What Will Happen To Our National Debt

U.S. spending is currently at an all-time high to combat the effects of COVID-19. The current level of debt-to-GDP is comparable to the period immediately after World War II. Despite the effort to reduce the national debt, it is apparent and crucial for the government to take on the debt during times of crisis. Being able to adequately and successfully respond to emergencies is one of the many reasons why the national debt should be reduced governments should respond to events in an appropriate and timely manner with its citizens in thought.

Income Security And Covid

Income security spending of $1.6 trillion was boosted by $569.5 billion in pandemic relief payments and $79 billion in child tax credit payments. It also included $397.9 billion for unemployment compensation, $168.1 billion on food and nutrition assistance, $89.8 billion in housing assistance, and $156.1 billion in federal employee retirement and disability costs.

What Is The Current National Debt

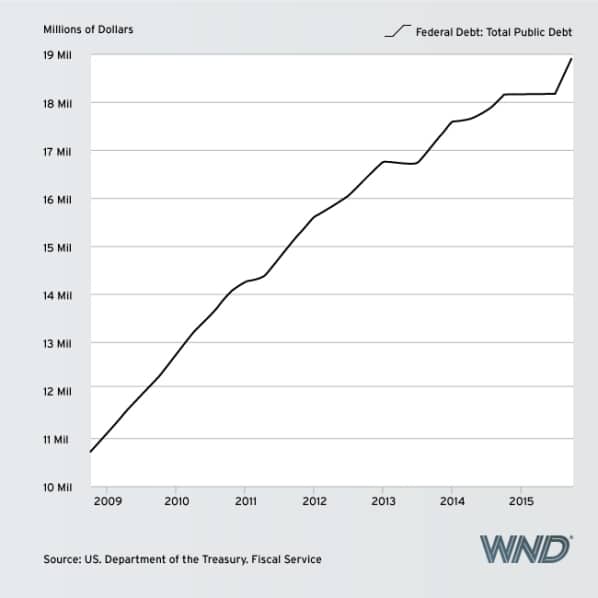

Despite the nations economic recovery, and the end of the wars in Afghanistan and Iraq, the U.S. debt-to-GDP ratio has remained above 100 percent since 2013. During fiscal year 2017, the total national debt passed $20 trillion for the first time in the nations history. Debt levels continue to rise.

In early 2018, an analysis by the nonpartisan Committee for a Responsible Federal Budget concluded that recent tax and spending legislation passed by Congress under President Donald Trump was on track to push the countrys debt-to-GDP ratio to highs not seen since immediately after World War II.The report stated that if the temporary spending increases and tax cuts are made permanent, the national debt would reach $33 trillion, or 113 percent of GDP, by 2028, and could be twice the size of the U.S. economy in about 25 years.

The COVID-19 epidemic is impacting national debts across the globe. The Congressional Budget Office projects a federal deficit of $1 trillion in 2020. An economic stimulus package from congress could prompt the U.S. national debt to surpass $25 trillion or higher.

Recommended Reading: How Does A Bankruptcy Trustee Find Hidden Assets

What School Was Like In The 13 Colonies

During the Civil War, the national debt ballooned to some $2.76 billion by 1866. Economic growth in the late 19th century, accompanied by inflation, helped make debt a smaller percentage of economic output. But after World War I, the debt-to-GDP ratio hit a record high 33 percent, with a debt of more than $25 billion .

World War I also saw a major shift in control over the national debt, as Congress agreed to give the Treasury Department more flexibility in raising money through sales of its bonds. Though it ceded its right to approve or disapprove of each individual sale, Congress would set an overall limit to that borrowing, known as the debt ceiling.

Congress has since raised or lowered the debt ceiling, or the maximum amount of outstanding debt that the federal government can legally incur, numerous times.

