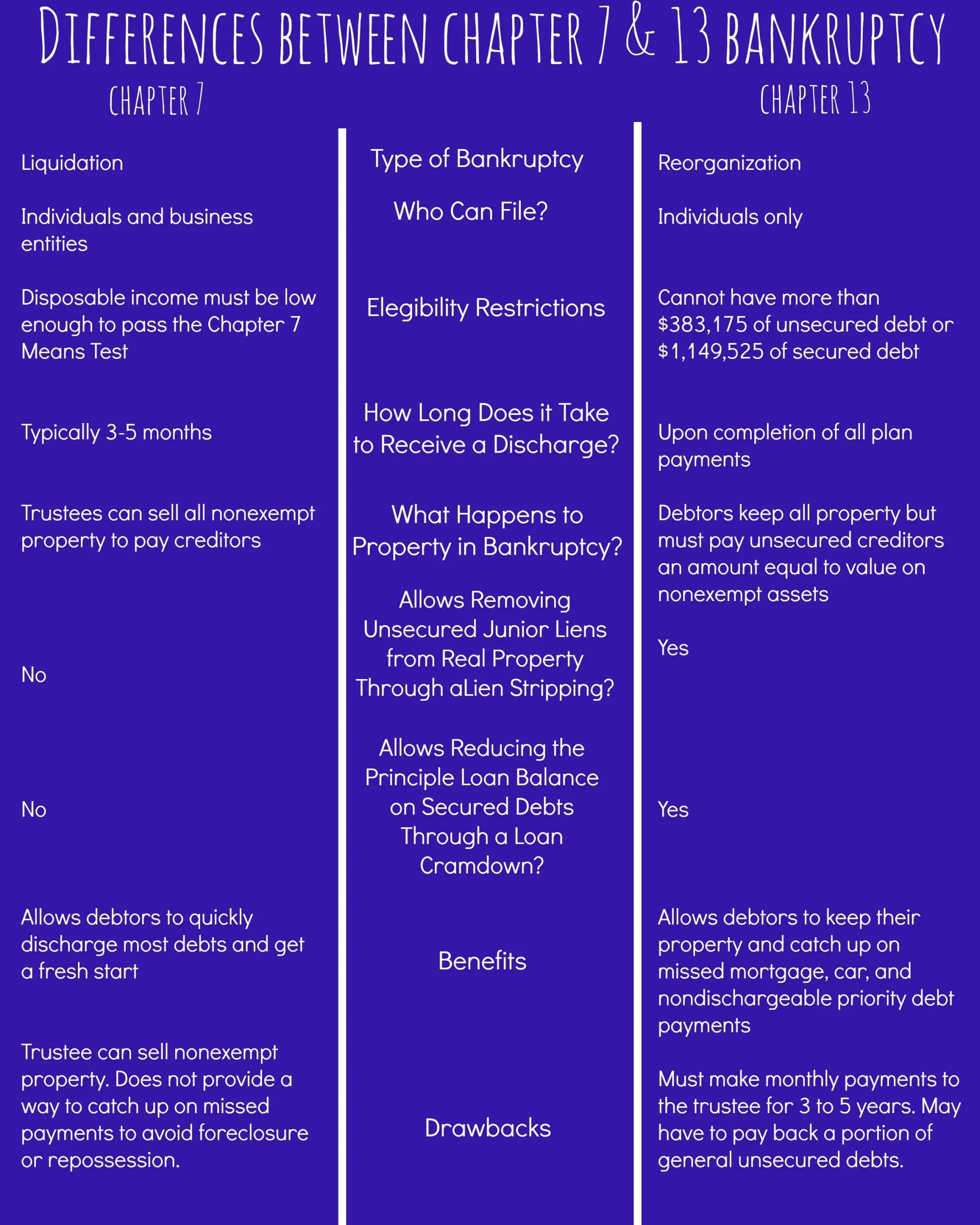

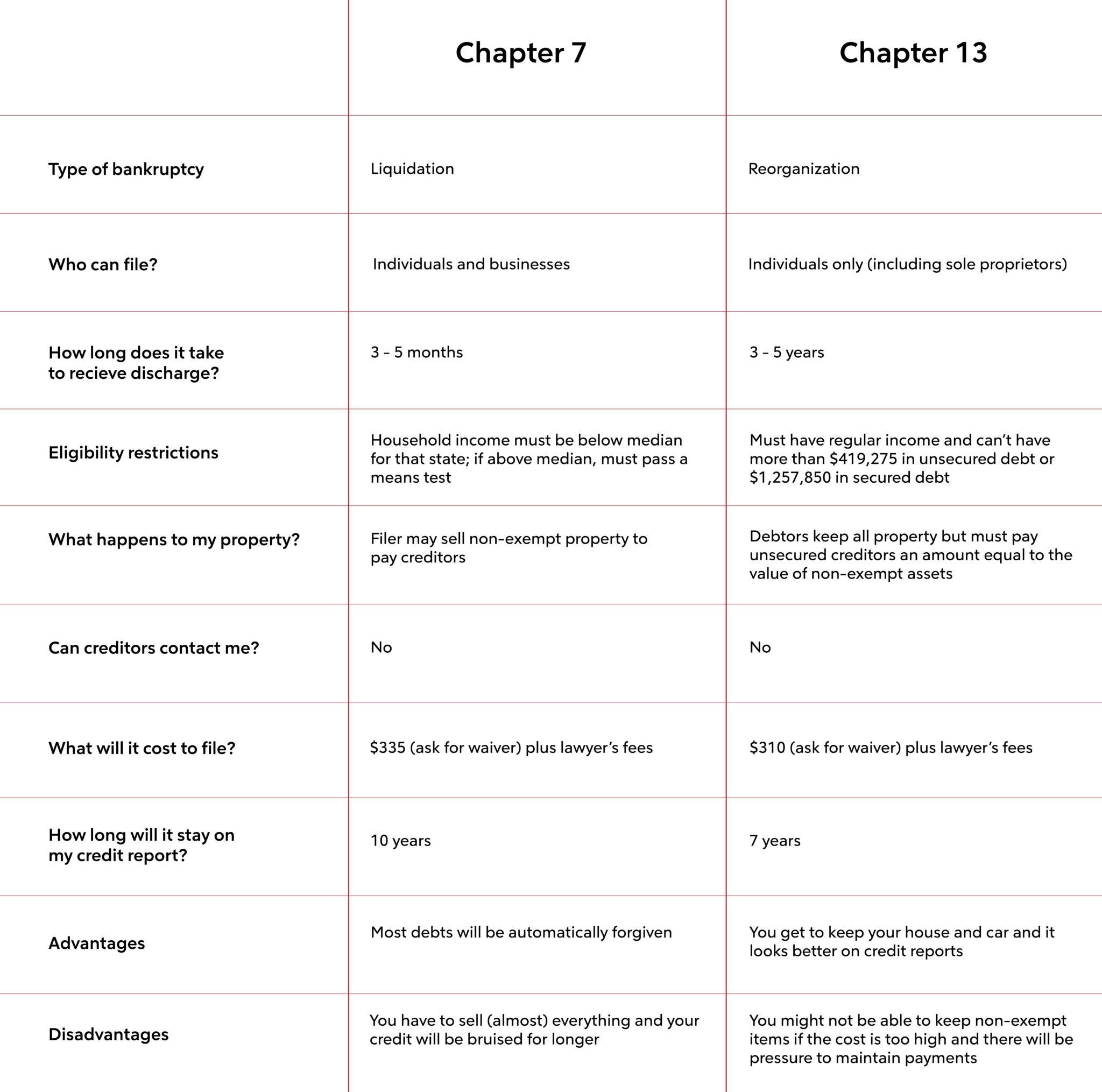

Chapter 13 Bankruptcy Vs Chapter 7 Bankruptcy

There are a handful of differences between Chapter 13 and Chapter 7 bankruptcy, related to eligibility, debt type, exemptions and length.

Chapter 13 Bankruptcy vs. Chapter 7 Bankruptcy

|

Chapter 7 Bankruptcy |

Chapter 13 Bankruptcy |

|

|---|---|---|

|

Chapter eligibility |

An individuals income must fall below the states median level or they must pass a means test. |

Anyone can file for Chapter 13 bankruptcy, as long as they have regular income. |

|

Type of debt |

Used to discharge most of unsecured debt, for example credit cards, medical bills, and personal loans. |

Typically used to repay secured debts, such as a mortgage or car loan, but may also be used to repay unsecured debts. |

|

Chapter exemptions |

A debtor can use exemptions to protect some of their assets from being sold to pay off to pay . |

