What Is An Ideal Ldr

Typically, the ideal loan-to-deposit ratio is 80% to 90%. A loan-to-deposit ratio of 100% means a bank loaned one dollar to customers for every dollar received in deposits it received. It also means a bank will not have significant reserves available for expected or unexpected contingencies.

Regulations also factor into how banks are managed and ultimately their loan-to-deposit ratios. The Office of the Comptroller of the Currency, the Board of Governors of the Federal Reserve System, and the Federal Deposit Insurance Corporation do not set minimum or maximum loan-to-deposit ratios for banks. However, these agencies monitor banks to see if their ratios are compliant with section 109 of the Riegle-Neal Interstate Banking and Branching Efficiency Act of 1994 .

What Can You Do If You Have A High Debt

If you have a high debt-to-income ratio, there are some things you could do to improve it, including reducing your monthly debt payments or increasing your income. Some suggestions include:

Reducing your debts by:

- Working to increase your credit score, which may enable you to negotiate a lower rate on existing loans

- Making a budget to limit your spending

- Minimising unnecessary expenditure

- Looking at options to refinance your home loan to lower your interest rate.

Increasing your income by:

- Considering a side hustle or income-producing investments.

In conclusion, keeping your debt-to-income ratio low can help you ensure you can afford your debt repayments and give you the peace of mind that comes from handling your finances responsibly. It can also help you be more likely to qualify for credit for the things you really want in the future.

If you are thinking about refinancing, Canstars eligibility checker tool can help you find out which loans may be more suited to you and connects you with a mortgage broker.

Cover image source: pogonici/Shutterstock.com.

Thanks for visiting Canstar, Australias biggest financial comparison site*

This content was reviewed by Deputy EditorSean Callery and Sub Editor Tom Letts as part of our fact-checking process.

Limitations Of D/e Ratio

When using D/E ratio, it is very important to consider the industry in which the company operates. Because different industries have different capital needs and growth rates, a D/E ratio value thats common in one industry might be a red flag in another.

Utility stocks often have especially high D/E ratios. As a highly regulated industry making large investments typically at a stable rate of return and generating a steady income stream, utilities borrow heavily and relatively cheaply. High leverage ratios in slow-growth industries with stable income represent an efficient use of capital. Companies in the consumer staples sector tend to have high D/E ratios for similar reasons.

Analysts are not always consistent about what is defined as debt. For example, preferred stock is sometimes considered equity, since preferred dividend payments are not legal obligations and preferred shares rank below all debt in the priority of their claim on corporate assets. On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt.

Including preferred stock in total debt will increase the D/E ratio and make a company look riskier. Including preferred stock in the equity portion of the D/E ratio will increase the denominator and lower the ratio. This is a particularly thorny issue in analyzing industries notably reliant on preferred stock financing, such as real estate investment trusts .

Read Also: Where To Buy Merchandise Pallets

Modifying The D/e Ratio

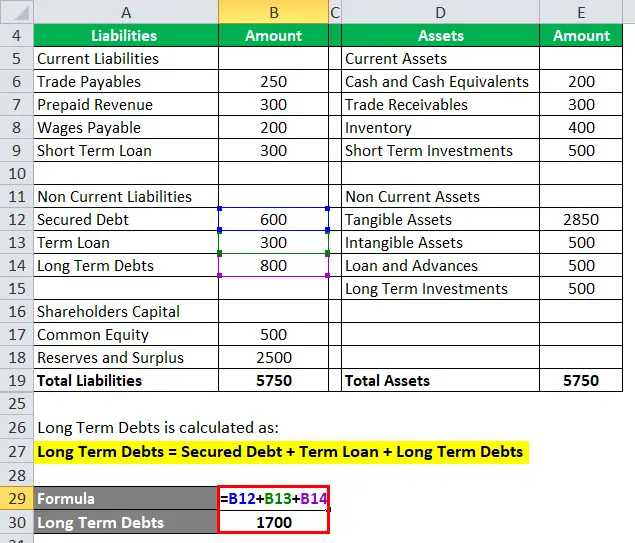

Not all debt is equally risky. The long-term D/E ratio focuses on riskier long-term debt by using its value instead of that for total liabilities in the numerator of the standard formula:

Long-term D/E ratio = Long-term debt ÷ Shareholder equity

Short-term debt also increases a companys leverage, of course, but because these liabilities must be paid in a year or less, they arent as risky. For example, imagine a company with $1 million in short-term payables and $500,000 in long-term debt, compared with a company with $500,000 in short-term payables and $1 million in long-term debt. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1. On the surface, the risk from leverage is identical, but in reality, the second company is riskier.

As a rule, short-term debt tends to be cheaper than long-term debt and is less sensitive to shifts in interest rates, meaning that the second companys interest expense and cost of capital are likely higher. If interest rates are higher when the long-term debt comes due and needs to be refinanced, then interest expense will rise.