Are We Helpless When It Comes To The National Debt

![US National Debt (And Related Information) [OC] US National Debt (And Related Information) [OC]](https://www.bankruptcytalk.net/wp-content/uploads/us-national-debt-and-related-information-oc-national-debt.png)

In some ways, yes. But there are actions you can take to mitigate the effect of the national debt on your life.

- Pay your taxes: According to the IRS, the federal government loses $1 trillion each year due to unpaid taxes.

- Put pressure on your Congressional reps: Call or write to your Representatives and Senators in support of tax code reform, increased funding for the IRS to track down tax cheats and closing loopholes that give the countrys most profitable companies tax bills that are lower than most Americans.

- Follow your reps voting history: If youre curious how your Representatives and Senators have voted on fiscal policy issues, thats easy to check. You can use voting history to back up your concerns when writing or calling your reps.

- Learn about healthcare reform: While national healthcare remains a contentious topic, it could pay to learn how other countries control healthcare costs and how those policies could benefit you, your neighbors and the impact rising healthcare costs has on the national debt.

Rehling from Wells Fargo Investment Institute says that while the national debt has increased substantially over the past decade, the U.S. isnt unique in this regard. The rest of the developed world has seen similar trends.

While these budget trends are unsustainable over the long run, there is no indication that current debt levels are overly worrisome, he says.

You May Like: Amazon Liquidation Pallets South Carolina

Us National Debt Expected To Approach $89 Trillion By 2029

Colored pencil and acrylic illustration of Government Spending blowing the roof off a capital … building. Check out my “Social Issues” light box for more.

Getty

The U.S. national debt is rising at a pace never seen in the history of America. With a current debt exceeding $28 trillion an increase of nearly $5 trillion in 14 short months, Washington is now debating an infrastructure bill with a price tag close to $2 trillion. Even without this additional spending, the national debt will approach $89 trillion by 2029 according to USDebtClock.org. This would put the countrys debt-to-GDP ratio at 277%, surpassing Japans current 272% debt-to-GDP ratio. The good news is that the U.S. economy grew by 6.4% in the first quarter of the year. The bad news is that, after we return to normal, future economic growth will not be as robust, primarily due to the burgeoning debt. Yes, America is losing, or perhaps already has lost, control of its public spending. But it hasnt always been that way.

Looking at data since 1901, federal government receipts and expenditures were mostly in line until the early 1970s. Sure, we had a deficit at times, including during WWI, the Great Depression, and WWII. Even then, Washington had some measure of control over its spending as the country was still under the gold standard. However, when Nixon abandoned the gold standard in 1971, the shackles were removed and Congress was free to spend, or rather overspend.

Federal Reserve Economic Data

Negative Real Interest Rates

Since 2010, the U.S. Treasury has been obtaining negative real interest rates on government debt, meaning the inflation rate is greater than the interest rate paid on the debt. Such low rates, outpaced by the inflation rate, occur when the market believes that there are no alternatives with sufficiently low risk, or when popular institutional investments such as insurance companies, pensions, or bond, money market, and balanced mutual funds are required or choose to invest sufficiently large sums in Treasury securities to hedge against risk. Economist Lawrence Summers states that at such low interest rates, government borrowing actually saves taxpayer money and improves creditworthiness.

In the late 1940s through the early 1970s, the U.S. and UK both reduced their debt burden by about 30% to 40% of GDP per decade by taking advantage of negative real interest rates, but there is no guarantee that government debt rates will continue to stay this low. Between 1946 and 1974, the U.S. debt-to-GDP ratio fell from 121% to 32% even though there were surpluses in only eight of those years which were much smaller than the deficits.

You May Like: How To Find Out If Someone Filed Bankruptcy In Ohio

Coronavirus And The National Debt

The U.S. government has taken efforts to offset the effects of worldwide health pandemic by borrowing money to invest in individuals, businesses, and state and local governments. Of these responses, the CARES Act has been the largest stimulus package in U.S. history. This stimulus package included $2.3 trillion towards relief for large corporations, small businesses, individuals, state and local governments, public health, and education. In order to pay for the relief fund, the government needed to expand its debt to do so, the government borrowed money from investors through the sales of U.S. government bonds.