A debtor can keep all of their assets, but they must use their disposable income to pay off their debts. |

|

The process length |

Typically completed within 4 to 6 months. Any earnings or property the debtor acquires after filing is not subject to distribution to creditors, with the exception of inheritances if they occurred more than 180 days after the petition date. In a Chapter 7 bankruptcy, foreclosure of a property by a lender stops, but only temporarily. After conclusion of the case, lenders can begin to seek mortgage liens once again. |

Typically completed within 3 to 5 years. |

When Is Filing Bankruptcy Under Chapter 13 Advisable

If you are from Rockville, MD and are considering bankruptcy, call our compassionate and competent bankruptcy lawyers in Maryland. We can help you decide on which options best fit your goals and financial standing.

If your unpaid debts are accumulating but you have non-exempt properties that you would want to keep, selling your assets to pay back your lenders is not your only option. There are certain programs and bankruptcy alternatives that might work given your situation.

Don’t Miss: Help With Credit Card Debt

Why Would You Convert From Chapter 7 To Chapter 13

In bankruptcy, conversion means switching from one chapter of bankruptcy to another before the first one is completed. This blog is about going from Chapter 7 to 13. These two options are quite different, so why would a person make that switch?

For two sets of reasons: because 1) changed circumstances make Chapter 13 the better option, and 2) you are induced to convert to Chapter 13 even if you would have rather just finished the Chapter 7 case.

Objections To The Debtors Repayment Plan

The trustee and creditors have to up to seven days after the meeting of creditors to object to the debtor’s repayment plan, unless there is an extension. For example, the trustee may believe that the debtor should pay more to unsecured creditors and objects to the confirmation of the repayment plan by filing a motion to dismiss.

In this instance, the debtor will receive the motion to dismiss, telling them either to correct the issue to the trustee’s satisfaction or show the bankruptcy court why approval of the payment plan is necessary. The debtor will then argue their case at the conformation hearing.

Don’t Miss: Can You Include Student Loans In Chapter 7 Bankruptcy

Why Is Legal Help Necessary For Bankruptcy Cases

If you wish to prevent lenders and debt collectors from contacting or harassing you, a bankruptcy petition will enable you to benefit from the automatic stay. Getting reliable legal assistance is necessary, since bankruptcy proceedings can be quite overwhelming.

A diligent bankruptcy lawyer in Maryland can help you with the following:

It Can Stop Debt Collections And The Foreclosure Process

If youre a struggling homeowner, Chapter 13 could be the help youre looking for. Filing Chapter 13 can stop the foreclosure process and give you a chance to catch up on your past-due mortgage payments. And if you have debts in collections, any debts discharged during Chapter 13 means your creditors can no longer take any action to try to collect the money from you.

Don’t Miss: Bankrupt Property For Sale

Income Limits For Chapter 7 Bankruptcy

The most common reason people file Chapter 13, however, is that they make too much money to file for a Chapter 7. These people may need to file Chapter 13. The income limits for Chapter 7 are adjusted periodically, so be sure to check current information. Even if your income is above the median for your family size you may still be able to file Chapter 7. The means test can be legally manipulated.

When youre considering which bankruptcy chapter to file, you ought to consult a certified specialist to help you. Its free, and no matter how much internet research you do, its never as good as checking with a seasoned professional.

The Role Of The Chapter 7 Trustee

The role of a chapter 7 trustee is very different than the role of a Chapter 13 Trustee. Once you file your bankruptcy, a bankruptcy trustee is assigned to your case. A Trustee is appointed and supervised by the United States Trustees Office, which is part of the Department of Justice but is not a government employee.

The primary role of a Chapter 7 Trustee is to administer your case and liquidate your non-exempt assets. The Chapter 7 Trustee accomplishes liquidation by selling your non-exempt assets to the extent necessary to repay your creditors.

If you refuse to hand over your assets to the Trustee, the Trustee may seek to obtain an Order from the bankruptcy judge assigned to your case compelling or forcing you to turn over the property. Although this may seem scary, most Chapter 7 filings are no asset cases, meaning that you either dont own any property or all of your property is exempt .

People filing for bankruptcy in Florida have the extra benefit that Florida has some of the strongest exemptions or protection from creditors that are used to protect your property from being liquidated or sold.

Read Also: When Can You Refinance After Bankruptcy