Finally, if we assume that the company will not default over the next year, then debt due sooner shouldnt be a concern. In contrast, a companys ability to service long-term debt will depend on its long-term business prospects, which are less certain.

What Is A Typical Ltv

LTVs range rather considerably and are largely determined by the lenders risk appetite and the nature of the underlying asset.

If cash is being used as collateral , then a borrower can probably expect to get 100% LTV. Real estate also tends to support higher LTVs up to 95% for residential properties and generally upwards of 75% of appraised value for commercial properties. At the opposite end of the spectrum is inventory, which is frequently capped at 50% LTV.

When it comes to personal lending, rare or customized assets may command among the lowest LTVs. Fine art, wine collections, and collector vehicles may be used as collateral. Still, the niche appeal and limited secondary markets for these assets limit their upside, which equates to a lower LTV .

Recommended Reading: Target Liquidation Charlotte Nc

How To Lower Debt

The only way to bring your rate down is to pay down your debts or to increase your income. Having an accurately calculated ratio will help you monitor your debts and give you a better understanding of how much debt you can afford to have.

Avoid employing short-term tricks to lower your ratio, such as getting a forbearance on your student loans or applying for too many store credit cards. These solutions are temporary and only delay repaying your current debts.

Read Also: Who Should I Refinance My Car Loan With

How To Calculate Your Debt

To calculate your DTI for a mortgage, add up yourminimum monthly debt payments then divide the total by yourgross monthly income.

For example: If you have a $250 monthly car payment and a minimum credit card payment of $50, your monthly debt payments would equal $300. Now assuming you earn $1,000 a month before taxes or deductions, youd then divide $300 by $1,000 giving you a total of 0.3. To get the percentage, youd take 0.3 and multiply it by 100, giving you a DTI of 30%.

Also Check: How To Get A Car Loan After Bankruptcy Discharge

What Is Included In Debt

Your DTI ratio should include all revolving and installment debts car loans, personal loans, student loans, mortgage loans, credit card debt, and any other debt that shows up on a credit report. Certain financial obligations like child support and alimony should also be included.

Monthly expenses like health insurance premiums, transportation costs, 401k or IRA contributions, and bills for utilities and services are generally not included. However, if you have long-overdue bills for these types of accounts, they might eventually be passed on to a collection agency. The debt may be included in the calculation if that is the case.

There are two types of DTI ratios that lenders look at when considering a mortgage application: front-end and back-end.

Should I Apply For A Home Loan With A High Dti

In limited instances, high debt-to-income ratios mean lenders may be less willing to give you a mortgage loan or may ask you to pay a higher interest rate for the loan, costing you more money. While you can still apply for and receive a mortgage loan with a high DTI, its best to look for ways to lower the ratio if possible so you can get a better interest rate.

Also Check: How Long Bankruptcy Last On Credit Report

How To Improve Your Financial Profile

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender wont see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, youre already ahead of the game. Knowing where you stand financially and how youre viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

Also Check: Can I Get Another Loan From Upstart

Pay Off Some Of Your Debts

You may have other forms of debt besides student loans, such as car loans, credit card balances or medical debt. If thats the case, you can improve your DTI by paying off the account with the lowest balance. Paying off that debt will decrease your overall debt and eliminate a monthly payment, bettering your DTI.

Alternatively, you could pay off the debt with the largest monthly payment. That will have the biggest impact on reducing your DTI, because youll get rid of your largest monthly debt burden.

You May Like: How Do You Recover From Bankruptcy

How Your Dti Is Used By Lenders

When you apply for a mortgage, lenders will look at DTI, your credit history and your current credit scores. Why? Because all this information taken together can help them better understand how likely you will be to repay any money they loan to you. While theres no immediate way to improve a credit score, certain actions can help , and can start you on a better path today. Think about:

- Pay down existing debt, especially revolving debt like credit cards. This will help improve both your DTI and your credit utilization ratio.

- Pay all bills on time every month. Late or missed payments appear as negative information on credit reports.

- Avoid applying for any new credit, as too many hard inquiries in a short time frame could affect your credit scores.

- Use your existing credit wisely. For example, make a small purchase with a credit card and pay off the full balance right away to help establish a positive payment history.

http://www.investopedia.com/terms/f/front-end-debt-to-income-ratio.asp

What Is Included In The Debt

The debts that are included in this calculation may surprise you for instance, monthly rent payments are often counted as debt for this calculation, and so is alimony. For the purposes of a DTI ratio calculation, debt doesnt have to come from a loan.

If youre considering a loan of any kind, whether its a personal loan or a mortgage loan, youll want to have your DTI ratio calculated. You should factor in the following when calculating your DTI ratio.

- Minimum credit card payments

- Any other miscellaneous debts that you may carry

Also Check: Can Restitution Be Included In Bankruptcy

Fannie Mae And Freddie Mac

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. However, they require mortgage insurance until the ratio falls to 80%.