National Debt Vs Budget Deficit

It’s important to understand the difference between the federal government’s annual budget deficit and the national debt. The federal government generates an annual deficit when its spending over the course of a year exceeds government revenue from sources including taxes on personal income, corporate income and payroll earnings.

When annual congressional appropriations exceed federal revenue, the U.S. Treasury finances the deficit by issuing Treasury bills, notes, and bonds. These Treasury products may be purchased by investors including individuals and pension funds banks, insurers and other financial institutions and the Federal Reserve as well as foreign central banks.

National debt is the sum of such annual budget deficits It is the total amount of money a country owes .

Recommended Reading: What Do You Lose In Chapter 7 Bankruptcy

Our Fiscal Forecast The Structural Deficit

At 79 percent of GDP, our federal debt is at its highest point since just after World War II. Unfortunately, the even more depressing fiscal fact is that our debt is projected to nearly triple over the next 30 years to more than twice the size of the U.S. economy. These levels have no precedent in American history.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch between spending and revenues, and the gulf between them is growing.

The growth in our deficit is caused primarily by three key drivers of spending demographics, healthcare costs, and interest on the debt as well as by revenues that are insufficient to cover the promises that have been made.

This growth in our debt isnt based on partisan factors or politics its the simple math of spending more than we take in. Some think we spend too much, while others say taxes are too low but theres no doubt that the federal budget has a structural mismatch.

Us National Debt Tops $30 Trillion For First Time In History

The Treasury Department this week reported that the total national debt of the United States surpassed $30 trillion for the first time in history, an amount equal to nearly 130% of America’s yearly economic output, known as gross domestic product. The eye-popping figure makes the U.S. one of the most heavily indebted nations in the world. The federal debt has been high and rising for decades, but the federal government’s response to the coronavirus pandemic, which involved massive infusions of cash into the U.S. economy, greatly accelerated its growth. At the end of 2019, prior to the pandemic, the national debt stood at $22.7 trillion. One year later, it had risen by an additional $5 trillion, to $27.7 trillion. Since then, the nation has added more than $2 trillion in further debt. A grim reminder

While the $30 trillion figure, by itself, has no significant meaning, it may serve to focus attention on what some see as a major concern for the future health of the country. “Hitting the $30 trillion mark is a reminder of just how high our debt is and just how much we’ve been borrowing,” said Marc Goldwein, senior vice president and senior policy director for the Committee for a Responsible Federal Budget.

Also Check: How Long Can A Bankruptcy Remain On A Credit Report

How Much Do Other Countries Owe The Us

Public debt makes up three-quarters of the national debt, and foreign governments and investors make up one-third of public debt. As of , the countries with the most debt owed to the U.S. are Japan, China, the United Kingdom, Luxembourg, and Ireland.

Though China had been the long-standing top placeholder for the country with the most debt owed to the United States, Japan currently holds $1.3 trillion worth of U.S. debt. The second place holder, China, currently holds $1.1 trillion in Treasury holdings. Together, they hold 31% of all foreign-owned U.S. debt.

Can Higher Inflation Help Offset The Effects Of Larger Government Debt

Through the first three quarters of 2021, measured consumer price inflation has been higher than anticipated by professional forecasters: expectations for average annual CPI inflation were around 2 percent,1 yet September CPI was 5.4 percent, about the same rate as has held since May.2 Currently high inflation may be temporary as pandemic-related supply chain issues and reallocation frictions limit the household sectors attempt to spend down accumulated financial savings driven by large fiscal deficits. However, recent surveys3 have noted an increase in medium-term inflation expectations.