For FHA, VA, and USDA loans, there are streamlined refinancing options available. These waive appraisal requirements so the home’s LTV ratio doesn’t affect the loan. For borrowers with an LTV ratio over 100%also known as being “underwater” or “upside down”Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance are also available options.

Ltvs And Market Forces

LTVs matter a lot, but not just for the reasons weve outlined.

All things being equal, most lenders would prefer more restrictive credit structures across the board as these tend to reduce the risk of loan loss. But lenders are also subject to market conditions and competitive forces, just like any other business.

Competition in the banking industry and the finance sector more broadly has forced many financial institutions to loosen credit policies and increase what is considered market LTVs. Those that do not risk missing out on potential new client opportunities.

Financial services providers must constantly evaluate their credit risk appetite within the context of market forces in order to remain competitive in their loan origination practices.

Read Also: United States Government Debt

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

Debt Ratios For Residential Lending

Lenders use a ratio called “debt to income” to determine the most you can pay monthly after your other monthly debts are paid.

How to figure the qualifying ratio

For the most part, underwriting for conventional loans needs a qualifying ratio of 33/45. FHA loans are less strict, requiring a 31/43 ratio.

For these ratios, the first number is the percentage of your gross monthly income that can go toward housing. This ratio is figured on your total payment, including homeowners’ insurance, HOA dues, PMI – everything that constitutes the full payment.

The second number in the ratio is the maximum percentage of your gross monthly income which can be applied to housing expenses and recurring debt together. Recurring debt includes payments on credit cards, car payments, child support, etc.

33/45

- Gross monthly income of $6,500 x .33 = $2,145 can be applied to housing

- Gross monthly income of $6,500 x .45 = $2,925 can be applied to recurring debt plus housing expenses

With a 31/43 qualifying ratio

- Gross monthly income of $6,500 x ..31 = $2,015 can be applied to housing

- Gross monthly income of $6,500 x .43 = $2,795 can be applied to recurring debt plus housing expenses

If you want to run your own numbers, feel free to use our Mortgage Loan Qualifying Calculator

Guidelines Only

Don’t forget these are just guidelines. Many risk factors are taken into consideration. Very often these guidelines are exceeded and the borrower still qualifies.

Don’t Miss: Cheap Bankruptcy Chapter 7

What Are Lending Ratios

Lending ratios, or qualifying ratios, are ratios used by banks and other lending institutions in credit analysis. Financial institutions assign a credit score to borrowers after performing due diligence, which involves a comprehensive background check of the borrower and his financial history.

Lending ratios are extensively used in the underwriting approval processes for loans. Lending ratio usage varies across lenders. They apply different ratios in , and the choice depends on the borrowers goals and the projects where they plan to deploy capital.

The ratios help to define whether individual or institutional borrowers will be able to fulfill financial obligations after obtaining a loan. The credit analysis process consists of qualitative and quantitative methods. Lending ratios are an integral part of quantitative analysis.

Employment Guidelines: Steady Work History

Mortgage lenders want to know you have a stable, reliable job and income to support your home loan payments going forward. The USDA loan, like most other home loans, generally requires a steady two-year work history for applicants.

There is no set minimum period that an applicant must have worked for a particular employer. However, the lender must confirm the applicants job for the previous two full years as well as the fact that their income has been steady, explains Solomon.

Typically, you must also be employed full-time. But you dont have to be a salaried, W-2 employee. All sorts of income are eligible for mortgage qualification.

Self-employed individuals are also considered, but they may have a harder time getting approved if they cant verify income, cautions Dennis Shirshikov, a strategist with Awning.com and a professor of economics and finance at City University of New York.

Don’t Miss: When Does Chapter 13 Bankruptcy Fall Off Credit Report

How To Calculate Debt

When you apply for a loan or consult a financial expert, you might hear the term debt-to-income ratio, or DTI ratio for short. But what does debt-to-income ratio mean? And why does it matter?

Hereâs some helpful information about DTI ratios, including how to calculate your own ratio and steps you can take to improve it.

Key Takeaways

- A debt-to-income ratio is a snapshot of your income in comparison to your monthly bills and other debts.

- Lenders may use your DTI ratio along with your credit history as an indicator of your financial health.

- Improving your DTI ratio before applying for a loan or credit card could improve your chances of approval.

Should I Include My Spouses Debt

In states where you have the option to do so, this depends on how beneficial it is for you. Having two incomes available means that you could qualify for larger loans. Combined debt and income could give a lower, stronger DTI ratio.

Applying as a couple would be ideal in such a case. However, if a couples combined credit score and debt-to-income ratio severely affect the prospects of qualifying for a good mortgage, it might be better to apply as an individual.

Recommended Reading: How Do I Refinance My Sallie Mae Student Loan

Recommended Reading: How To Declare Bankruptcy For Student Loans