Inflation has two main effects on the governments budget and the economy. First, unexpectedly high inflation works as a “soft default” on current government debt since the real value of the debt asset is repriced under new inflation expectations. This reduction in real debt reduces capital crowd-out and increases investment. Second, the U.S. tax code has various elements which are not automatically adjusted for inflation. As nominal incomes rise, nominal thresholds apply at lower real levels and usually increase the tax liability to taxpayers. Additionally, capital income faces a higher real tax burden, as taxes generally apply to nominal, not real, returns on investment. Real tax revenues rise with inflation which generates an ambiguous effect on macroeconomic output: future deficits are reduced, but the after-tax return on investment falls.

Change in revenues, share of GDP

| 0.36% | 0.51% |

Recommended Reading: How To Buy Homes From Banks

Lower Returns On Your Investments

Bonds issued by the Treasury are typically seen as low-risk investments. When interest rates rise, the yield on these low-risk investments also rises, making them more attractive investments for income-minded investors over other riskier income-generating investments like corporate bonds.

This could leave companies that typically rely on bonds short on the loans they need to finance expansions and operations and translate into lower returns for equity investors when companies fail to meet revenue targets.

Forms Of Government Borrowing

In addition to selling Treasury bills, notes, and bonds, the U.S. government borrows by issuing Treasury Inflation-Protected Securities and Floating Rate Notes . Its borrowing instruments also include savings bonds as well as the government account securities representing intergovernmental debt.

Other nations have borrowed from international organizations like the International Monetary Fund and the World Bank as well as private financial institutions.

Don’t Miss: How Many Bankruptcies Has Trump Filed

National Debt Of The United States

| This article needs to be . Please help update this article to reflect recent events or newly available information. |

| This article is part of a series on the |

|

|

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms “national deficit” and “national surplus” usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

During the COVID-19 pandemic, the federal government spent trillions in virus aid and economic relief. The CBO estimated that the budget deficit for fiscal year 2020 would increase to $3.3 trillion or 16% GDP, more than triple that of 2019 and the largest as % GDP since 1945.

Us National Debt: Great Depression To Great Recession

The national debt again jumped dramatically as the economy tanked and the size, scope and role of government expanded during the Great Depression and the New Deal.

Then came World War II, when the debt-to-GDP ratio would rise above 77 percent for the first time in the nations history, reaching 113 percent by the end of that conflict.

In the post-war years, the national debt shrank in comparison to the booming post-war economy, which saw high GDP growth. The debt-to-GDP ratio went as low as 24 percent in 1974.

Recession and rising interest rates soon caused it to swing upwards again, as did the huge permanent tax cuts during Ronald Reagans first term and increased spending on both defense and social programs, and by the early 1990s, the debt-to-GDP ratio had reached nearly 50 percent.

Economic growth in the late 90s, combined with tax increases under both Presidents George H.W. Bush and Bill Clinton helped bring the debt load back in line, and by 2001 the national debt was less than 33 percent of GDP.

But that would soon change, thanks to increased military spending after the terrorist attacks of 9/11, tax cuts under George W. Bush, and the arrival of the Great Recession, when GDP fell rapidly and business activity and tax revenues shrank.

Also Check: Can You Open A Checking Account While In Bankruptcy

Debt By Year Compared To Nominal Gdp And Events

In the table below, the national debt is compared to GDP and influential events since 1929. The debt and GDP are given as of the end of the fourth quarter in each year to coincide with the end of the fiscal year. That’s the best way to accurately determine how spending in each fiscal year contributes to the debt and compare it to economic growth.

From 1947-1976, debt and GDP are given at the end of the second quarter since, during that time, the fiscal year ended on June 30. For years 1929 through 1946, debt is reported at the end of the second quarter, while GDP is reported annually, since quarterly figures are not available.

At the end of the fourth quarter in 2021, the national debt was about $29.6 trillion. Based on the fourth-quarter GDP of $23.9 trillion, the debt-to-GDP ratio was about 124%.

| End of Fiscal Year |

|---|

| COVID-19 and American Rescue Plan Act |